Deribit Exchange: A Complete Beginner's Guide

Deribit Exchange is a leading cryptocurrency derivatives trading platform primarily surrounding Bitcoin and Ethereum futures and options contracts. Deribit Exchange allows users to easily manage, buy and sell cryptocurrency options and futures swiftly and securely while providing substantial liquidity to meet market needs.

Enclosed is a how to guide for the convenience of Deribit’s users introducing Deribit Exchange. This how to guide will demonstrate Deribit’s core features, functionalities and how to navigate the exchange platform.

This guide will cover primarily how to use Deribit Exchange. Included topics are:

- Basic Deribit Statistics (volume, tradable currencies, order book sizes)

- How to sign up for Deribit Exchange

- How to navigate deposits and withdrawals on Deribit

- How to create & manage Perpetual Swap Contracts

- How to create & manage Futures Contracts

- How to create & manage Options Contracts

- How to utilize leverage and margin trading on Deribit Exchange

- Fees to expect

- Conclusion

Basic Deribit Statistics (volume, tradable currencies, orderbook sizes)

Active Users : Deribit Exchange has proven to have a solid and growing active user base. Significant trading volume is always a good sign of a strong user base, which Deribit provides. Deribit does not publicly list their exact amount of active users, but displays over 5,000 members in their officially online telegram chat forum. Additionally Deribit’s YouTube presence has over 200,000 views.

Tradable Currencies:

