Complete Guide to CFD Trading in Forex

A contract for difference (CFD) is a derivative product that enables traders to speculate on assets such as equities, indices, commodities, and forex without ever owning the underlying asset. In essence, when you trade a CFD, you contractually agree to exchange the difference in the price at which the contract was entered and the price when the position is closed. Ultimately, whether you make a profit or loss depends on which way the price of the underlying asset moves.

How Does CFD Trading Work?

CFD trading involves buying and selling of CFDs. Neither party to the contract is required to buy or sell any assets, however.

For instance, let’s say GBP/USD trades at $1.3 and you buy a CFD betting that the pair’s quote will move to $1.4. Of course, the opposite party to the contract will be betting that the pair’s price will fall. If the pair’s price does touch $1.4, you can close your position and collect profit. If the pair’s price falls, though, you’ll need to pay the difference to the other party to the contract.

This may sound a little abstract to beginners, but that’s what this guide is for. Let’s go into some detail and explore CFDs.

Basic Concepts

Following are the basic concepts and terminology that every CFD trader needs to know before their first trade.

Short vs. Long

With traditional trading, a trader makes a profit only when the price of the underlying asset increases. However, CFD trading allows traders to profit even when an asset’s price falls, i.e., a trader could generate a profit even though the value of the asset itself may reduce.

CFD traders can either go long or go short on a pair. Going long means a trader wants to bet that the price will rise, and vice versa.

For instance, let’s revisit our previous example. Since you wanted to bet that the GBP/USD will quote higher, you’ll buy a CFD and go long on the pair. If the pair quotes below $1.3 when you close the position, you’ll incur a loss, and you’ll make a profit if the pair quotes above $1.3. Conversely, if you believed that the pair is likely to quote below $1.3, you’ll want to buy a CFD and go short on the pair.

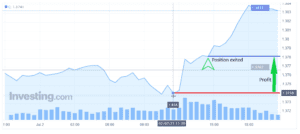

Say you went long on the pair at $1.378 around 11:30 am as shown below. The price, fortunately, moves in your favor. In this case, here’s what the payoff (profit in this case, as illustrated with the green arrow) will look like:

Leverage

CFD trading lets traders take on leverage. Essentially, traders can take on large positions without an upfront cash outlay. For instance, say you want to go long on a mini lot (i.e., 10,000 units) of EUR/USD when it’s trading at $1.2. A standard trade would require you to put $12,000 down upfront. However, with a CFD, you only need to put down the margin money (discussed next), say 5% or 10% (i.e., $600 or $1,200).

Leverage is a two-edged sword, though. If the trade works in your favor, you’ll generate far more returns than you could have in a standard trade, keeping the cash outlay constant. However, the reverse is just as true. In simpler words, leverage amplifies both, profit as well as loss. Losses can even wash your margin away, and if you had put in additional maintenance margin, you could lose that too. This is why you must always supervise your leverage ratio and manage risks when you’re trading CFDs.

Margin

Now, about that 5% to 10% cash outlay we talked about in the example above — that’s margin money; money required to be deposited with your broker to open a leveraged position. Margins may be of the following two types:

- Deposit margin

This is the money you’d need to deposit with your broker to open a leveraged position.

- Maintenance margin

Your broker will give you a “margin call” when your trade isn’t looking too good and has started to incur losses. The broker will demand that you deposit more money when your losses start exceeding the deposit margin and any additional funds you have lying with the broker.

If you don’t deposit additional funds, the broker will just exit the position, realize the losses, and use your funds to make those losses good. A good trading signals provider will always give you a stop loss, so you never end up in this situation.

Hedging

CFDs can also function as an effective hedge and help you cap your losses on your standard trades. Hedging works by taking simultaneous positions on a given security.

For instance, let’s talk about EUR/USD. Say you purchased a mini lot of EUR/USD at $1.19. However, the recent geopolitical events signal that a correction may be in the works. You could protect yourself against the losses in this case by shorting the EUR/USD pair with a CFD.

Since you’ve shorted EUR/USD at $1.19, any loss from the price drop will be offset by the CFD trade. If the price drops to $1.15, a loss of $400 will be completely offset because you’ve shorted the pair.

CFD Trading Strategies

Now that we have the basic terminology out of the way, let’s talk about trading.

Randomly initiating trades is like driving a car with your eyes closed and hoping you won’t crash. To become a successful CFD trader, you need a coherent trading strategy. You might want to use a forex trading journal to keep your head straight and disciplined. Before we get to the strategies, let’s talk about how the strategies are categorized.

All strategies may be broadly categorized as either fundamental or technical.

Fundamental strategies have a value-oriented approach and aim to focus on the company’s fundamental strengths and weaknesses.

For example – does the company have a competitive advantage? Does the company have healthy cash flow? Is its business vulnerable to regulatory changes and restrictions? Does the top management have a solid track record? Does it have a history of poor corporate governance? Does it have a product portfolio that will sustain growth over a long period? … you get the idea.

