The Digital Asset Diversification Illusion

Last Updated: 30th October 2018

Diversification is the key for any successful investment portfolio. The reason investors diversify their investments is in order to limit their exposure to a single investment. If a portfolio consists solely of a single stock and at the same time the stock market were to experience a downturn, so too will the portfolio. Conversely, if an investor’s portfolio is well diversified between say, stocks AND bonds, their exposure, and therefore their losses, would have been mitigated.

This concept has been similarly adapted for the cryptocurrency market. Instead of having a portfolio consisting only of Bitcoin, diversification into other digital assets such as: Ethereum, Litecoin and DASH is being encouraged. However, in this article, I intend to highlight the inefficacy of diversification in the cryptocurrency market.

The Diversification Illusion

Diversification is a system used to mitigate risk by dividing up investments into different asset classes and industries. The rationale behind diversification is such that, in the likelihood of a single negative event, it is hoped that an investor’s individual investments would react differently, therefore, minimising any potential losses.

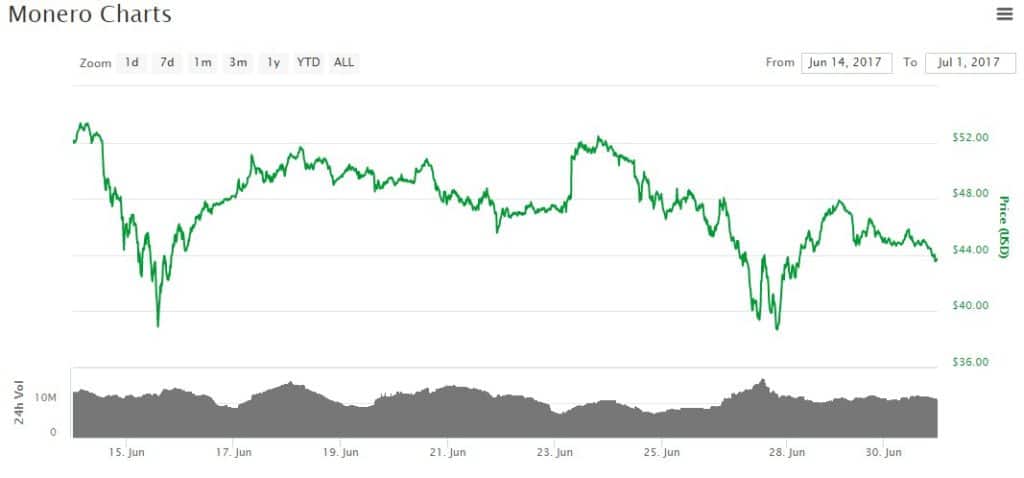

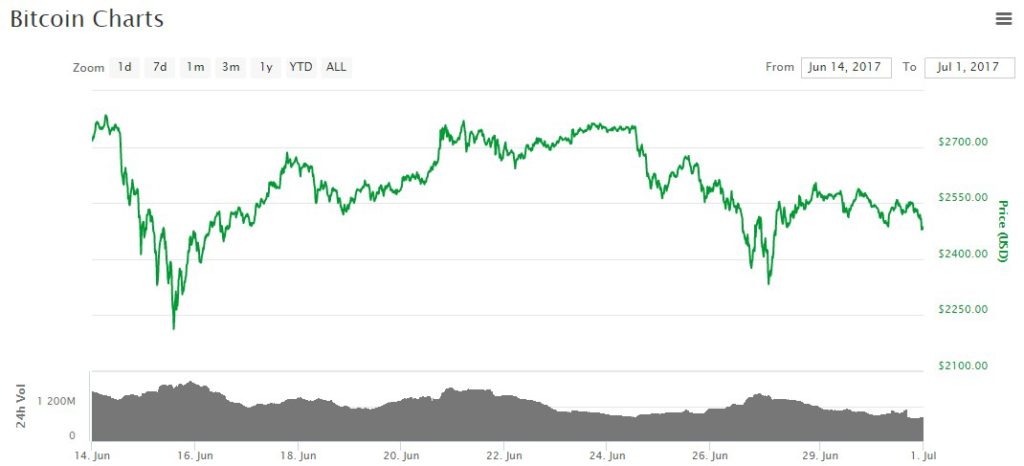

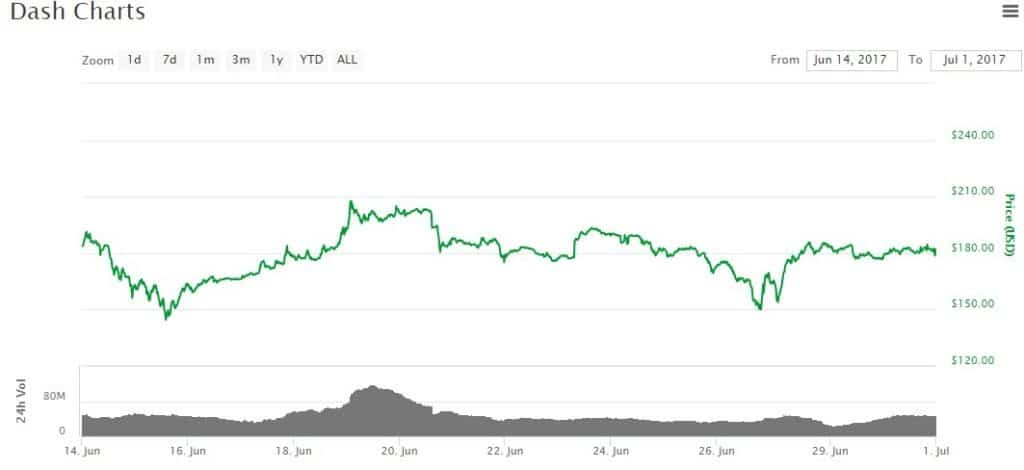

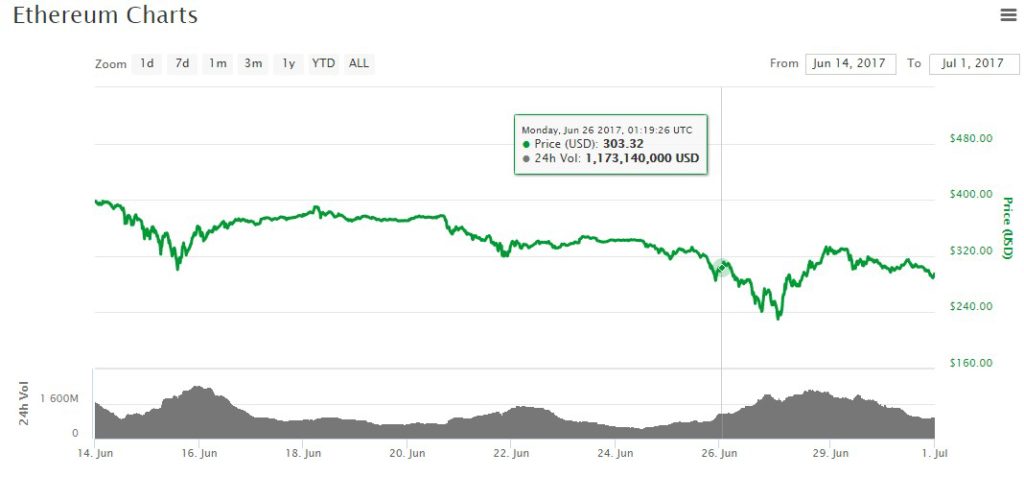