- Bitcoin

- Ethereum

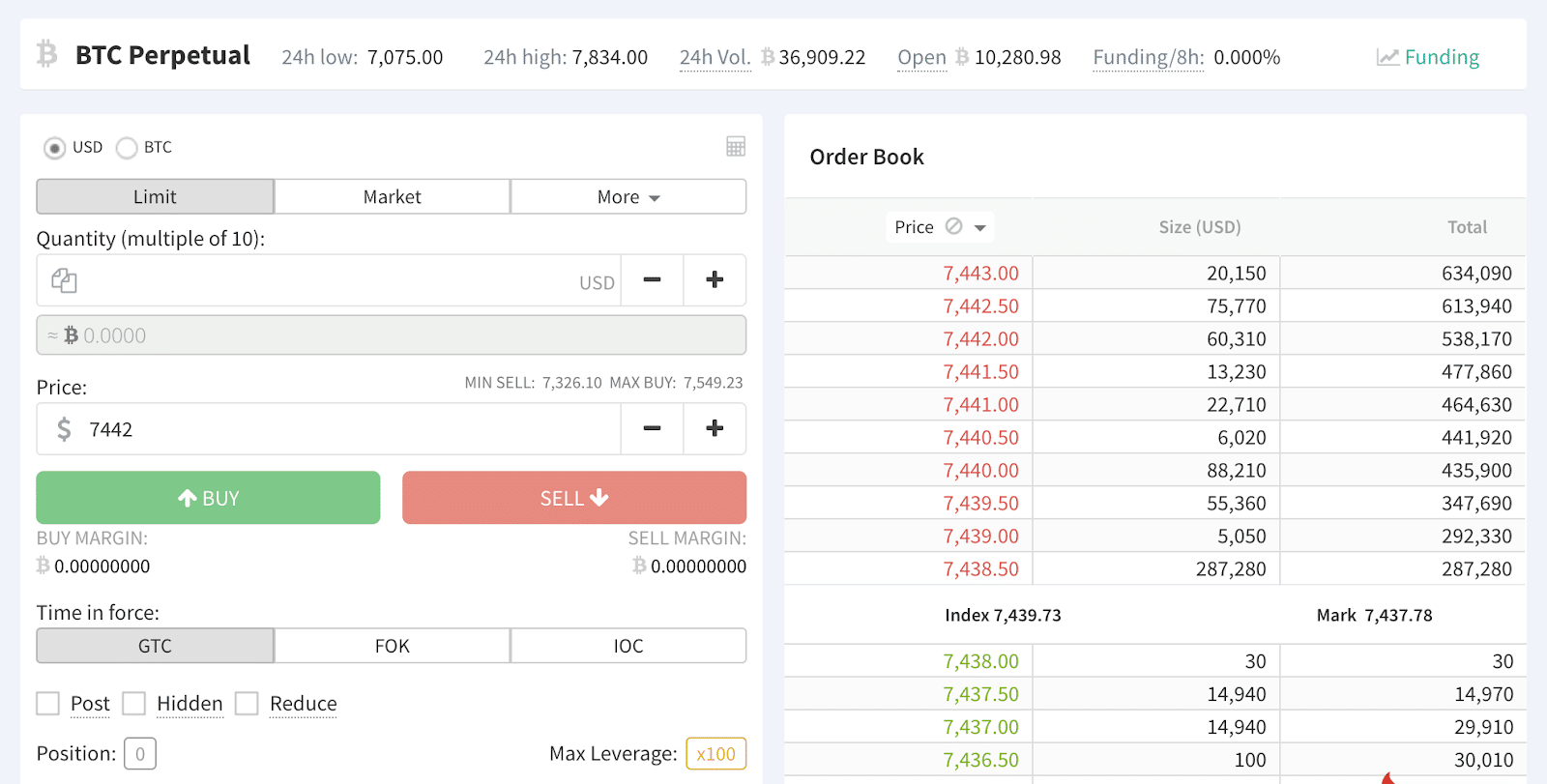

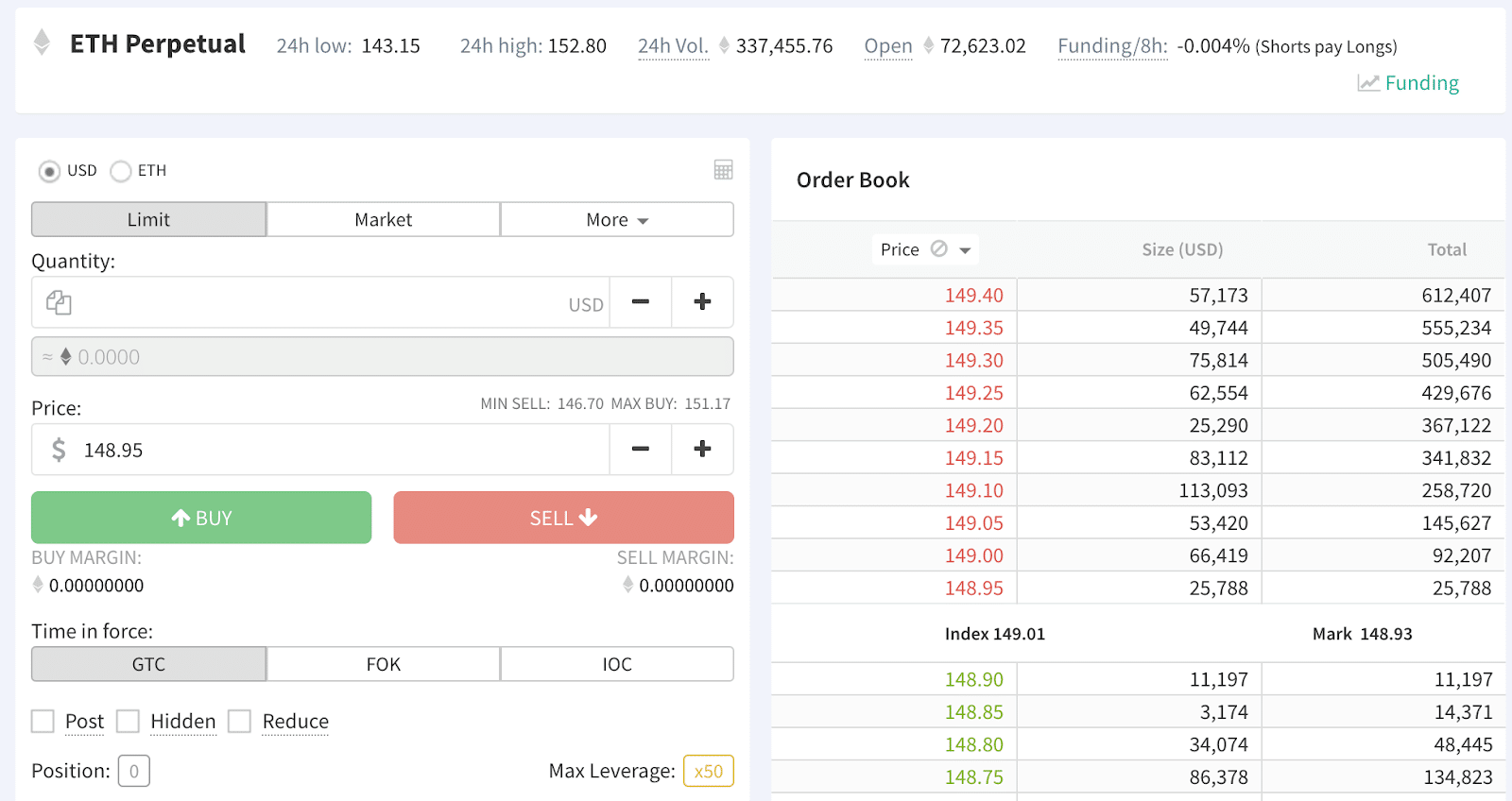

Volume: As shown in the images below, Deribit Exchange provides exceptional volume for its users.

Bitcoin combined options and futures have a 24 hour volume of over 15,000 bitcoins.

Ethereum combined options and futures 24 hour volume of over 85,000 ETH.

