Top Crypto Lending Platforms

Fancy earning crypto while you sleep? Crypto lending might be for you. There are a number of services by which you can offer over-collateralized loans to people. So they have to put up more collateral than the value of the loan, giving you a large margin of safety. So the most important thing is to find a platform that you can trust to manage the loans. We've listed our favourites right here. Let's dig into it.

How does crypto lending work?

Centralized crypto lending platforms operate similar to the traditional banking system. These platforms decide who is eligible for a crypto loan and the interest rate to be charged. These platforms adhere to strict know your customer (KYC) protocols. This means that your cryptos will only be lent out only to trustworthy borrowers, and the interest earned solely depends on the changes in supply and demand.

Decentralized crypto lending platforms use smart contracts to issue and manage crypto loans autonomously. Using smart contracts, anyone can originate a crypto loan and lend to anyone with no KYC needed.

Smart contracts allow lenders to pool their cryptos together and automatically distributes the loans to borrowers. It has the terms of these loans codified into the contract, which also autonomously distributes interest to the lenders. Typically, borrowers deposit funds to a smart contract, often in fiat, for more than the amount of crypto loan they wish to take. This is called collateralization, and some platforms require borrowers to collateralize their loans by a minimum of 150%.

The collateral is used by smart contract to guarantee that crypto lenders do not lose their money due to market volatility. The smart contract automatically begins liquidating the collateral if the value of the loan goes beyond a specified percentage. You can boost your earnings even more by following signals from expert traders and making consistent gains from your stack.

Best Crypto Lending Platforms

Venus

Venus is a decentralized crypto exchange (DEX) and one of the top lending platforms. Launched in November 2020, Venus uses Binance Smart Chain to tokenize crypto assets. It is touted as a decentralized marketplace for borrowers and lenders with borderless stablecoins.

Venus Liquidity

As of this publication, Venus had an average 24-hour turnover of $101.65 billion. According to Coinbase, this accounts for about 99.88% market share of decentralized lending platforms. This means that users can access instant liquidity.

Venus Collateral

Users who want to borrow on Venus must collateralize their loans but can only borrow the equivalent of 75% of their collateral. Liquidation will be triggered if the value of your collateral drops below 75%.

Note that the collateral must be in crypto since Venus Exchange doesn’t accept deposits in fiat currency.

Venus Fees and Interest

There are no ‘taker’ or ‘maker’ fees applicable on Venus, i.e., no trading fee is incurred on Venus, only network fee. Although the network fee charged varies daily, it is well below the global industry average. Thanks to the Binance, Smart Chain transactions are fast, and fees are low.

Lenders earn a compounded interest rate annually (APY) paid per block. This ranges from 1.13% to 13.41%. The interest earned is determined by the protocol in a curve yield which is automated based on the demand for the particular crypto being borrowed.

Venus Supported Cryptos

Venus uses a synthetic stablecoin (VAI) which is collateralized by various stablecoins and cryptos. The Venus Protocol enables users to mint VAI. When users supply their crypto for lending, receive a vToken which will be used to redeem the collateral supplied by borrowers. For example, if you supplied BTC for lending, you will receive vBTC to either transfer into cold storages that support Binance Smart Chain or hedge against other cryptos.

Venus supports 17 cryptos; ADA, BETH, FIL, DAI, LINK, DOT, BCH, XRP, LTC, ETH, BTCB, BNB, BUSD, USDT, USDC, XVS, and SXP.

Compound

Compound is decentralized lending exchanged founded in May 2019. Users on the platform can supply their cryptos in return for a synthesized token which they can use to redeem their cryptos at any time. For example, if you supply ETH, you receive cETH, which you can convert to ETH at any time.

