Forex Hedging Strategies

If you've traded in FOREX before, you’ll want to consider hedging your positions to reduce your maximum losses. Today I’m going to weigh in on what hedging is as it relates to FOREX. To do this, I'll cover two questions that'll give you a deeper understanding of hedging.

- What does hedging mean?

In essence, hedging is a risk mitigation strategy. Think of hedging as insurance for financial transactions. You spend a small amount to take a position that will offset the risk of fluctuations in price. When the market turns unfavorably, a hedge will allow you to cap your losses so you don’t go bankrupt.

Note that hedging is not a strategy for earning a profit, but for capping your loss. In fact, hedging brings along the added cost of entering and exiting an additional transaction, thereby reducing your profit.

Hedging is a common practice in multinational companies that have exposure to multiple currencies. There is a very real cost that accompanies hedging, but it can save you millions when things go south. Let’s jump into the next section to see why multinational companies (and even traders) hedge FOREX positions.

- Why would you need to hedge FOREX?

I am going to use an example to really drill this concept in your brain.

If you invest in equities, you know that by taking a bet on an airline company, you are also taking a bet on oil prices – this is how big of a cost oil is for an airline and how that will affect profits.

Let’s assume you run an airline company based in England.

Now, your airline needs to pay for ATF (aviation turbine fuel) so you can run your flights. The payment for oil, however, happens in USD. When you make the payment, you will need to convert your GBP to USD.

Assume that you purchased 40,000 barrels of oil at $60 per barrel when GBP/USD was at $1.35, i.e. £1 buys you $1.35. You will need to pay the seller a total of $2.4 million or £1,777,777 (you can calculate this as 2.4 million divided by $1.35). You place the order and smile your way home thinking you’ve had a productive day.

15 days later, on the date of payment – the GBP/USD pair is quoted at $1.25. Let’s recalculate how much you will pay for the same quantity of oil.

At this rate, you will pay £1,920,000. That is a giant hole in your company’s bank account worth £142,333.

To avoid this, you’ll need a hedge. The hedge will cost you money, but it’ll be a long way off £142,333.

Awesome, I believe that should help you really grab on to what hedging is, and why companies and traders do it. Let’s now take a step forward and get our hands dirty with FOREX hedging strategies that you can directly apply to your trades. As you read through these strategies, notice how businesses and traders use different strategies.

FOREX HEDGING STRATEGIES

- Direct FOREX Hedging Strategy

This is a plain-vanilla strategy that is not too complicated, and perfect for beginners while they test the waters. It is also illegal in the US. But I will teach how you can legally use this strategy to hedge FOREX. Before we get into the strategy, let’s lay some groundwork regarding why it is illegal.

The US Commodity Futures Trading Commission banned direct hedging because they were of the view that it guarantees a loss for the trader. Let’s look at how.

Assume that you open a long position on GBP/USD and at the same time open a short position on the same pair to offset your position. Perfect, so you end up with 0 profit, right? Not quite.

You also incur spread expenses, which pulls you into the red even though you offset your position. This is why the CFTC put a ban on direct hedging. If you open a long GBP/USD and subsequently attempt to short that pair, the broker is legally obligated to close your first trade.

Here is a legal workaround: Instead of going long and short on the same pair, we will use 3 pairs to offset our position. For our example, we will pick GBP/USD, USD/INR, and GBP/INR.

For example, let’s say you went long on GBP/USD and USD/INR and short on GBP/INR. Notice how you will have gone long and short on all 3 currencies by doing this. Naturally, you could choose any 3 currencies and apply the same strategy to legally hedge your FOREX trades.

- FOREX Correlation Hedging Strategy

Do you remember the stats class in college that you slept through? This is where those classes are going to save you a ton of money. I am specifically referring to the concepts of correlation.

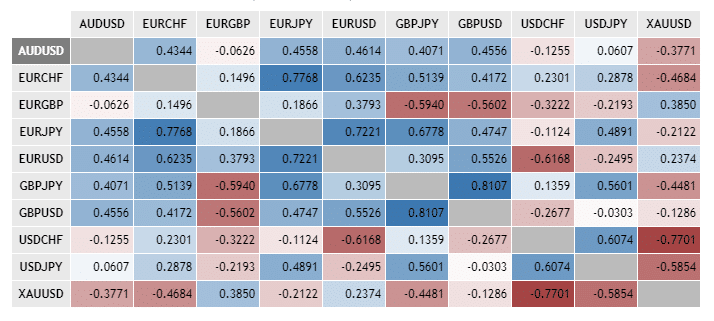

This strategy is a step further from the direct hedging strategy. To use this strategy, you will need a correlation matrix for the currency pairs, like the one below:

While our focus is not to learn the concepts of correlation, I'll explain what the -0.6168 correlation coefficient means; It means that these pairs move in the opposite direction at least 61% of the time (or roughly 6 out of 10 times).