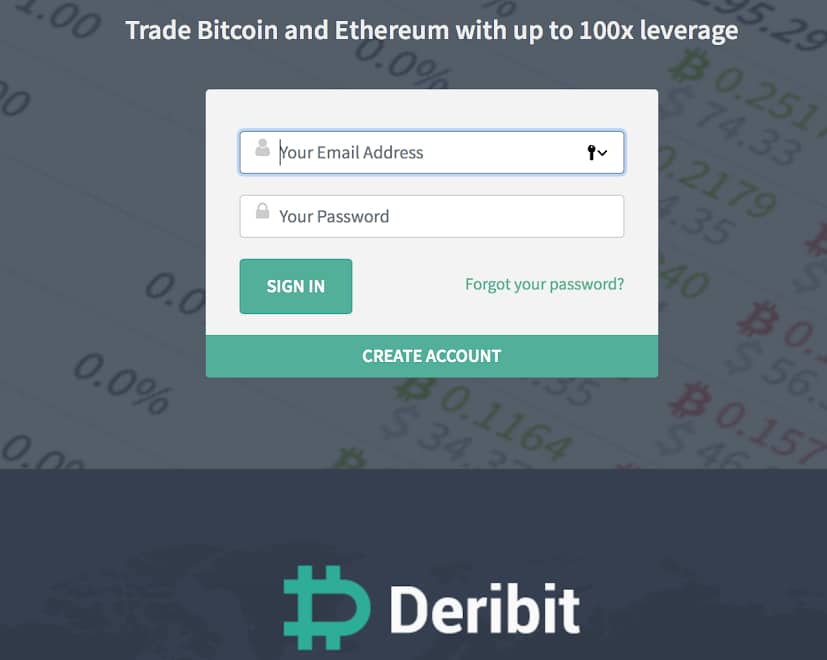

How to sign up for Deribit Exchange

Deribit Exchange offers a quick and easy sign up process that should allow users to get trading in minutes. On their front page, users are prompted to sign in or “Create Account”. New users will click “Create Account” and follow through the simple sign up verification process, entering and verifying their email.

