Top 10 Crypto Chart Patterns

If you're a crypto trader, you'll find chart patterns to be a vital tool in your toolbox. These patterns show you the ebbs and flows of the market and form the basis of all technical analysis. You'll want to pay attention to them if you want to avoid losing your shirt playing against the market.

Like forex chart patterns, crypto chart patterns are segmented into two primary categories – trending and reversal chart patterns. In this article, we will break down the top 10 crypto chart patterns that you'll find useful in your trading.

Trending Crypto Chart Patterns

These chart patterns indicate that the price of particular crypto will continue trading in the prevailing trend. They are also called continuation patterns. In many instances, trending chart patterns form when the price action consolidates but instead of a reversal, the price continues trading in the previously observed trend.

Here are the most notable crypto trending chart patterns:

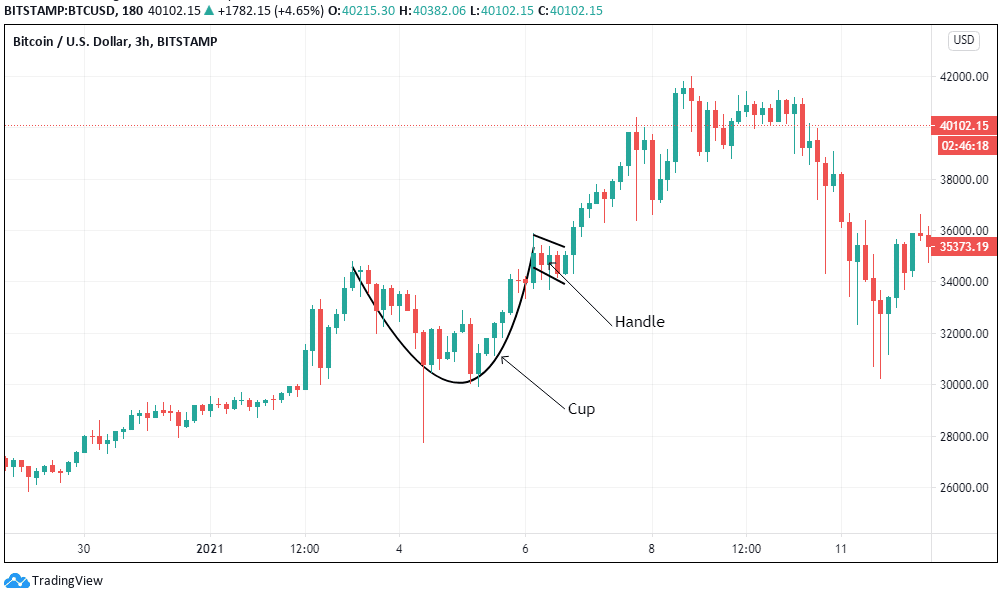

Cup & Handle Pattern

The cup and handle crypto chart pattern signals a bullish continuation in price action. As the name suggests, this pattern occurs when the price action consolidates from a bullish trend forming a U-shaped “depression” that resembles a cup and a downward price movement that looks like a cup's handle.

The cup often forms after a sustained uptrend. It represents the period where the crypto price is pulling back and consolidating. This pullback doesn't wipe out the gains from the uptrend. It’s followed by a rally of equivalent size, resulting in the U-shape. After the rally, the price then trades in a sideways channel forming the “handle.” Typically, after the handle is formed, the market experiences a renewed rally with the price breaking above the previous highs formed by the ‘cup.' This breakout results in the continuation of the previous uptrend.

Note that depending on the time-frame you are trading, it may take a while for the cup and handle crypto chart pattern to form fully. For monthly candles, it could be years in the making.

The Triangle Crypto Patterns

The triangle chart patterns can be ascending, descending, or symmetrical.

Ascending triangle pattern: This is a bullish continuation pattern. The high price swings form a horizontal line in this pattern, while the lower price swings form a rising trend-line – these two lines form a triangle.

You can identify the ascending triangle chart pattern under these conditions:

- The market is in an uptrend which is followed by price consolidation.

- The price forms higher lows and a rising trend-line can be drawn connecting the higher lows. This shows that short-sellers are getting exhausted and cannot push the price much lower since buyers are pushing the price higher.

- High price swings do not go beyond the flat upper trend-line, which is the resistance level.

- The price breaks through the upper trend-line, which is confirmation of the trend continuation.

