London Breakout Strategy Explained: What is it? How does it Work?

London is a dominant player in the foreign exchange (forex) market. In 2019, it accounted for $3.6 trillion of the $6.6 trillion total average daily trading turnover (54.5%). Its market-leading status within the global scene has seen entire trading strategies emerge that aim to take advantage of this. One of these strategies has been dubbed “the London breakout strategy”.

In this article, I’ll discuss the London breakout strategy in great detail. Specifically, I’ll elaborate on what it is, how you can integrate it into your day trading, its advantages and disadvantages, and more. However before I dive into the London breakout strategy, I’ll set the stage with some discussion of breakout trading more broadly.

Breakout Trading

Before exploring what breakout trading is, let’s first understand what is a breakout.

What is a Breakout?

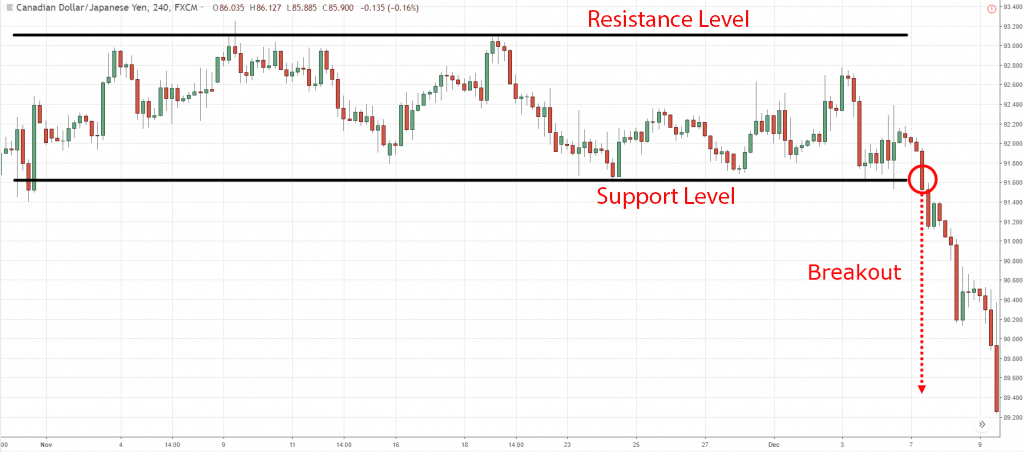

Typically, a breakout refers to any price movement beyond or below a defined level. There are two primary levels in trading, namely the support level and resistance level. The former category refers to a price below which an asset, in this case, a currency pair, does not fall for some time. A line drawn along the lowest lows helps identify the support level.

On the other hand, the resistance level is the price at which the increasing prices stop rising, change direction, and start to fall. In simpler terms, it can be termed as the level beyond which the currency pair encounters resistance that prevents further price increases. The resistance level is mainly occasioned by an influx of traders who wish to sell a particular currency pair at a given price. A line drawn along the highest highs denotes the resistance level while

Breakout Trading

Based on the overview of what a breakout is, trading breakouts (or breakout trading strategy) refers to the concept whereby a trader takes a position at the initial stages of a trend. Such a trader uses the support level or resistance level as the basis for taking the position. This is because any movement below or above the respective levels, marked by lines, will represent the beginning of significant price movements.

(source)

Usually, traders take a long position or exit short positions if the price shoots above the resistance level. Conversely, they take a short position or exit long positions when the price drops below the support level.

Notably, a high trading volume helps traders confirm the breakouts. This explains why the London breakout strategy exists. However, it is not uncommon for there to be a breakout failure.

A failed breakout occurs due to a temporary sell drive by traders wishing to profit quickly. Such sellers buy a currency pair immediately they identify a breakout but subsequently sell the currency pair shortly after. If in large numbers, this selling drives the price either downwards towards the breakout point. However, in a legitimate breakout, the price trend should revert to the original breakout direction. A failed breakout/breakout failure is said to have occurred when this does not happen.

What is the London Breakout Strategy?

Relationship between Opening Hours and Trading Activity

The forex market opens at 5 pm EST on Sunday (when the Sydney stock exchange opens at 8 am AEDT on Monday) and closes at 5 pm EST on Friday (when the New York stock exchange closes).

Thanks to overlapping forex trading times between operating markets in London, New York, Tokyo, and Sydney, the forex market remains constantly open. Even so, individual markets usually have set opening and closing times. For instance, New York opens at 8 am EST and closes at 5 pm EST, while London opens at 3 am and closes at noon. Tokyo remains open between 7 pm and 4 am, and Australia between 5 pm and 2 am (all times in EST).

That said, only a few hours of the day are good for trading – when the market is most active. This happens when two or more of the four main markets are open simultaneously. Or, when each market opens, but more specifically when the London and New York markets open, that is equally a good time for trading. Notably, New York is the second market after London in terms of the average daily forex trading turnover.

Accordingly, the London breakout strategy capitalizes on the increased trading activity recorded during the first hour of trading. Therefore, this strategy is also known as the London open breakout strategy or the London daybreak strategy.