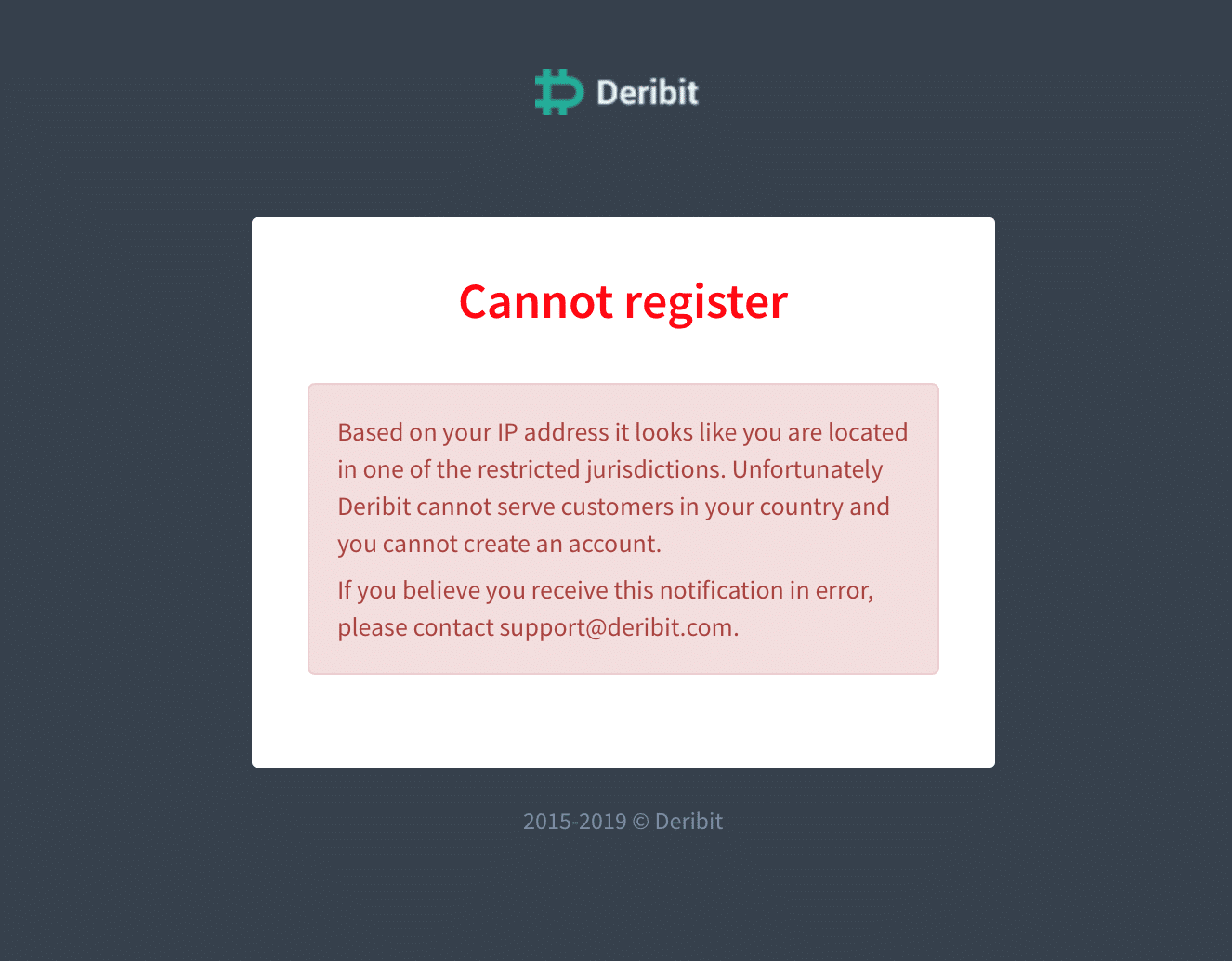

Location: Be sure to make sure your computer network is coming from a country in which Deribit Exchange provides services! Otherwise you will be prompted with this screen:

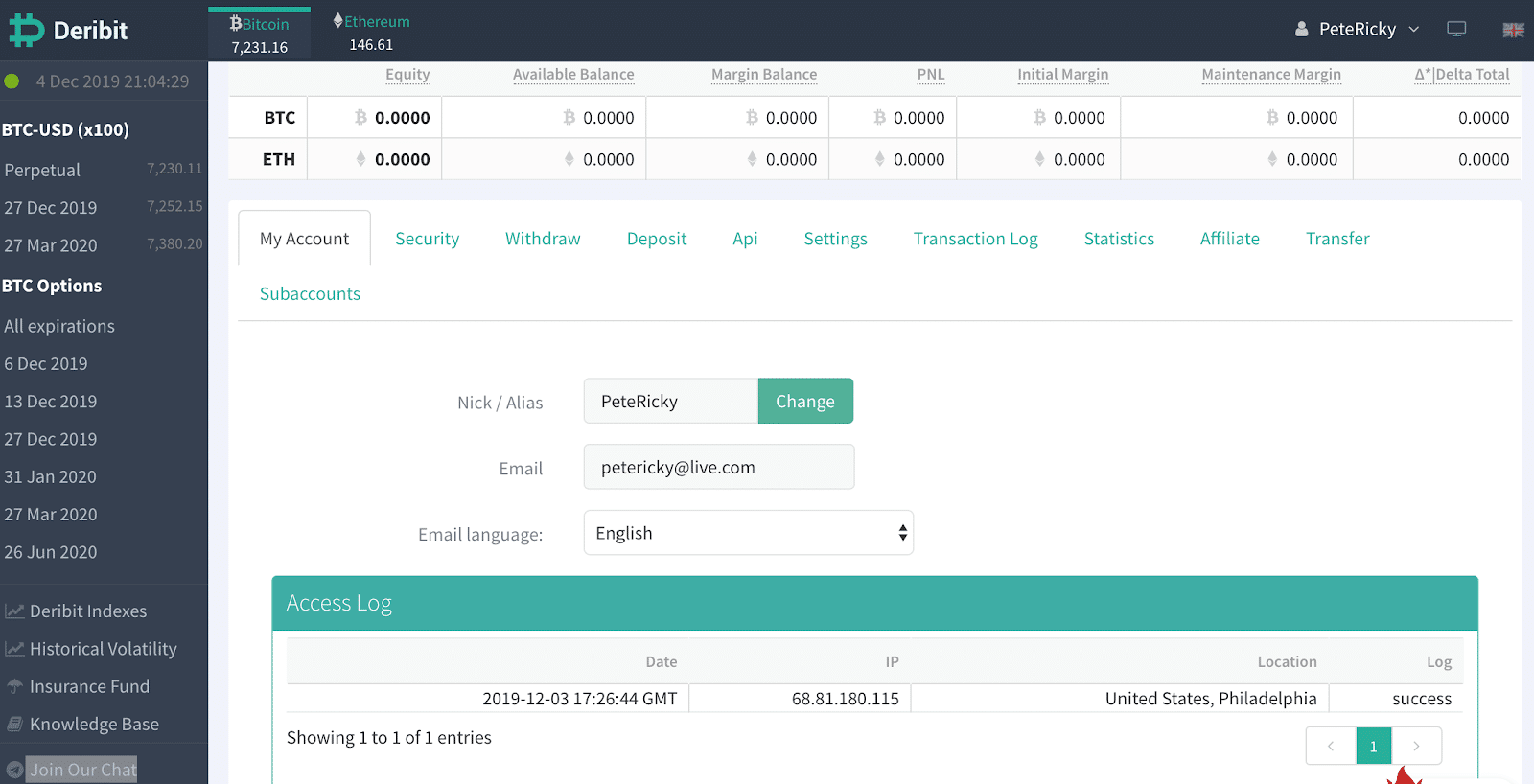

Dashboard: Once signed in, users will be able to begin interacting with Deribit exchange platform to begin trading! Users can click their username in the top right, and click “My Account” to go to the dashboard of their account. This is what you should see:

How to navigate deposits and withdrawals on Deribit

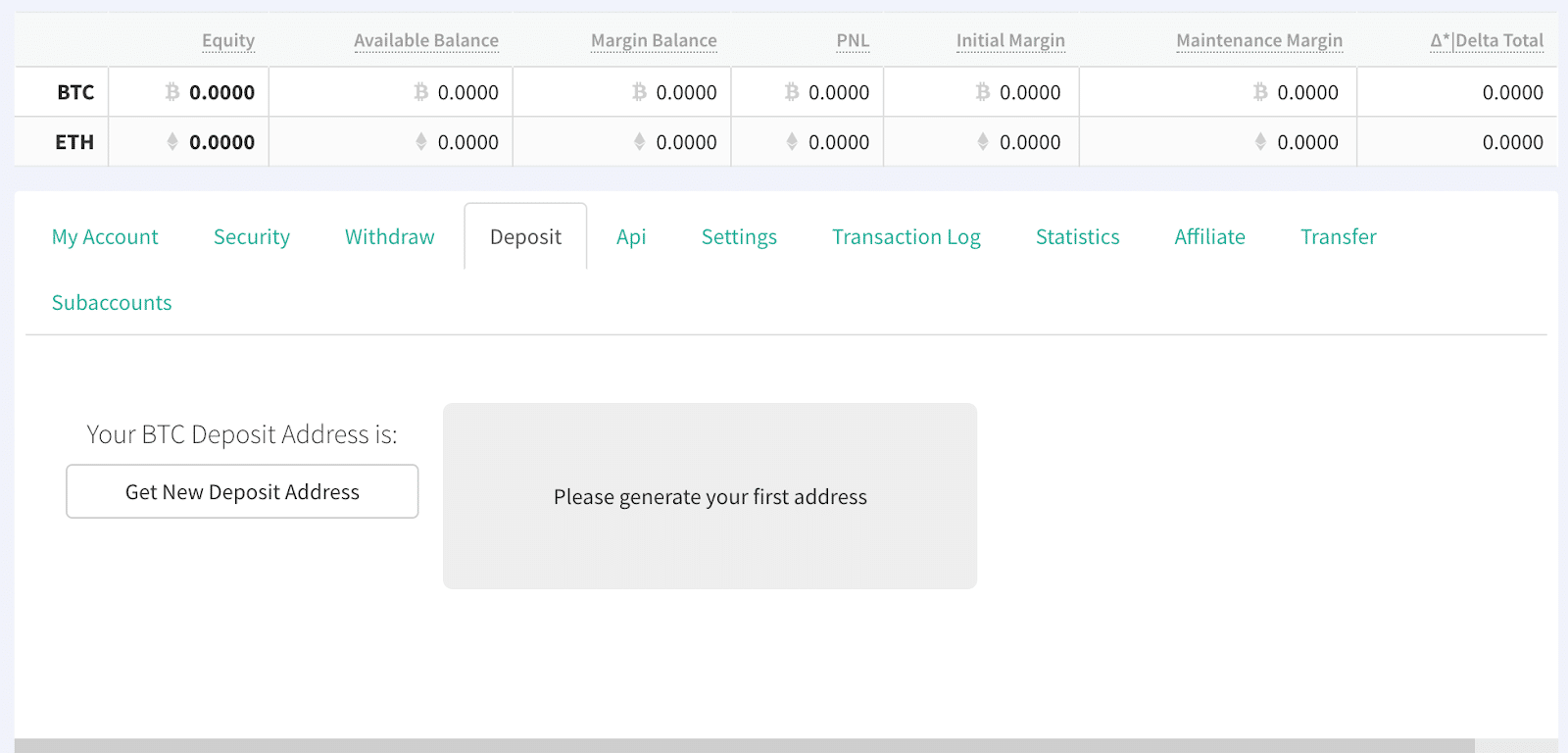

Deposit section & details/instructions: Once in “My Account” dashboard, users can click Deposit in order to deposit Bitcoin or Ethereum. You will be prompted to generate a new address. Click “Get New Deposit Address” to create your personal Deribit exchange wallet. Copy this address in order to send bitcoin and ether to it. Once the address is copied, you will be able to paste wherever you are sending your original bitcoin or ether from.