When trading the ascending triangle pattern, good entry points form when the price breaks out above the upper horizontal line.

Descending triangle pattern: is the opposite of the ascending triangle pattern. The descending chart pattern shows a bearish price continuation. These are the conditions necessary for the formation of a descending triangle.

- The market is in a sustained downtrend, followed by a short price rally.

- The price forms lower highs and a dropping trend-line can be drawn connecting the lower highs. This shows buyers are getting exhausted in the market and that the bears are pushing the price further downwards.

- Lower price swings do not trade below a flat horizontal trend-line. Connecting the downward sloping trend-line and the flat bottom line forms a descending triangle.

- A bearish continuation forms when the price breaks below the flat horizontal bottom line.

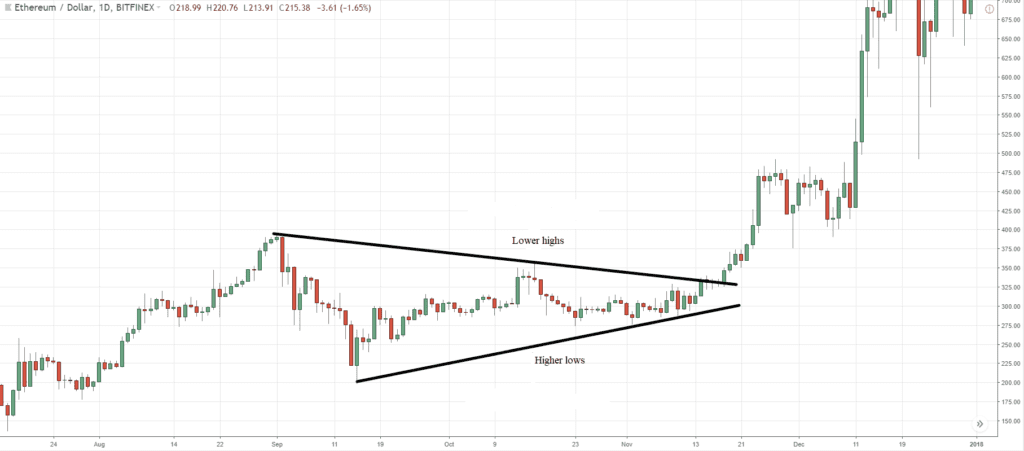

Symmetrical triangle chart pattern: show price consolidation. This pattern is characterized by the market forming higher lows and lower highs simultaneously. When you draw a trend-line connecting the lower highs and another connecting the higher lows, they appear to be converging. This chart pattern is also called a pennant.

Note that the symmetrical triangle pattern can be either a continuation or a reversal chart pattern. Continuation occurs when the price breaks out in a direction similar to the price action before consolidation. The reversal occurs if the price breakout is opposite to that before consolidation.

Rectangle Crypto Chart Pattern

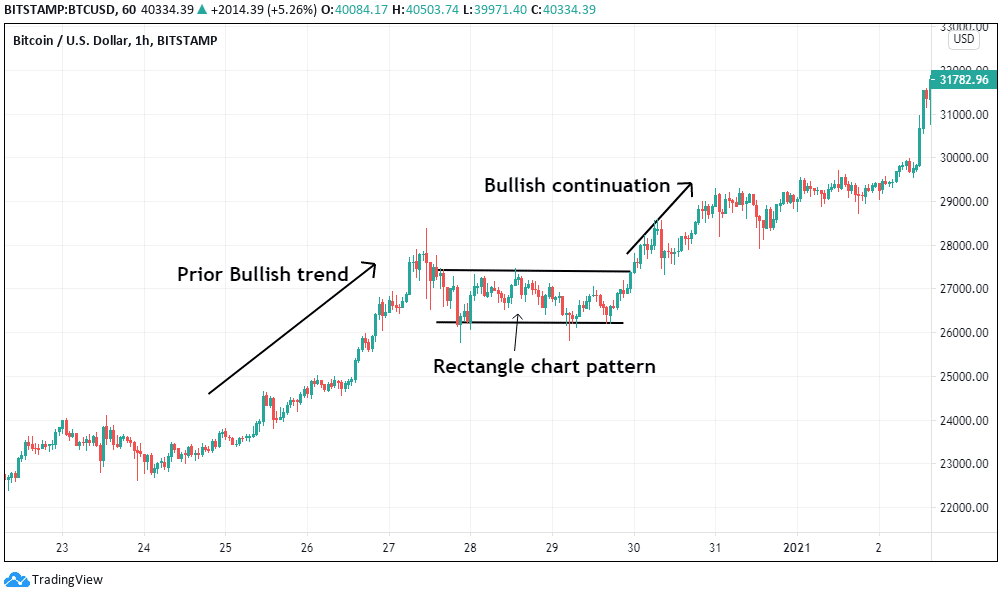

The rectangle chart pattern is the simplest and most popular among the top 10 crypto chart patterns since it easily identifies both continuation and trend reversals.

