The Top 6 Privacy Coins 2021

Privacy coins can have explosive price action, as we'll show later. So if you want in on that volatility you'd better bone up on the top projects in the space so you can load your bags and prepare for takeoff. Privacy coins often make their largest moves towards the end of the cycle, as with most other altcoins, so if you're seeing this and thinking that it's too late for you or that bitcoin has already gone up too much, have a gander at the following projects.

If you're looking to actively trade these coins for small but consistent gains, you might be interested in trading signals on telegram, where you can get long/short signals from a group of professional traders in the space and learn as you go.

What is a privacy coin?

A privacy coin is a type of cryptocurrency that deliberately obfuscates a transaction link. This ensures that the wallet activity between the transacting parties remains anonymous and cannot be tracked. It becomes impossible to establish the transaction history or the funds that a particular wallet holds with cryptographic obscuring.

This article reviews the top privacy coins in 2021 with a market capitalization of over $1 billion.

How Privacy Coins Work

Most cryptocurrencies like Bitcoin are not anonymous – they are pseudonymous. This means that a person's real identity is not the same as their public wallet address. However, the transactions of a particular wallet are made public. That means you can view the amount of cryptocurrency held by a wallet and its transaction history. Note that it is not impossible to make the connection between a wallet address and your real-life identity. However, note that people can track your wallet along with every financial activity.

Privacy coins like Monero and Pirate have solved this privacy problem by making cryptocurrency entirely private.

Why use Privacy Coins?

The need for decentralization and absolute privacy precipitated the mainstream acceptance of cryptocurrencies in general. Blockchain technology has ensured anonymity and no external controls on the cryptos. Over time, cryptocurrencies have emerged as a viable store of value. This has been especially true in 2020 as the coronavirus pandemic ravaged the value of fiat currencies.

However, as we have noticed, most mainstream cryptocurrencies such as Bitcoin are not entirely private and anonymous. With the increasing mainstream penetration of DeFi, cryptocurrencies are becoming a daily part of financial transactions. Globally, counties are developing their version of cryptocurrencies, which won't be anonymous as well. Governments can't relinquish surveillance and the treasure trove that comes from financial data. We live in an age where information and data are being monetized and frequently weaponized. More so, with the increasing threat of authoritarian governments, absolute privacy is needed now, more than ever.

This is where Privacy coins thrive. They offer you the same blockchain advantages and store of value as other cryptocurrencies, but with an added advantage of absolute privacy. Privacy is a human right, and with Privacy Coins, your financial privacy is strictly yours.

Monero (XMR)

Monero was launched in 2014. There are 17.91million XMR in circulation with market capitalization of about $8.592 billion. From January to May 2021, it has gained over 207%.

When you transact using XMR, both the identity of the sender and the recipient are cloaked using “Ring signatures.” When the transaction is initiated, it is signed by a group of random signers hiding the identity of the actual sender. Think of this as buying a gift for a colleague but instead of signing just your name on the card; you have the entire office sign it. They will not know who gifted them unless you say it is you. That's how Monero works – the recipient won't know you are the originator of the transaction unless you reveal your identity.

A Monero sender will generate a one-time ‘spend key' that the recipient can only detect. The recipient is the only person who can spend the crypto using that key. Monero also uses stealth addresses which generates a one-time public key for recipients. It ensures that the fund being received is not directly connected to your wallet, but miners can verify that this transaction occurred, preventing the double-spending problem. More so, the Ring Confidential Transactions (RCT) masks the amount being sent and received. RCT is used as proof that Monero is not being used fraudulently.

Dash (DASH)

Dash is considered the pioneer of privacy coins. It was created in 2014 from a hard fork of Litecoin. At the time, it was called XCoin, then later rebranded to DarkCoin and finally Dash in 2015. Currently, there are 10.12 billion DASH in circulation with market capitalization of about $4.23 billion. Between January and May 2021, DASH has gained over 376%.

Dash uses a two-tier architecture that powers the blockchain. The first layer consists of miners who secure the ecosystem and confirm the transaction on the network. The second layer is the masternode. In Dash, the network is divided into just the miners' nodes used to calculate keys and confirm transactions by miners; and masternodes whose key functions are: governance, securely storing user data, processing transactions for light wallets, and facilitating instant and private transactions.

The master record holds all the database of transactions. It is the masternode that provides the technology for mixing payments. The payment can go through several masternodes to increase the anonymity of the transaction. Any community member can run a masternode by downloading the full blockchain history and maintaining a minimum balance of 1000 DASH.

The most prominent features of Dash include InstantSend and PrivateSend.

With InstantSend, users can perform instant transactions thanks to the masternode network. This is unlike other blockchains, where you have to wait for transactions to be confirmed in a block. With Dash, masternodes validate that the funds used for a particular transaction haven't been spent and locks them until the transaction is complete to avoid double-spending. However, a transaction with InstantSend requires an increased commission.

Dash also has a PrivateSend feature which is an improvement on CoinJoin. Here, users can break down their DASH transactions into various denominations and mix them with other transactions within the network. This ensures that the final transaction is obscured and no one can know the total amount of the transaction, making it impossible to track transactions on the blockchain. This is achieved by mixing payments based on the CoinJoin protocol, i.e., mixing the contents of two or more wallets into one. Using PrivateSend is to pre-mix multiple wallets into one and execute the final transaction already with that wallet. It is believed that this technology allows you to hide the chain of payment transactions due to the complexity of their analysis. When a transaction is split into equal parts, and it is no longer possible to determine where the money goes from the wallet, where the merger of other wallets took place.