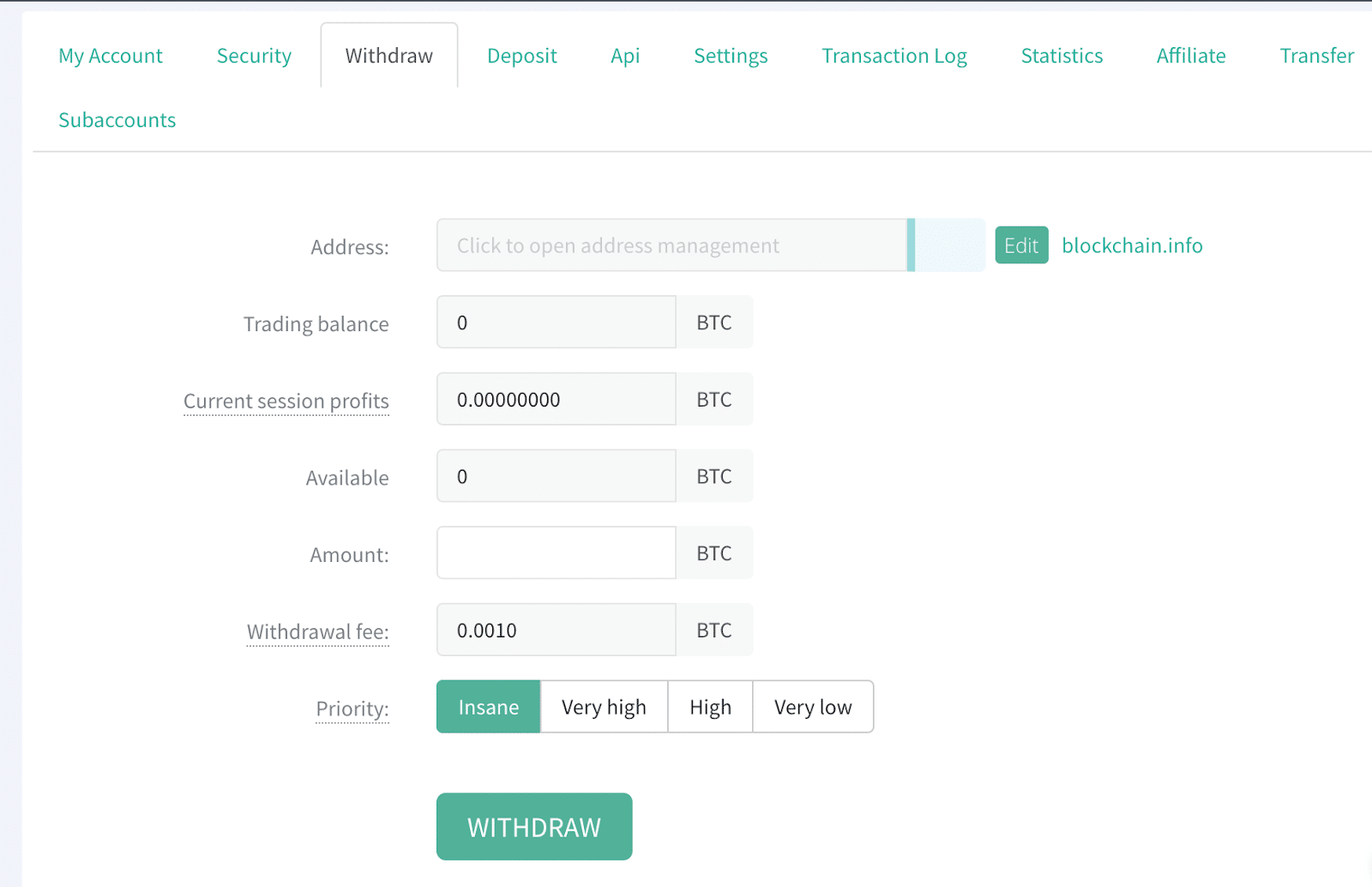

Withdraw section & details/instructions: Once in “My Account” dashboard, users can click withdraw to remove their funds from the exchange. You will need to have an address copied in order to paste it into the withdraw address field. Once the address you want to withdraw to is pasted, in the “Priority” section you are able to decide how fast you want your transaction to go through (and in turn how high of a fee to pay).