The pattern is formed during price consolidation after a sustained bullish or bearish trend. During the consolidation, the crypto asset trades in between two horizontal channels of support and resistance. This means that when you draw a horizontal line touching the price highs and another touching the price lows during the consolidation, they form a rectangular pattern.

Flag Crypto Patterns

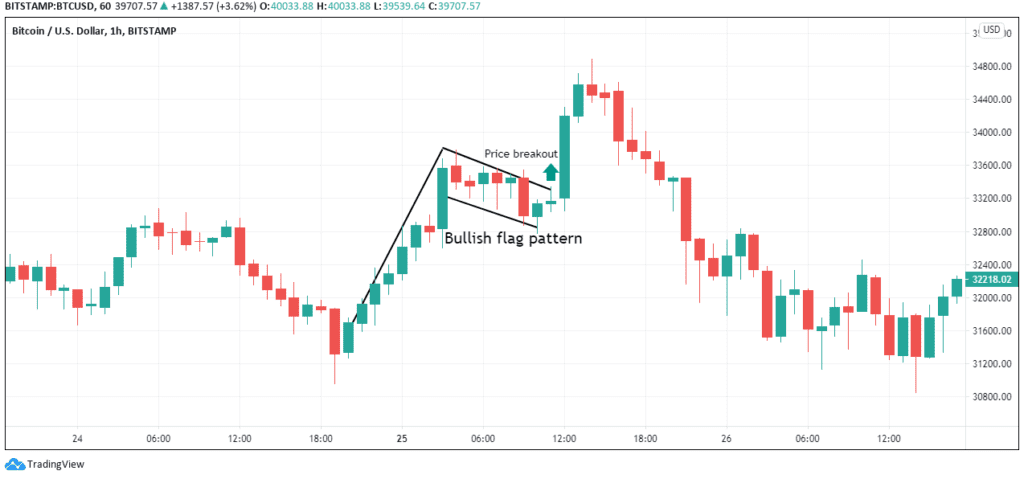

The flag pattern is a continuation chart pattern which forms after a short period of consolidation following a persistent trend in one direction. This chart pattern can either be a bullish or bearish flag pattern.

There has to be a prior uptrend for the bullish flag pattern, which forms the “pole” of the flag pattern – followed by a short price pull-back period. When you draw trend lines on the consolidation, they form a downward pointing flag.

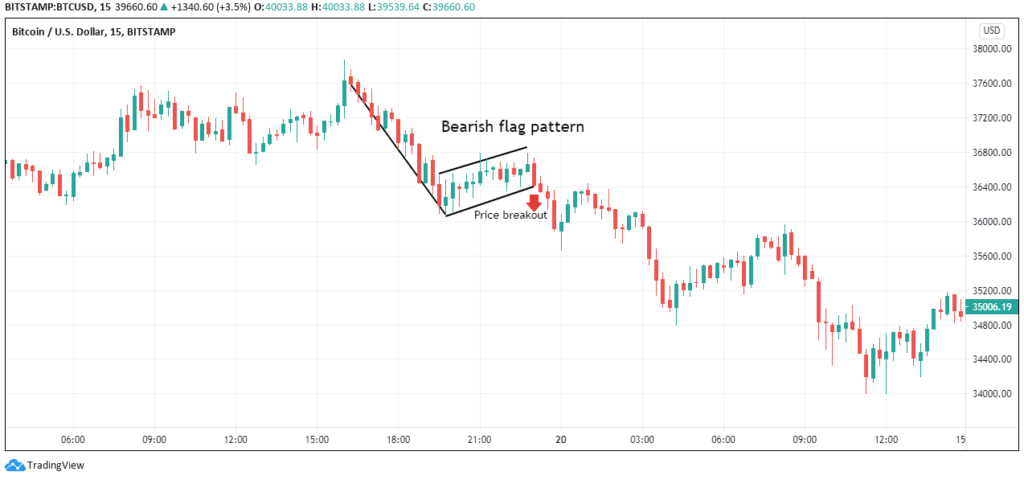

A bear flag pattern forms after a short upward price consolidation following a sharp downtrend. Here, the bear flag points upwards and has a positive slope.