Diversification is a principle that has seen success in more developed asset classes such as: stocks, bonds and alternatives. However, when applied to digital assets, it is simply not as effective. This is because, digital assets are all highly correlated. This simply means, digital assets tend to mimic each other in the way that they trade. When Bitcoin increases in value, it is likely that so too will Ethereum, Litecoin, Dash, Monero and other countless digital assets. On the other hand, when Bitcoin decreases in value, it is likely that so too will the other digital assets mentioned above.

Over the same time period, you can see just how similar the larger digital assets by market capitalization trade. It is this uncanny similarity that makes it incredibly difficult for the average investor to diversify his/her holdings responsibly.

However, this is not to say that diversification in amongst digital assets is useless, quite the opposite, it is still very useful. For example, if Bitcoin were to experience a 15% loss in value in a single day, it is likely that other digital assets will experience a similar loss. However, they will experience this loss differently. Some digital assets will end up losing more of their value than others, therefore, diversification will have helped in limiting this loss.

Instead, I argue, it is diversification into other asset classes, not just digital assets, that will protect the average investor and therefore yield the best results. Diversification into other asset classes such as: stocks, bonds and real estate will better protect an investor.

Conclusion

Diversification into digital assets with the intention to mitigate risk is largely an illusion. Digital assets are much too correlated in their trading pattern to provide any meaningful protection. Instead, it is assigning a portion of your investments into other asset classes that is more likely to yield the best more results.