Fundamental strategies are inarguably effective. However, they are more suitable for value investors rather than traders. Investors that want to hold positions for the long-term, giving enough time for the company’s price and value to converge may find fundamental strategies more useful.

The trading room jives differently. Traders live, walk, and breathe technical analysis. Of course, that’s what we’ll focus on here — so let’s dive right in.

Scalping

Scalping is one of the most commonly used strategies among traders, and for good reason. It’s a straightforward strategy that allows traders to pocket gains from the difference in a forex pair’s bid-ask spread.

Scalpers need to always stay alert, though. Since their per-trade profits are quite low, they must execute a high volume of trades to generate sufficient profits over the course of the entire day. CFDs are the perfect tool for scalpers because they generate higher gains by introducing leverage to the trades.

As a rule of thumb, more heavily traded pairs tend to have the lowest spreads. Following are the spreads for some of the most heavily traded pairs as on the day of writing:

Generally, scalpers aim to scalp volatile currencies because they produce gains relatively faster. Alternatively, scalpers could choose pairs with low spreads because they can produce gains faster than non-volatile pairs with higher spreads. If you’re a beginner keen on learning about scalping, you may want to check our forex scalping guide.

Swing trading

If you’re familiar with the Elliott Wave Theory, you know that financial markets tend to trend in waves, not linearly. Swing trading aims to use this tendency in the trader’s favor. As a swing trader, you’ll look for sudden spikes in the prices of a forex pair and take a position by estimating its reversal.

Though similar to contrarian trading (discussed next), there is one differentiating factor between both these strategies—the time frame. Swing trades tend to stay open for the entire trading day. While your position remains open through the trading day, you’ll need to keep an eye out for the trend’s reversal and sell when the price swings higher than your purchase price or lower than your sales price.

Contrarian strategy

The contrarian strategy is a high-risk, high-reward proposition. This strategy originates from the idea that like most things in the world, the trends of forex pairs are impermanent and will reverse at some point. As a contrarian trader, you’ll essentially bet on when the price will change its trend, i.e., you’ll anticipate a point from which it will trend downwards if it's currently in an upward trend or vice versa.

If you play your cards right and the reversal does happen, you’ll earn a decent profit. You can use technical indicators like Fibonacci retracement to estimate when a trend reversal may occur. For instance, if the price of USD/CAD has been in an uptrend and your indicators signal a trend reversal, you could buy a CFD and go short on USD/CAD, and wait for the actual reversal.

Evidently, the contrarian strategy is all about timing the market. Therefore, it’s a risky strategy. However, if you do it right, the rewards will be worth your while.

Range trading

If the two words beginners remember after listening to the business channel for the first time, it’s support and resistance levels. That’s precisely what range trading is.

Range trading is a strategy whereby the trader looks for oversold or overbought areas (alternatively referred to as resistance and support areas) of forex pairs, and buys a pair when it’s in the oversold territory (i.e., below the support level) and sells a pair when it’s in the overbought territory (i.e., above the resistance level).

For instance, if you believe the GBP/EUR will trend between €1.12 (support) and €1.16 (resistance), a trader may take a short CFD position when the pair quotes above €1.16 and take a long CFD position when the pair quotes below €1.12.

Costs Associated with CFD Trading

Of course, CFD trading comes with a cost too. Therefore, a trader breaks even when they generate enough gains to cover the costs, and not when their purchase and sales price are equal. Following are the costs you should consider while calculating the gain on your trades.

CFD holding Costs

Traders incur holding costs only when they don’t close their positions by the end of the trading day, i.e., 5 pm New York time. However, it’s possible to incur negative CFD holding costs too since they depend on the direction of the spread.

Spreads

Spread has the same meaning as everywhere else. It’s the difference between a CFD’s buy and sell price. As soon as you initiate a trade, you know the spread you need to cover to start producing gains. A narrow spread allows you to produce gains faster (or incur losses if the price moves unfavorably) since the price will need to move only a little to cover the spread.

Market data fees

Brokers charge market data fees, as the name suggests, for offering market data. The fees vary among brokers, so be sure to check the fees your broker charges before you pay for the subscription of services.

Final Thoughts

As with any type of trading, CFD trading comes with a set of risks. As a trader, you should always stay cognizant of your risk appetite. Once you have your risk profile figured out, you can choose a CFD trading strategy accordingly. Remember that CFDs are leveraged and are capable of amplifying both, the profit and the loss. Consider using risk mitigation strategies like hedging to cap your downside risk, especially when the markets are volatile.

Learning the ropes of forex trading can be difficult without guidance and mentorship. That's why many people chose to join free telegram trading groups, where you can watch the trades of professional traders and take in their thought process.

Each CFD trading strategy requires the use of a different set of technical indicators. Having an excellent trading platform that offers real-time data and interactive charts goes a long way in increasing your trading business’s long-term profitability. Most platforms offer a demo account that you can use to see if the platform’s services fit the bill; use the demo account and practice beforehand as this can be very helpful when you have to execute trades quickly.