In the bull flag chart pattern, price continuation occurs after the price breaks out above the resistance level. For the bear flag, the bear trend continues when the price breaks out below the support level.

Reversal Crypto Chart Patterns

Reversal crypto chart patterns mark a period where the prevailing market trend shifts into an opposite trend. For example, if the prevailing trend was bullish, a reversal chart pattern indicates that the market is about to adopt a bearish trend. In this case, it shows that sellers are exerting downward pressure in the market. Similarly, if the prevailing is bearish, a reversal chart pattern forms when the market is shifting into an uptrend.

Here's a brief description of the top reversal crypto chart patterns:

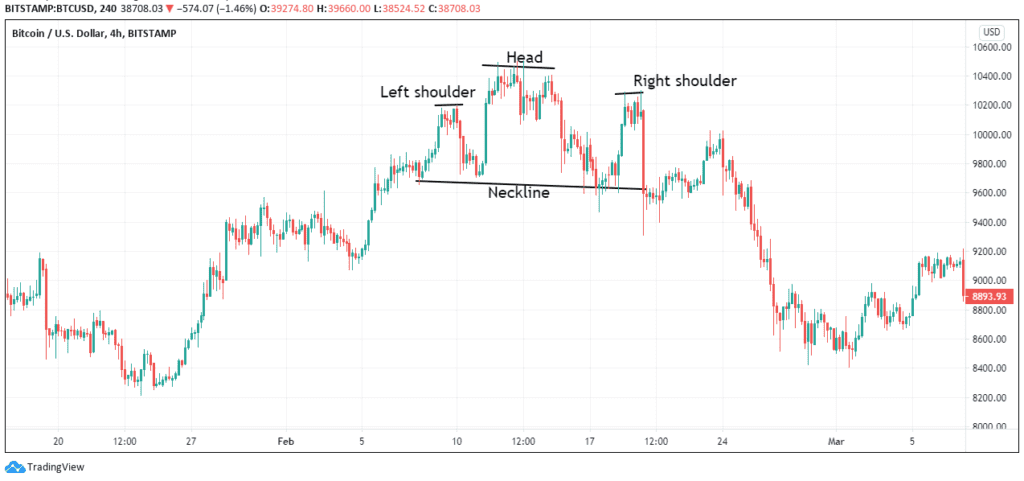

Head and Shoulders Crypto Pattern

The head and shoulders chart pattern represents a trend reversal from bullish to bearish. Typically, this pattern forms after a bullish trend. It is characterized by price swings that form three peaks – the left shoulder, the head, and the right shoulder.

The left shoulder forms when there is a price pullback. After this pullback, the price will swing back up, to a level higher than the prior high. However, this price rally won't be sustained as sellers will push it downwards to the level of the previous swing low. The right shoulder is formed after buyers attempt to push the price back up, but fail to reach the previously attained levels (the head). Short sellers push the price downwards. This is a confirmation that bears are dominating the market.

When you draw a trend-line from the lows of the first shoulder and the second shoulder, you'll notice that they are approximately on the same level. This is the “neckline”, and it forms the support level. If the price breaks below it, it's an indicator that a bear trend is beginning.

If you intend to trade a reversal using the head and shoulder crypto chart pattern, you must wait until the entire chart pattern forms to reduce your risk in trading.