Given that London opens at 8 am GMT, traders looking to use this strategy should be prepared to monitor price movements in the first hour. For traders wondering what time in EST the London breakout strategy takes place, that would be 3 am. However, they need to be up earlier than that. Here’s why.

The 2-Hour London Breakout Strategy

Indeed, the first hour post-London open is crucial as it normally has characteristically significant trading activity. And as we have already detailed, breakout traders confirm breakouts whenever there is a high trading volume. However, it is equally crucial to begin monitoring the forex market at least one hour earlier. This timeframe results in what we refer to as the 2-hour London breakout strategy.

In the United Kingdom (UK), most financial institutions and banks start their day at 8 am GMT. As these organizations facilitate money transfers, it is easy to establish how they directly contribute to the increased trading activity within the first hour. But why should you be concerned with the hour prior to London open?

Well, the answer lies in the concept of volatility. The forex market, like other markets, responds to news in that price movements are influenced by emerging information or data. Information relating to economic growth, changes in inflation and interest rates, and more generally impact the prices of currencies.

In cases where a news release was issued, say, in the United States, after the London forex market had closed for the day, traders are bound to anticipate price movements when the market opens the following day. Their heightened anticipation is naturally bound to build the volatility way before London opens. Typically, this happens within a one-hour window, although it has been established that volatility usually starts to build up half an hour before the opening.

Therefore, traders looking to exploit the breakouts in the foreign markets should be stationed in front of their computers or phones from 7 am to 9 am GMT (2 am to 4 am EST). Remember that London opens at 8 am GMT (3 am EST).

How to Trade the London Breakout Strategy

As stated, most of the trading activity is often limited to the first hour after London opens. This means that you should initiate a position within this compressed time frame, else you will not have a second opportunity. In this regard, entering a long or short position a few minutes after the markets open is one of the most fundamental tips if you are to exploit the London daybreak strategy effectively.

Granted, you have committed to honoring this requirement. How then do you trade the London breakout strategy? There are two ways you can go about this:

- Initiating a long position after currency pair’s prices increase above the resistance level

- Entering a short position after currency pair’s prices move below the support level

Whenever the prices break any of these two levels, volatility will likely increase, resulting in the price movement along the breakout’s direction. This is why it is important to await confirmation, i.e., by looking at the level of trading activity.

In cases where the breakout fails, you may exit a short position if the price increases beyond the resistance level. Or, you may exit a long position if the price drops below the support level. This approach to trading the London breakout strategy protects you against losses.

Exiting the trade as quickly as possible is vital to prevent the loss from increasing. Importantly, you can also use stop-loss orders to prevent losses, especially if there is a breakout failure.

Stop-Loss Orders in London Daybreak Strategy

Stop-loss orders provide an excellent avenue that automatically lets you exit a position with a loss. To determine where you should set the order, simply analyze previous breakouts. More specifically, rely on prior resistance or support levels beyond which prices have increased or dropped.

Next, set your stop-loss order level slightly above (a buy stop order) or below (a sell stop order) the resistance level or support level, respectively. This way, you will exit your position when you do not want the price to breakout.

Is the London Breakout Strategy Profitable?

The use of stop-orders may signal that the London daybreak strategy is has a high potential for losses. After all, all trading strategies have an associated risk. However, the London breakout strategy is profitable. This often happens whenever there is a long-term range. Two horizontal trendlines define the long-term range. The first connects the major resistance levels while the second joins the major resistance levels.

A long-term range influences both bullish and bearish traders to place more orders in the forex market. The former group will place buy-stop orders above the resistance level. On the other hand, the latter category (bearish trader) will short the market by also placing a buy stop order. The passage of time results in an overwhelming number of buy-stop orders.

When a price breakout occurs (above the resistance level), the stop orders trigger these numerous buy stop orders. This increases the buying pressure, pushing the prices upwards in the breakout direction.

Notably, the inverse is true for breakouts that involve a price drop below the support level. In this case, traders place an overwhelming number of sell stop-orders such that when a breakout occurs, the market witnesses a large volume of sells. This pushes the price further down in the direction of the breakout, as shown in the image below.

(source)

Traders can easily profit from the London breakout strategy by strategically analyzing the range.

Advantages and Disadvantages of London Breakout Strategy

Advantages

- The use of stop-loss orders limits the risk exposure

- The reliance on trading volumes to confirm the breakouts enables traders to exit a position quickly before the losses increase

- The London breakout strategy offers the opportunity for significant gains when the breakout trade succeeds

- The use of resistance levels and support levels as the basis for entering and exiting a trade means that the London daybreak strategy has an inbuilt trade management capability

Disadvantages

- Breakout failures greatly impede the success of the London breakout strategy

- Opportunities that allow traders to exploit breakout trading are limited or are infrequent, which means that a trader who solely intends to identify breakout opportunities is likely to waste valuable time that could have gone toward pursuing other opportunities

Conclusion

All in all, the advantages of the London breakout strategy substantially outweigh the disadvantages. This makes this trading approach particularly useful in the forex market. However, despite the possibility of making huge gains, it is crucial for traders to place stop-loss orders.