Compound’s Liquidity and Supported Cryptos

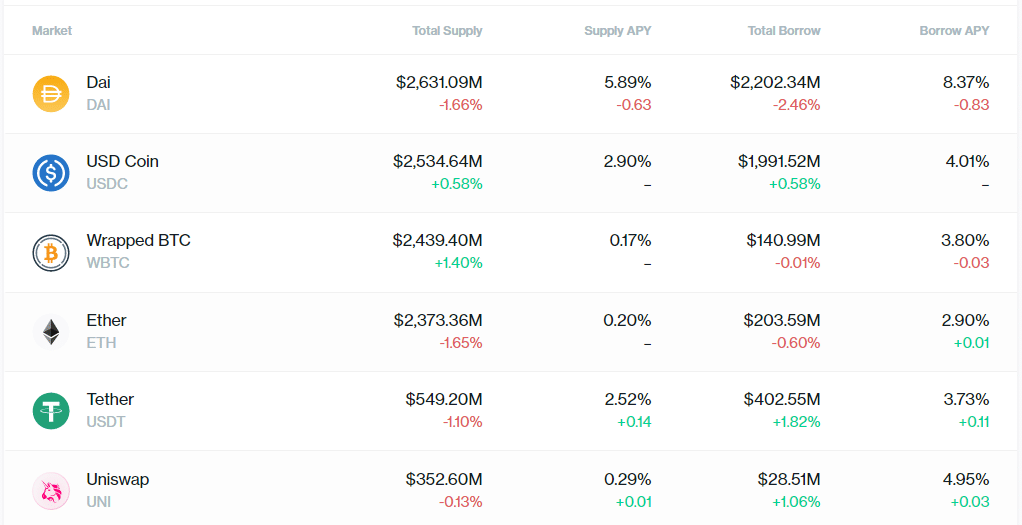

As of this writing, Compound had a 24-hour trading volume of $101.17 billion. The platform supports nine cryptos, including; DAI, USDC, WBTC, ETH, USDT, UNI, COMP, BAT, and ZRX.

Compound doesn’t support fiat currencies. Any deposits and withdrawals must be in crypto.

Compound’s Fees and Interest

Compound exchange doesn’t charge any fee on transactions. The Compound protocol is free to use and openly accessible to anyone.

The interest received by lenders and paid by borrowers is determined by an algorithm based on the market supply and demand for specified crypto. There is no minimum lending or borrowing amount, and the lender can earn interest about every 15 seconds, or they may choose to compound the interests for as long as they wish. Note that borrowers and lenders interact directly with the smart contracts, and there are no counterparty negotiations since everything is automated.

For lenders, the annual percentage yield (APY) differs depending on the crypto: 5.92% for DAI, USDC 2.86%, WBTC 0.18%, ETH 0.19%, USDT 2.47%, UNI 0.29%, and 0.83% for ZRX. For borrowers it’s; 8.42% for DAI, 3.98% USDC, 3.83% WBTC, ETH 2.89%, USDT 3.7%, UNI 4.92%, and ZRX 7.02%.

AAVE

Originally known as ETHLend, AAVE was launched in November 2017. It is a decentralized cryptocurrency lending platform and the first DeFi lending protocol. With AAVE, crypto lenders deposit their funds into a pool that borrowers can access. Lenders are issued with aTokens that allow them to collect interest and withdraw their cryptos any time they wish to.