Double/Triple Tops and Bottoms Chart Pattern

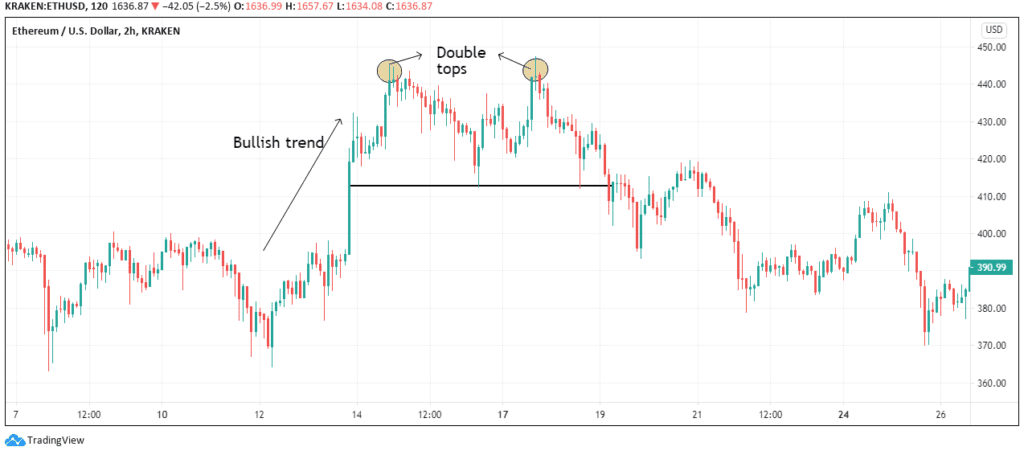

A Double top pattern signals reversal of a bullish trend to a bearish trend. This chart pattern occurs when the price forms two peaks at the same level. These peaks represent the resistance level reached by the asset during a bullish trend.

During an uptrend, the price reaches the first peak then pulls back slightly to a support level. The price then bounces back to a second peak, touching the resistance level created by the first peak. This pattern shows that buyers cannot push the price beyond the resistance level and that the bullish momentum is dissipating. Consequently, the prices drop below the support level and adopt a bearish trend.

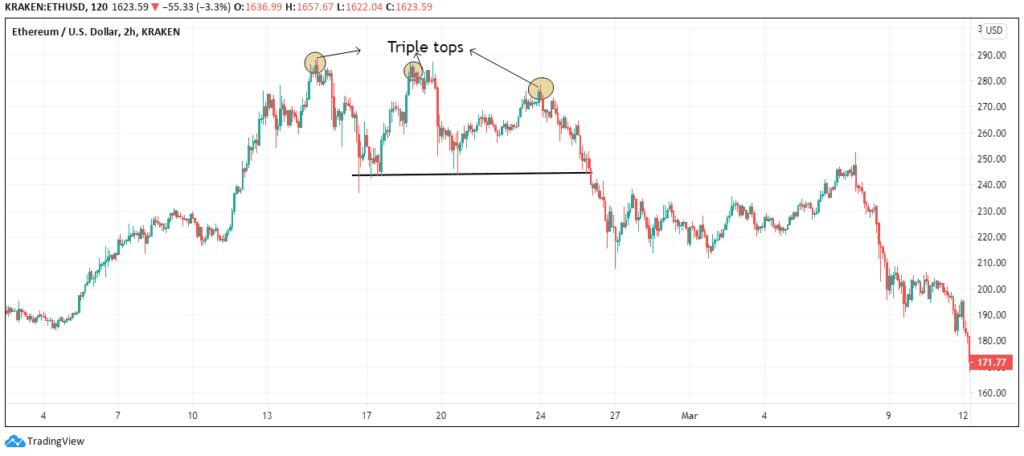

Triple tops are similar to double tops only that they form three instead of two peaks. The triple tops chart pattern is a bearish reversal pattern. The three peaks formed are approximately at the same support level. This implies that the support level is tested at least three times before the price adopts a bearish trend.

A double bottom chart pattern is a bullish reversal pattern and considered the opposite of the double bottoms chart pattern. When the price is on a steady downtrend, it reaches a level where sellers cannot push the prices much lower. This is where the first bottom is formed – a resistance level where prices cannot go much lower. The price retraces to a higher support level, but the short-sellers push the price back down, forming a second bottom at the resistance level. Buyers overwhelm the sellers in the market, causing the prices to bounce off the resistance level, reversing the downtrend.

