How To Avoid Bad Trades In Crypto

Introduction

Unlike other financial markets, the cryptocurrency market has grown exponentially in popularity in recent years. The main reason for this rise is a loss of faith in fiat currencies and seeking alternative avenues to hedge their portfolio.

The number of traders holding long-term positions in the market is also increasing, while institutions are adopting cryptocurrencies as an investment and medium of exchange. Today, most companies are issuing their own currency called tokens, which they use to provide goods or services to clients.

The total crypto market cap is pegged at $2.11 trillion with over 10,000 cryptocurrencies being traded on several platforms. Due to the crypto market having such a large volume, as traders we need to approach the market carefully because the market may exhibit unusual behavior.

The key to trading cryptocurrencies is to have sound money management and trading psychology. This is vital to remember since many people believe that the cryptocurrency market is a quick way to get rich. On the contrary, it’s easy to build your $100 trading account to $500 and it’s just as easy for your $500 trading account to go all the way down to zero.

The goal of every crypto trader should be to avoid bad trades. Following signals from professional traders can help you keep your head straight. Keep in mind that avoiding bad trades has the same overall effect on your trading account as riding a good trade. This could have an enormous effect on the overall balance of your account so you absolutely must develop this skill.

Avoiding Bad Trades In The Crypto Market

Trading the crypto market requires a lot of patience, this is a skill most traders involved in the crypto market lack. All of this is down to your trading psychology and money management.

This article will address questions such as, how do you know when to take your money off the table if your trade is profitable or not?

How long should you ride the trade if it is profitable? And how long should you stay in a losing trade?

These are skills you need to master in trading.

Holding a position for too long in a trade (either in profit or loss) can prove detrimental to your trading balance, especially in the crypto market. Also, closing a trade too early is not good as you’re leaving money on the table.

The principles on how to avoid bad trades in the crypto market can also be implemented in other markets like the Forex and Stock market.

Average True Range (ATR)

This is the most important technical indicator when it comes to having profitable and consistent money management. I’ll teach you how the ATR is used for your money management (instead of a volume indicator) and how you can help you avoid bad trades.

The ATR doesn’t get you into trades but it helps you set your Take Profit (TP) and Stop Loss (SL). This ultimately avoids very bad trades.

The ATR dictates how you set up your trades. It tells you the total number of pips the coin has moved and is likely going to move in a specified timeframe. Not many traders are privy to this information but this gives you an insight on what price levels your TP and SL should be placed.

The crypto market is wild due to its high volatility, this also reflects on the value of the ATR. The ATR values are usually much higher than that of other markets in a similar timeframe.

The value of your TP is 2 X ATR value while your SL is 2.5 X ATR value. This is only for crypto traders and not recommended for Forex or Stock traders.

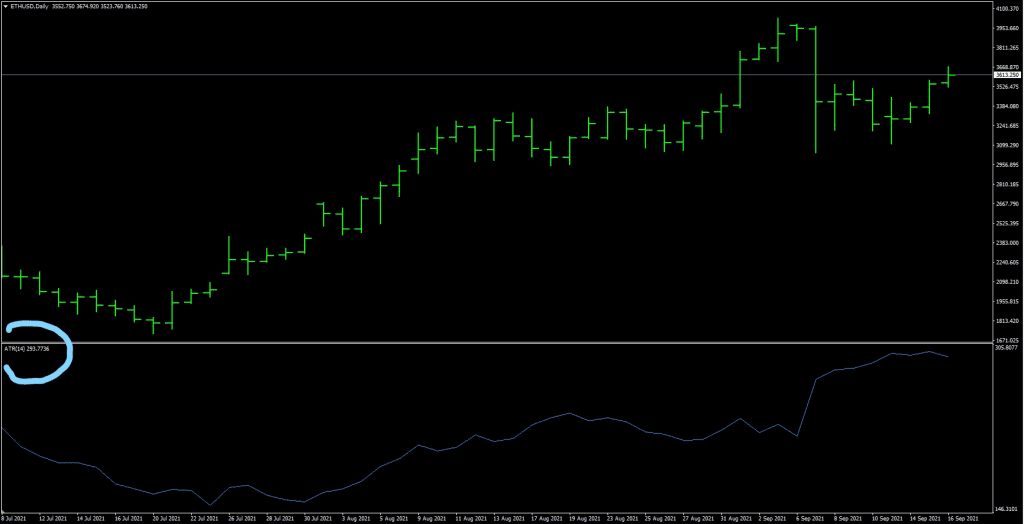

The value of the ETHUSD chart below is 293.

So a good TP would be (2 X 293) = 586; To get the TP value, add or subtract this value (586) from the current price value depending on the type of order you wish to place. For long orders, add the value from the current price value and for short orders add the subtracted value to the current price value.

A good SL would be (2.5 X 293) = 732.5; add or subtract this from the current price value. For long orders, subtract the value from the current price value and for short orders add the calculated value to the current price value.

The ATR can also show us how to enter an ongoing trade and how to avoid a bad entry into an ongoing trade. It can also serve as a basis for our principle of identifying a bad trade.