AAVE Liquidity and Supported cryptos

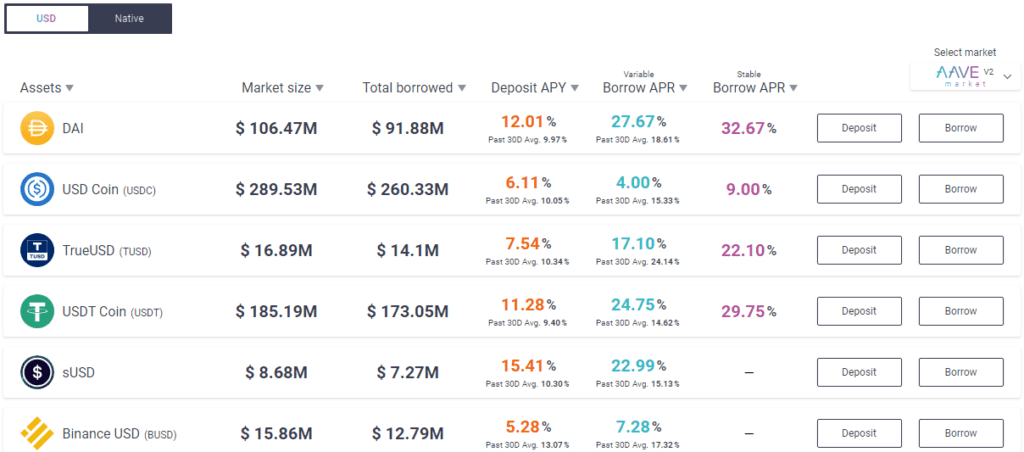

As of this publication, AAVE had liquidity of about $5.4 billion. The platform supports 24 cryptos: AAVE, BAL, BAT, BUSD, CRV, DAI, ENJ, GUSD, KNC, LINK, MANA, MKR, REN, SNX, sUSD, TUSD, UNI, USDC, USDT, WBTC, WETH, XSUSHI, YFI, and ZRX.

However, borrowers can only access DAI, USDT, TUSD, USDC, KNC, MKR, WETH, BAT, MANA, WBTC, ZRX, LINK, REN, and ENJ.

AAVE Fees and Interest

Borrowers who take loans denominated by AAVE do not incur platform fees. AAVE offers overcollateralized loans between 50% to 75%. However, the platform is introducing under-collateralized loans, which could be the first step towards non-collateralized loans. The non-collateralized loans are called flash loans but only available to developers due to the technical expertise required. With these loans, liquidity must be returned to the protocol within one block transaction.

AAVE has variable and stable rates for borrowers. Stable rates are fixed in the short term but can be adjusted in the long-term depending on the market conditions. Adjusting the stable rate only happens when the average borrow rate falls below 25% while the utilization rate goes above 95%.

During this writing, lenders on AAVE could receive APY of up to 15.4%, depending on the crypto deposited. With variable annual percentage rate (APR), borrowers incur between 0.03% up to 31.54%, while with stable APR, they incur between 0.18% to 36.54%.

BlockFi

BlockFi is a centralized crypto lending platform launched in August 2017 and is considered the best crypto lending platform for beginners. Since it’s headquartered in the US, it complies with strict federal laws and KYC and AMLpolicies. It is also a CME liquidity provider for bitcoin futures and options block.

BlockFi supported cryptos

BlockFi supports ten cryptos: BTC, ETH, LTC, USDC, GUSD, LINK, USDT, BUSD, PAXG, and PAX.

Users can deposit their cryptos with BlockFi and receive a loan denominated in US Dollars. The loans are overcollateralized by at least 50%. That means if you deposit, say, BTC worth $1000, you are eligible for a USD denominated loan worth $500.

BlockFi Fees and Interest

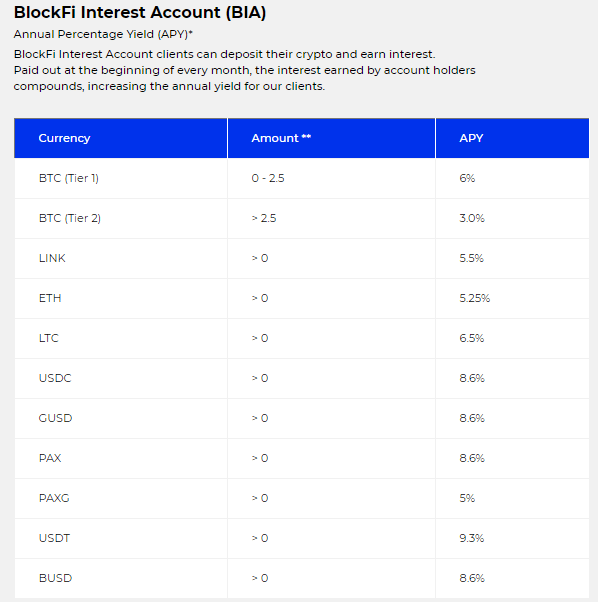

If you deposit your cryptos with BlockFi Interest Account (BIA), you are eligible to earn interest at the beginning of every month, which can be compounded to increase the APY.

