What is Crypto Staking (and Why You Should be Doing It)

Generally, getting returns from cryptocurrencies is associated with crypto trading and crypto mining practices. However, there is another way, called crypto staking, to gain stable income from the crypto realm if you prefer a passive approach.

Crypto staking has become one of the most popular methods to earn fixed returns due to its easy accessibility, eco-friendly design, and hands-off framework. The staking rewards can be considered analogous to interest payments from saving bank accounts or dividend amounts from stock shares.

If you are interested to learn more about this lucrative earning method, go through this article to understand what staking is, how it works, and its potential benefits.

What is crypto staking?

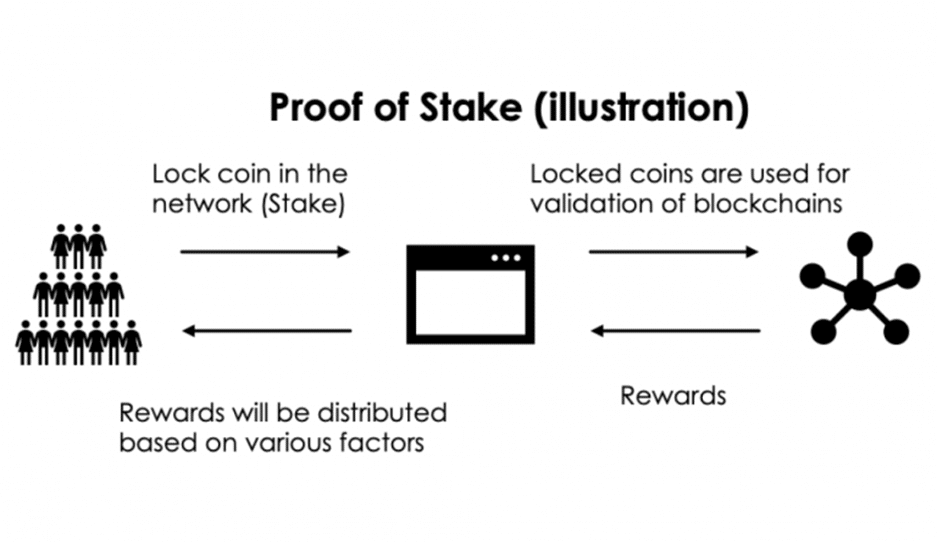

Crypto staking refers to the process of “locking up” some crypto assets in order to support the corresponding blockchain’s working and governance. Resultantly, the network grants the stakers (who stake or lock their coins) some rewards in the form of coins or tokens.

Cryptocurrencies operate via blockchain technology in which new blocks are added after a careful verification procedure. Proof-of-stake is one of these verification mechanisms that function with the help of stakers. That being said, crypto staking works only for coins that utilize the PoS mechanism as opposed to the PoW protocol, which utilizes mining power to validate transactions.

During crypto staking, the coins are taken out from the network circulation for a specific period of time to power the relevant proof-of-stake blockchain. Stakers/validators authenticate the blockchain transactions and ensure the legitimacy of recorded data. For substantiating and approving these transactions, they are rewarded with the same tokens they are verifying the transactions for.

To become a validator and have a part in the blockchain governance network, you need to have the required number of coins for staking purposes. All in all, crypto staking offers crypto investors an opportunity to commit a portion of their crypto holdings for some time and receive a substantial annual yield consequently.

How does crypto staking work?

One of the best things about crypto staking is that it does not require any activity on the part of traders or investors. Instead, the participants just need to allocate the coins for staking, and the network takes care of what happens next.

So, what comes off behind the scenes then? Firstly, when a transaction has to be processed (new block creation) on the blockchain, a validator is semi-randomly selected by the system for producing a new block to prevent the monopoly of any single party, maintaining a fair ecosystem. The chances of being selected as a validator may increase proportionately with the number of coins you stake and for how long the coins have been staked.

Note that this validator forges the new information (block) by utilizing the staked holdings that serve as a catalyst in the procedure. Afterwards, the other participants verify the addition of the new block, establishing a network consensus. For doing this work, the validator gets a reward in the form of native coins. And the cycle repeats as a new validator is then chosen for drafting the next block and so on.

How to start staking?

Staking crypto is a quite straightforward and simple process. Here are the steps to follow if you want to participate in staking:

1. Select the suitable crypto coin

The first and most crucial step is to choose an appropriate crypto coin that matches well with your investment plans. As already mentioned, staking works for only PoS digital assets; hence you need to select a currency with the proof-of-stake model.

For picking out a coin, you can look at various components, such as its APY rewards, minimum staking amount, lock-up span, and the working mechanism of the parent blockchain. Before choosing the coins, you should conduct thorough research and avoid selecting only on the basis of offered rewards. It is because even though you select a coin with maximum APY, if its intrinsic value plunges, your staking rewards would be rendered useless, resulting in the loss of base amount as well.

Hence, it is recommended to go for stable, long-term investments after carefully analyzing all the necessary features.

2. Choose a staking procedure

After selecting the crypto, you can stake it in four ways:

-

Become a validator

You can start staking by becoming a validator, i.e. run your own staking system/node. Consequently, you can get higher rewards and more incentives or governance rights on some blockchains. However, powering your own staking node requires advanced skills, specific online hardware, an uninterrupted internet connection, and a large number of relevant crypto coins. For example, to qualify as ETH 2.0 validator, you must stake at least 32 ETH, i.e., worth more than $105,000 (at the time of writing).