This also means that 39% of the time they don’t move in the opposite direction, which leaves you exposed to the risk of adverse fluctuations – this is precisely where this strategy differs from the direct hedging strategy where you could eliminate 100% of the exposure.

Here is how you can apply the FOREX correlation strategy: Open a long position on the EUR/USD and USD/CHF pairs. This effectively squares off your exposure to the fluctuations in USD. However, you are still exposed to fluctuations in EUR and CHF. Note that you will want to go long on both pairs since they are negatively correlated. Going long on one and short on the other will have the effect of doubling your position.

If the pairs you chose are positively correlated, things are a little different. Let’s talk about the positively correlated GBP/USD and GBP/JPY. To hedge, go long on the GBP/USD and short on the GBP/JPY because the pairs are positively correlated. The correlation tells you that when GBP/USD rallies, so will the GBP/JPY. See what I mean? So, to hedge positively correlated pairs you will want to long one pair, and short the other.

You can also use a financial asset instead of a second currency pair, provided there is a strong correlation between the two. An example of these financial assets could be gold or oil. In fact, the USD/CAD pair is strongly correlated with the price of oil. This makes intuitive sense because Canada’s economy is strongly influenced by oil prices.

I would recommend that you use the FOREX correlation hedging strategy only when you are working with several currencies and building a relatively complex hedge. In other cases, stick with either a Direct Hedging Strategy or an Options Hedging Strategy, speaking of which…

- FOREX Options Hedging Strategy

Let’s break this name down. We already know what FOREX and hedging are, so we will first talk about what options are (in the context of FOREX hedging).

A FOREX option gives you (the buyer of the option) the right to buy (using a call option) or sell (using a put option) a currency at a predetermined price on or before a specific date (or the expiration date) of the option. An option gives you the right, but not the obligation to execute this transaction.

This is the strategy that most closely resembles the concept of insurance. You pay a premium for purchasing the option and protect yourself against adverse movements in the rates of currencies in question.

Again, we will work through an example to see how this works.

Let’s say you open a long position on the EUR/USD at $1.2. But, you suspect that the pair may see a steep decline. So, you hedge your risk by buying a put option (an option to sell) at $1.1 with a 30-day expiration.

Now, during these 30 days, you may exercise your put option at any time. Let’s say on the date of expiration the pair quotes at $0.90. Your put option would be in the money even though your long position is in the red. In this case, you sell the EUR/USD at $1.1 to the writer of the put option, and he must buy even though the rate is $0.90. Your loss in this case is the loss on the long position, plus the premium paid on the put option, softened by the gain you make on the put option.