Deposits of up to 2.5 BTC earns an APY of 6% while >2.5 BTC earns a 3% APY. Altcoins have no deposit thresholds. LINK deposits attract an APY of 5.5%, ETH 5.25%, LTC 6.5%, USDC 8.6%, GUSD 8.6%, PAX 8.6%, PAXG 5%, USDT 9.3%, and BUSD 8.6%.

The interest in crypto-backed loans depends on the collateral and the loan-to-value (LTV) ratio. LTV of 50% attracts a 9.75% interest rate, 35% LTV attracts a 7.9% interest rate, and a 20% LTV attracts a 4.5% interest rate. Note that all loans have an origination fee of 2%.

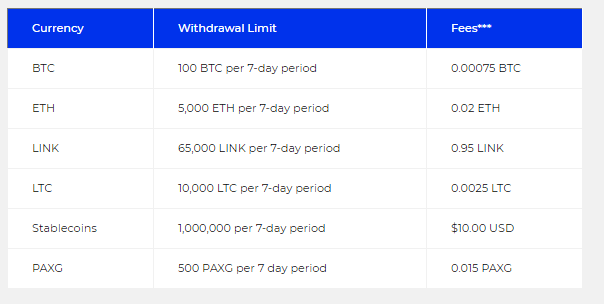

BlockFi allows one free crypto withdrawal and one free stablecoin withdrawal per calendar month. Subsequent withdrawals during that month attract withdrawal fees. More so, there is a 7-day withdrawal limit for every account.

Celsius Network

Celsius Network is a decentralized peer-to-peer lending platform launched in June 2017. It was built around the Celsius crypto wallet, allowing users to use the cryptos stored in their wallets as collateral for loans. To date, Celsius Network has processed about $8.2 billion worth of loans for over half a million users.

Celsius Network supported cryptos

Celsius Network is considered the best crypto lending platform in terms of the variety of cryptos supported. It supports 36 different cryptos, including; ETH, CEL, BTC, SNX, MATIC, BNT, PAX, BUSD, TCAD, THKD, TAUD, USDT, DAI, USDC, TGBP, GUSD, TUSD, AAVE, UMA, XAUT, DASH, PAXG, COMP, LINK, BCH, EOS, LTC, BAT, ZRX, XLM, ETC, KNC, UNI, XRP, ZEC, MANA, BSV, and OMG.

To start earning interest on Celsius Network, one only needs to create a Celsius wallet, deposit cryptos, and interest will start accruing immediately. The interest is calculated weekly and can be compounded.

Celsius Network Fees and Interest

Users can earn interest of up to 17.78% annually by simply depositing their cryptos on Celsius Network. The interest is calculated weekly but can be compounded for as long as the user chooses. You can also withdraw the principal and your interest at any time. When you deposit your cryptos, they are converted to CEL tokens. The CEL tokens can be used to receive and pay interest, send and receive payments, and be staked to earn higher interest rates.

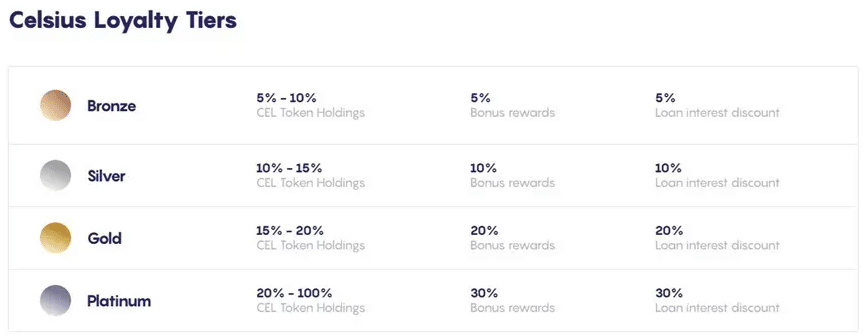

Users on Celsius Network are classified into four tiers; Bronze, Silver, Gold, and Platinum. Bronze Tier: Users have 5 to 10% of their crypto portfolio held as CEL tokens. They are entitled to 5% bonus interest payments and a loan discount of 5%.