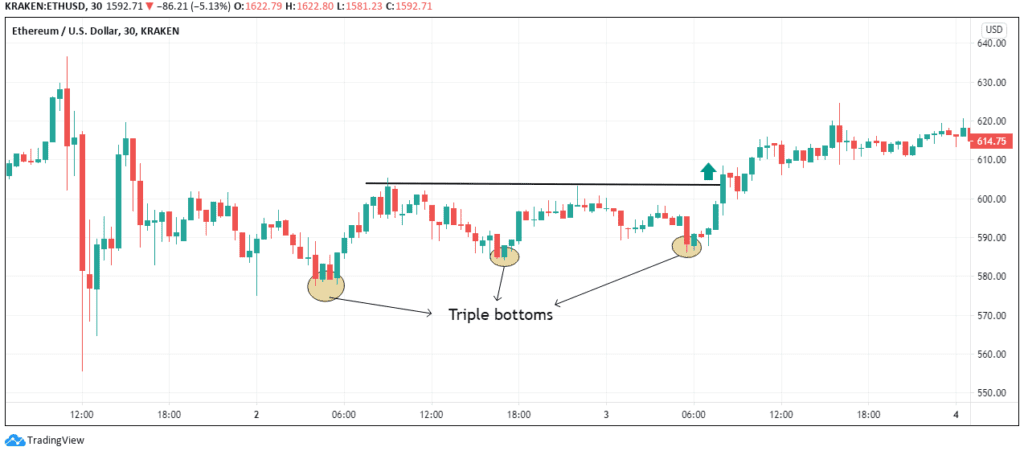

A triple bottoms chart pattern is the opposite of the triple tops chart pattern. The pattern is formed like the double bottoms chart pattern but has three swing lows at approximately the same level. The prior bearish trend is reversed when the price breaks above the resistance level.

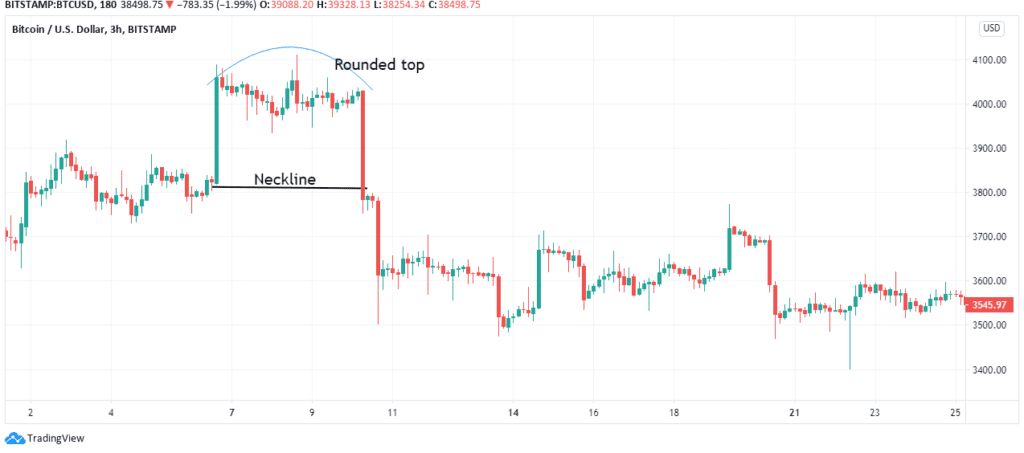

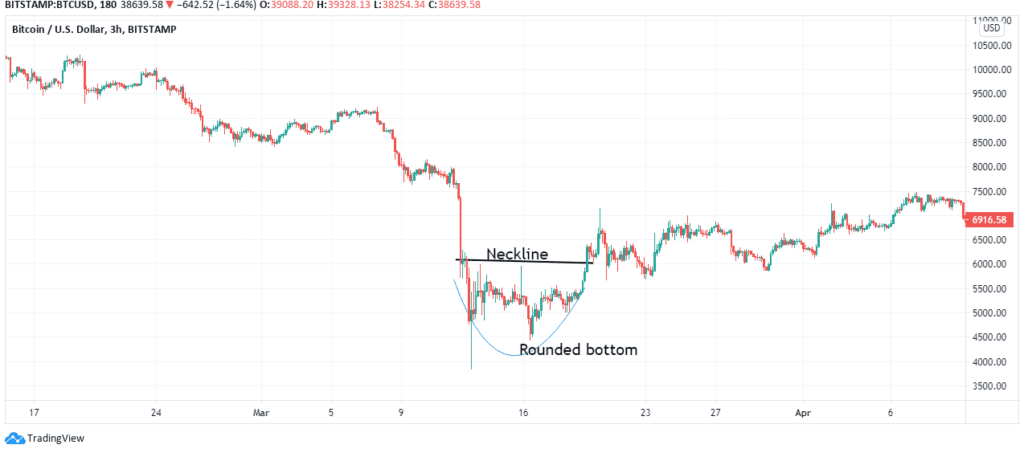

Rounded Top and Bottom Crypto Chart Pattern

Typically, the rounded top and bottom crypto chart patterns are used to identify longer-term reversal trends. Since it forms over a longer period, this pattern represents a gradual reversal of a trend.