Usually, when the market moves very far past the value of the ATR, it has covered the highs and lows for that specific time and any trade entry during these periods would be considered a very bad trade in the crypto market.

From the ATR value in the chart above (293), if the price has fluctuated far beyond this value it would be a bad trade to enter such positions. So it is in your best interest to stay away from the trade and wait for the next signal from your trading tools.

The ATR is also useful when you are scaling out your trades. The concept of ‘scaling out’ comes in handy when you’re in a winning trade. It helps you keep your profits in your pocket.

Before you place a trade, say $50 or 0.05 standard lot size on ETHUSD, you place two trades $25 each.

One of the trades will have its TP at the 2 X ATR value and the SL at the 2.5 X ATR value. While the second trade will not have a reasonable TP, your SL will also be 2.5 X ATR value.

Once the first trade hits its TP, you then move the second trade’s SL to the entry point of the trade so you have a break-even if the price dips. This is the concept of scaling out.

Money Management And Trading Psychology

The importance of money management and trading psychology cannot be overstated, they should come before trading tools. The right trading tool gets you into a good trade, but money management and trading psychology keeps the money in your pocket.

Good trading psychology and money management help you stick to a laid-out strategy in trading the market which includes maximizing your trading tool. Trading journals can help you keep an even head and find patterns in your trades.

Avoiding bad trades in crypto trading all boils down to being able to abstain from trades when the following trading conditions aren’t met:

- You don’t have a signal from your trading tools

- Your current price has moved very far from the value of your ATR

Discipline and patience are major factors in trading psychology.

Trading crypto requires a distilled trading psychology to incorporate these principles into your activities.

Discipline is your ability to stay with what your technical indicators tell you to do. When they say go long/short, you do just that. When they say to get out of a trade, you do exactly that.

You can’t afford to trade without emotions.

As a crypto trader, you need to have an already built-in system. This will help you execute and close an open trade much faster. Once you’ve built this system and it has proven to be profitable, you NEED to follow it religiously. Being disciplined plays a big part in achieving this.

Creating a system means that for each trade you take, you have a set of guidelines that dictates how you enter a trade, how you ride a trade when it’s in profit, how you manage a trade when it’s in loss and how you exit a trade.

The overall effect of the points highlighted above is to get you into good trades while avoiding bad trades in the crypto market.

You could also get trading signals from a trusted source.

Once the signal is sent, all you need to do is make sure you follow every instruction given; the entry point, the take profit, the stop loss, and most importantly, the exit point.

You can get reliable crypto trading signals from our Telegram group and join over 100s of crypto traders by clicking here:

Patience is so essential for crypto traders. From my experience, out of all traders from the major markets (Stocks, Forex, & Crypto), crypto traders have the least patience and this attitude tends to rub off on anyone trading in this market.

In the crypto world, there are always opportunities, this is what you must realize. So the narrative of you getting rich quickly must be gotten rid of. Each opportunity mustn’t be treated like it’s your last one, you must just make sure you’re prepared for the next one.

Once you have this in mind, the likelihood of getting into bad trades is much less.

How To Setup Your Trades

I’ll teach you how to set up your trades in this section and also answer some questions that might also come up.

One of the primary things to know is that trading is not a get-rich-quick scheme. Chances are you’ll blow your first few accounts if you have this mindset.

I also always recommend to people that this shouldn’t be your sole source of income. As any professional trader will tell you, there are ups and downs just like every other occupation out there.

It could however be a very lucrative side income for you if you have a good trading system. A good trading system generates at least 60% ROI (Return on Investment) and this can be very much improved over time.

For every crypto trader, you should have a journal as this helps you keep track of your trades while you also note areas of improvement needed in your trading system.

Before entering a trade, you should check if there is news from reputable crypto websites for that day as this determines how you set up your trades. You could also watch out for press releases from high-profile individuals though this is rare. The crypto space is still relatively new so the effect of each news can’t be accurately determined.

If there’s any unexpected news event and you have an open position it’s best to close such positions regardless of if the trade is running in profit or the loss. Asides from this, you exit a trade when your indicator tells you so.

Frequently Asked Questions

This section of the article answers some commonly asked questions about trading and how to confirm your trades.

-

What are Pips, Lot, and Leverage?

Pips are like the cell of any traded securities, it is the smallest unit of trade.

Lot is a trading unit that measures your transaction amount, the market is traded in specific amounts called lot sizes. You have standard, mini, micro and nano lot sizes.

Leverage is what allows smaller investors like ourselves to trade the market. Trading the market requires a large amount of capital and the concept of leveraging provides us with that.

-

How much do I need to start trading the market professionally?

Any amount is enough depending on the broker. The minimum amount for most brokers is usually $10. Most signal groups have a free tier where you can join and test out their services.

-

What timeframe should I trade for crypto?

I often recommend the daily timeframe because it compensates for the volatility of the market and most indicators work better on this timeframe.

-

What indicators should I use for the crypto market?

Several indicators can be used in the crypto market depending on how the trading signals are interpreted. The market works with demand and supply. You can get more details on trading tools in this article here.