Silver Tier: 10 to 15% of the portfolio is held in CEL tokens. Users receive 10% bonus interest and a 10% discount on loans

Gold Tier: 15% to 20% of the portfolio is held in CEL tokens. Users receive 20% bonus interest and a 20% loan discount.

Platinum Tier: 20% to 100% of the portfolio is held in CEL tokens. Users receive a 30% bonus interest and a 20% loan discount.

Users on Celsius Network do not incur any fees – there are no loan origination fees, withdrawal fees, deposit fees, default fees, nor early termination fees.

Borrowing on Celsius Network attracts interest rates as low as 1% APR. Taking CEL denominated loans attracts interest rates of as low as 0.7% APR. The interest payable on a loan varies depending on the supply and demand of a particular currency, duration of the loan, and the loan to value (LTV) ratio, ranging from 20% to 50%.

Conveniently, Celsius Network has a calculator for both loan and earnings to calculate the potential cost and rewards, respectively.

Nexo

Nexo is a centralized crypto lending platform launched in 2018. The platform has processed more than $1.8 billion for more than a million users in 200 countries globally. Nexo has insured user deposits for up to $350 million; this is in partnership with Ledger Vault and BitGo. It plans to increase its insurance coverage to over $1 billion in 2021.

Nexo supported cryptos

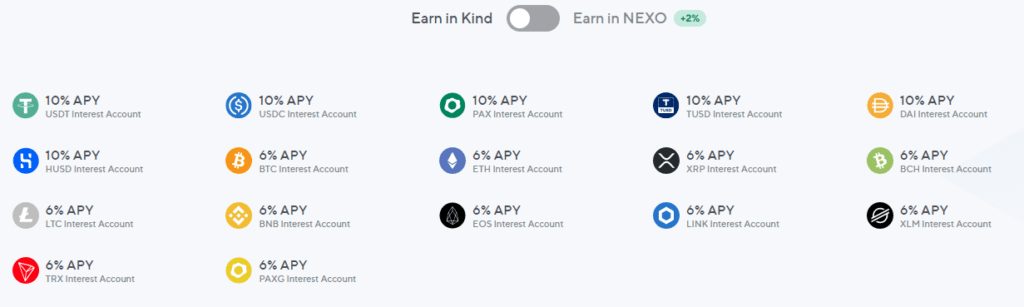

Nexo supports 17 cryptos, including; USDT, USDC, PAX, TUSD, DAI, HUSD, BTC, ETH, XRP, BCH, LTC, BNB, EOS, LINK, XLM, TRX, and PAXG.

Nexo accepts fiat currencies, and users can earn interest in EUR, GBP, and USD. Borrowers also have access to 40 fiat currencies.

Nexo Fees and Interest

Lenders can earn between 8% and 10% APY by depositing their crypto with Nexo. For EUR, GBP, and USD, they earn 10% APY. However, if lenders have at least 10% of their holding in NEXO, the platform’s native token, they are eligible to receive an extra 2% in interest.

There are no stringent KYC policies for one to be eligible for a loan with Nexo. You can receive instant cash loans in 40 fiat currencies, USDC, or USDT with no credit checks. However, only these cryptos are accepted as collateral with Nexo: BTC, ETH, XRP, LTC, XLM, BCH, EOS, PAXG, NEXO, and BNB. The loan attracts interest rates of as low as 5.9% APR.

Bottom Line

With the mainstream explosion of DeFi, there are several crypto lending platforms, with many more popping up daily. We have ranked the top crypto lending platforms based on their general liquidity, user-friendliness, number of cryptos supported, and affordability of loans. If you want to earn even more cash with your stack, consider following some free trading signals.