Traders use the rounded tops chart pattern to identify long-term bearish reversal patterns. It signals the ending of a bullish trend and the start of a possible bear trend. This chart pattern resembles an inverted U. It occurs when, after a long-term bull run, the price consolidates for an extended period forming a rounded top. Subsequently, the price drops below the ‘neckline' signaling the start of a downtrend.

Conversely, the rounded bottom chart pattern is a bullish reversal pattern showing the end of a bear run and the possible beginning of a bullish trend. In this case, the asset price has to consolidate for a long period, after a sustained downtrend, forming a U-shaped pattern. Eventually, the price will start rising and break above the ‘neckline' signaling the start of a bull run.

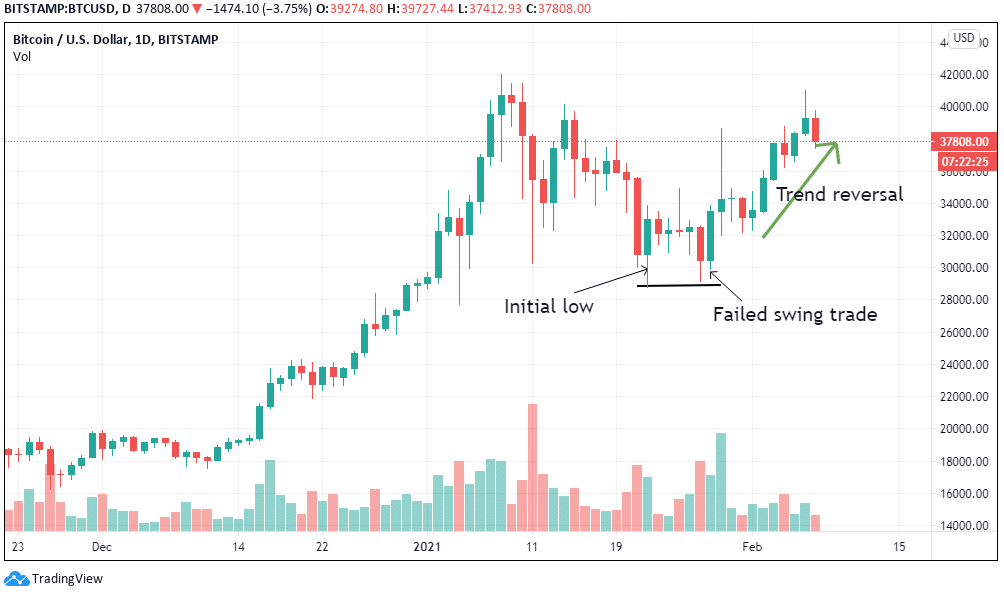

The Failure Swing Trading Crypto Chart Pattern

This chart pattern often occurs when large speculative traders fail to form new highs or lows. These speculators often enter positions by taking advantage of deferred liquidity accumulated by other traders through limit orders such as buy and sell stop and stop-loss levels.

These large speculators attempt a swing trade by placing large orders in a relatively narrow price range.

In a bear market, failure swing trading occurs when short-sellers unsuccessfully attempt to achieve new lows. This is often a signal of an impending reversal of the downtrend into an uptrend. The bear trend reversal is completed when the price breaks through a prior high.

Similarly, the pattern in the bull market forms after buyers attempt and fail to form new highs. The bull trend reversal is completed when the price breaks through the previous low and adopts a downtrend.

Bottom Line

Chart analysis is the backbone of technical analysis in crypto trading, and we have covered the 10 most helpful crypto chart patterns. Most of the chart patterns we have discussed can be used for price action analysis across any time-frame. Although most crypto traders use these chart pattern analyses to support their trades, we strongly recommend that you conduct thorough back-tests when selecting which crypto chart pattern to support your trading.

While understanding these crypto chart patterns will help you start to predict trends in crypto prices, we highly recommend you seek the guidance of professional traders who have years of experience predicting crypto trends. The crypto market tends to be relatively volatile, so signing up for telegram signals from professional traders will ensure that you are spotting trends accurately.