Pirate (ARRR)

Pirate chain was created in 2018. Between January and May 2021, ARRR gained over 4400%. Currently, there are 181.12 million ARRR in circulation with a market capitalization of about $1.528 billion.

ARRR utilizes zk-SNARKs that 100% shields the peer-to-peer transactions on the blockchain. This makes all transactions with Pirate Chain completely anonymous and private.

The problem of double spending in the network is eliminated by using the Delayed Proof of Work (DPOW) concept. This concept also safeguards the Pirate Chain from 51% attacks using the Bitcoin blockchain as a backup for the ARRR. It means that if hackers wanted to attack the Pirate Chain, they would have first to attack Bitcoin – making it virtually impossible.

The Pirate Chain also implements the use of a block explorer. It ensures that observers can see the transactions on the platform but cannot see the senders and recipients' addresses. What's more, the code prevents any leakage of the transaction metadata from being made public.

ZCash (ZEC)

ZCash was created in October 2016 as a hard fork of Bitcoin. It has gained over 471% between January and May 2021, and has a market capitalisation of about $3.617 billion.

Like ARRR, ZEC uses zero proof of action (zk-SNARK) in its transactions. Funds at ZCash can be transparent (publicly available) or protected (closed to the community).

Here's how Zcash works.

Typically, when you want to send cryptos, you have to input the recipient's public address, then wait for the miners to verify the transaction and add it to the next block. In Zcash, you can choose from two different types of transactions. You either choose the typical transparent transaction, or you can customize the transaction the be shielded. A shielded transaction ensures absolute privacy.

Since transactions are always recorded in the blockchain, the transfers are protected in the best possible way. Payments are published in the blockchain, but the sender is not revealed. Users who have the right key can see the content. A special feature of ZCash is that by consent, users can provide others with their keys.

Every ZEC transaction has a ‘spend key' and a ‘view key.' The spend key is used when you intend to transfer ZEC from your wallet, while the ‘view key' is used to show the details of a particular transaction. If users have conducted a shielded transaction but would want to share the details of this transaction with others, they would give them the ‘view key.' That enables them to check out the details of the private transaction. More so, ZEC transactions have a ‘memo field' that users often use – typically institutions – to share data they want the recipients to view. These “selective disclosure” capabilities allow a user to prove that transactions have occurred.

Verge (XVG)

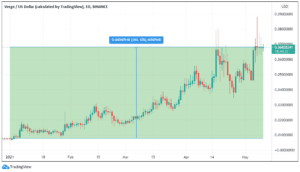

Verge was originally developed in 2014 under the name DogecoinDark but then relaunched in 2016 under the name Verge. In 2021, XVG has gained over 765% within the first five months. As of this writing, there are over 16.4 XVG in circulation with a market capitalization of about $1.1 billion.

The primary privacy feature of Verge is to obscure the IP addresses of the users on its network, guaranteeing data protection. It offers completely anonymous transactions by hiding the location and IP address of transaction participants. It achieves this by using the “TOR” and “I2P” networks.

In particular, these networks ensure that transactions are not readable or traceable to outsiders, and the IP addresses used are encrypted. All transactions made through Verge are processed within a few seconds. This is ensured by the use of the “Simple Payment Verification” technology. XVG works within the Wraith protocol, which further guarantees anonymity in transactions.

Wraith Protocol technology allows the user to quickly switch between private and public registers on the Verge blockchain. This makes transactional data invisible in the blockchain

Verge is one of the few cryptos that use multiple mining algorithms. This means that miners can extract XVG in 5 different ways. They include Scrypt, X17, Lyra2rev2, Elder, and Blake2s. Very few of these algorithms use ASIC hardware.

Horizen (ZEN)

Horizen is a fork of ZClassic, which is a fork of Zcash. It was created in 2017 and currently has a market capitalization of about $1.58 billion with over 11.06 million ZEN in circulation. It has gained over 1100% between January and May 2021.

Horizen is an interoperable blockchain system that operates on a decentralized hub infrastructure. It is the first completely decentralized and fully customizable sidechain on the market, offering scaling solutions. The Horizen side chain platform is designed to enable businesses and developers to create real-world Blockchain applications at an affordable cost and quickly in Horizen's fully distributed, secure, and privacy-protected architecture.

The sidechain platform focuses on scalable data privacy and allows businesses and developers to create private or public blockchains using a unique side chain technology known as Zendoo.

Horizen uses the ZeroCash protocol, such as Zcash and ZClassic. It, therefore, runs on Zcash's ZK-snark technology. In many ways, Horizen is similar to ZCash – they both give users the ability to send private or transparent transactions. Like ZCash, Horizen also sells two types of addresses: t-addresses (transparent) and z-addresses (private).

The key difference between Horizen and ZCash is that while ZCash has a fairly standard consensus Proof-of-Work model, Horizen also implements “Secure Nodes” and “Super Nodes” in addition to mining. It has the largest network of dedicated nodes in the industry with a multi-level node system. The Horizen project also seeks to go beyond pure cryptocurrency and support a wide range of blockchain-based services through sidechains.

Users must stake a minimum amount of ZEN to protect nodes and supernodes and receive 20% of the block rewards. Miners receive 60%, and the last 20% is reserved for the treasury fund.

Bottom Line

Decentralized finance (DeFi) is the without a doubt is the future of finance. With the increasing need for absolute privacy, privacy coins are bound to be the center of DeFi transactions. With tokens like Pirate Chain appreciating over 40x so far this cycle, safe to say we're in for a bumpy ride. If you'd like some tips from top traders, try out our free telegram signals group, where our top traders provide free buy/sell signals on the crypto market, helping you confirm your trades and make more consistent profits.