-

Stake through exchange

Although becoming a validator is not possible for most investors, there are many other simpler ways to partake in staking. One of the ways is to stake with a crypto exchange that allows crypto staking. The minimum staking amount requirement is relatively low on exchange platforms, making it an accessible and viable option for most individuals. You just need to sign-up with the relevant exchange, buy from the coins available for staking, and confirm your order. Some major exchanges that support staking include Binance, Coinbase, and Kraken.

-

Join a staking pool (stake through blockchain wallet)

You can also engage in staking by joining a stake pool. Staking pools are run by validators who gather funds from various crypto investors and distribute the staking rewards. In other words, crypto stakers who cannot afford to become independent validators deposit their holdings into the pool for enjoying a portion of staking rewards.

Firstly, to stake through a pool, you have to transfer your crypto to a crypto wallet. Then select a suitable pool and send your crypto there through the wallet. You should consider a pool’s viability, authenticity, fees, and size before deciding on it.

-

Cold staking

You can also stake through cold crypto wallets. During this process, staked coins are stored in secure offline wallets while the staker has to be online with their hot wallet, that might or might not be empty. However, cold staking is less common as very few exchanges support it.

Best coins to stake – How much can you earn?

Naturally, staking is only possible on those crypto assets that integrate the proof-of-stake mechanism. Here is a list of some of the best and most popular coins to stake, along with their estimated annual yield relative to the amount of staked crypto.

1. Ethereum 2.0 (ETH)

The most-awaited Ethereum 2.0 upgrade of the Ethereum protocol has been designed on the proof-of-stake model, making it one of the ideal options for crypto stakers. To get started with Ethereum staking as a validator, you need to launch some specific software and deposit a minimum of 32 ETH. If it is not possible, you can stake ETH by joining a pool.

According to an estimate, the current average APR for staking on Ethereum 2.0 is around 5%. In simple words, if you lock up 32 ETH for staking, you would have 1.6 ETH by the end of the year. This gain comes out to be $5371 according to the coin’s price at the time of writing.

2. Tezos (XTZ)

Tezos is an open-source blockchain that supports smart contracts and dApps with its native token called XTZ, which powers its platform. XTZ can also be staked to validate blockchain transactions, a process called “baking” in the Tezos lexicon. Individuals who stake around 8000 coins are given voting and governance rights on the network. Whereas participants who cannot lock up this many coins can delegate a limited amount of assets to the bakers for earning rewards and partaking in governance.

Bakers can earn 16 XTZ for each forged block or an 8% APY. For delegators, the average APY is about 5%-6%.

3. Cardano (ADA)

Like Ethereum and Tezos, Cardano is an advanced blockchain network adaptable with smart contracts and DeFi. ADA, the utility token of the Cardano ecosystem, can be staked through delegation or operating a stake pool for earning rewards.

The platform provides a unique staking rewards calculator on its website, allowing the participants to estimate their rewards. For instance, a delegate staking 500 ADA would earn around 23.04 ADA or 4.61% APY. On the other hand, a pool owner can earn up to 79,017 ADA yearly (yield of 15,803%) with a pledge amount of 500 ADA.

4. Solana (SOL)

Solana is also a smart chain-based blockchain modelled to aid decentralized applications. SOL is the native token of the system that can be used for on-network transactions and staking. You can earn SOL staking rewards by becoming a validator or a delegated staker (who joins the staking pool)

SOL staking rewards are directly proportional to the number of coins you stake and the adjusted staking yield. According to some estimates, the average annual yield for delegated stakers is about 6%-7%.

Should you take part in crypto staking? What are its key benefits?

Before staking your crypto holdings, you should analyze several factors and determine whether it aligns with your trading goals and long-term objectives. Staking may not be suitable for entities who want quick profits as it involves locking coins, restricting all active trading ventures. Instead, it is appropriate for investors who feel comfortable with earning passive income by the long-term holding of cryptocurrencies.

Some primary elements you can check before diving into the staking sphere include:

- Whether the staked cryptocurrency has a positive and bullish future outlook.

- What is the magnitude of returns you could potentially get after the staking period ends.

- What is the minimum required amount for staking.

- Whether the ratio of expected returns and rewards outweigh the corresponding risks.

If you make the right selection, staking can offer significant rewards.

- You can acquire elevated returns on your crypto holdings in the form of interest that could reach up to 20-30% per year.

- Staking requires far fewer resources than mining. It does not involve the utilization of any complex computational equipment like mining.

- By staking, you maintain the regulation and security of a blockchain. As a result, you would be granted voting or participation rights in the specific blockchain network.

- Staking is a relatively simple and undemanding way to grow your assets. Moreover, it is pretty effortless to start staking with an exchange platform with a few clicks.

Bottom line

Cryptocurrency staking is a reasonable way to earn an income without much effort or active monitoring, and is substantially more profitable than just holding onto your crypto investment and hoping the price increases over time. Not to mention, crypto staking is also energy efficient and does not require large and heavy machinery. However, it also incorporates several risks inherent to crypto-related investments, such as high volatility and loss of valuation. Therefore, to achieve long-term profitability in this domain, you must evaluate the downsides and perks of crypto staking and try to go for stable and established networks.