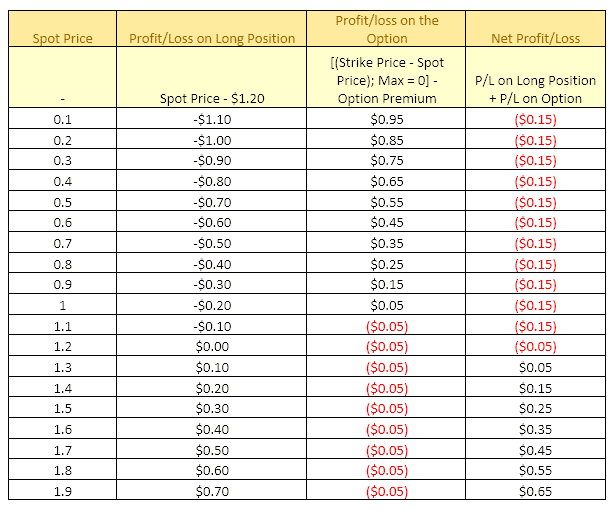

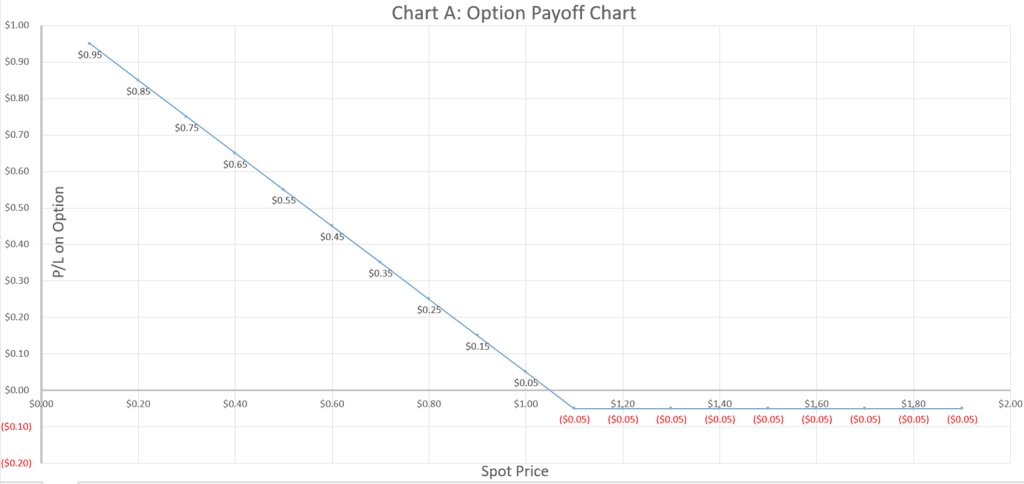

I pulled up an Excel sheet and drew up the payoff charts for this put option for those of you who like to understand things more visually. Let’s look at the chart to see what your profit potential is when the premium paid on the option is $0.05. Here are the data points:

This is the payoff chart if you had only purchased the put option without opening the long position. This is just to give you clarity on how a put option behaves:

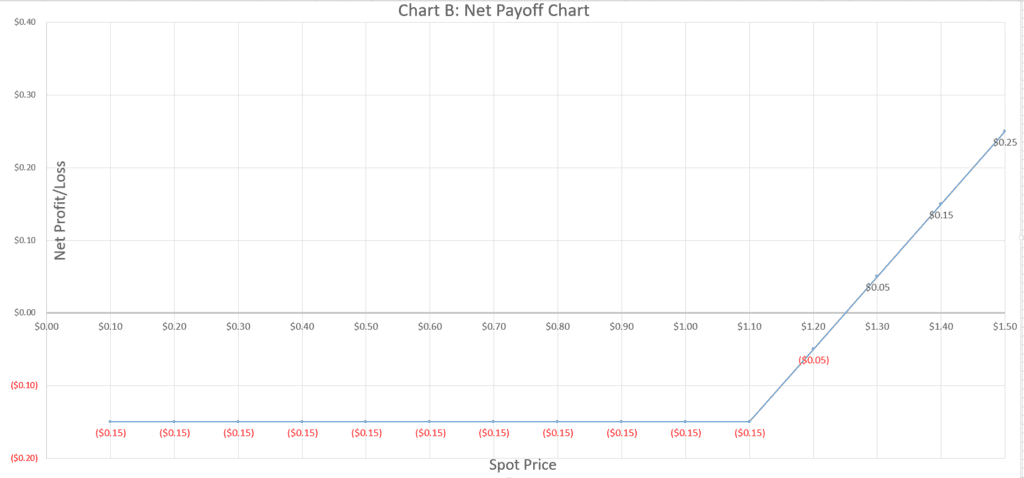

However, we did not only just buy a put option. We used the put option to hedge our long position. So, this a chart showing the net payoff on the transaction at different spot prices:

Notice how in both cases, your downside risk is capped, while there is unlimited upside potential.

- FOREX Hedging with Forward Contracts

This is the strategy used by corporations to shield themselves against currency fluctuations. This is done by entering into an agreement with another party to sell or buy currency, at an agreed-upon rate at a specific date in the future (or during the contract period). There are 4 types of forward contracts:

- Closed Forward Contract

- Open Forward Contract

- Long-Date Forward Contract

- Non-Deliverable Forward Contract

Our discussion will focus on the first two types.

Closed Forward Contracts

Also referred to as a “fixed,” “standard,” or “European” contract, a closed forward contract involves an agreement between two parties to exchange an agreed amount at a specific future date. The agreed amount is typically the spot rate of the currency on the date of transaction, plus a premium or discount computed from the interest rate differential of the currencies in question.

This is the most commonly used type of forward contract among businesses that wish to hedge their exchange rate risk.

It is important to note that the exchange of funds under a closed forward contract will only take place at the expiration date.

Open Forward Contracts

An open forward contract is the same as a closed forward contract, except that the transaction may be carried out at any point within the contract period, i.e. on or before the date of maturity. Open forward contracts, therefore, offer more flexibility.

Assume for a moment that you are an importer. You know you are going to need a specific currency within the next 30 to 60 days, but you do not have a specific date for when you would need to make the payment to your suppliers. In this case, buying a closed forward contract does not make sense because you cannot obtain the funds until the maturity date. Therefore, you would want to opt for an open forward contract to hedge your exchange rate risk.

Final Thoughts on FOREX Hedging

Hedging FOREX provides downside protection. However, it might also limit your ability to earn a speculative profit. While most businesses are more comfortable choosing downside protection against speculative profit, that is not how most traders feel.

Precisely because of this, traders can generate far superior profits with an options-based strategy. They are versatile instruments that allow you to hedge a diverse set of risk profiles. Options are the best of both worlds – they cap your losses, but the profit potential remains unlimited. However, option strategies are more suitable for traders who have advanced knowledge of the subject. If you're looking for ideas on what currencies to trade and how to play it, try out some free telegram forex signals.