How to create & manage Futures Contracts

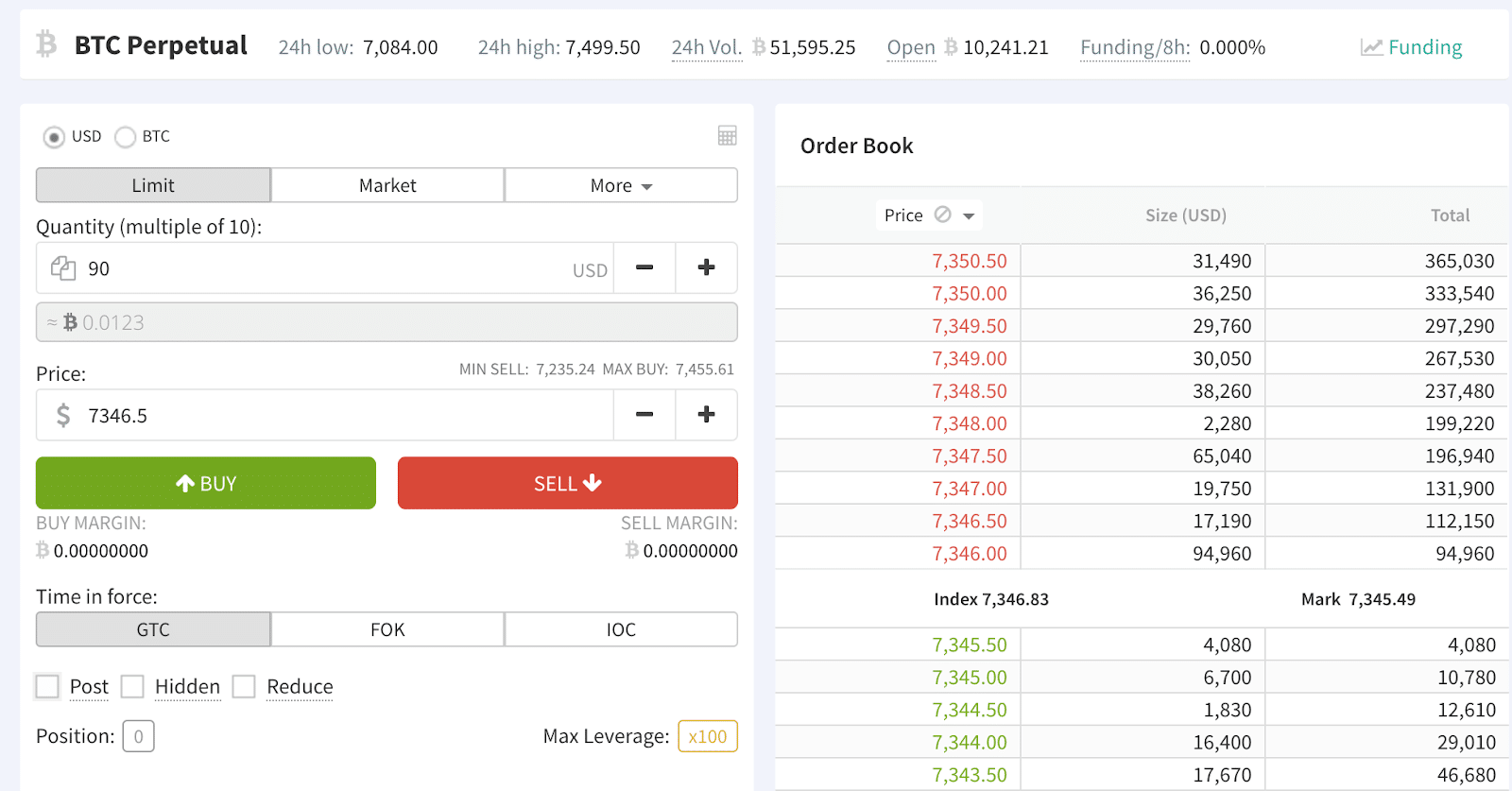

- What are cryptocurrency futures contracts: A futures contract is a technique to hedge positions and reduce the risk of the unknown. In a futures market, if the price is $7,000/BTC, an investor needs to buy 700 futures contracts, each worth $10. If an investor wishes to open a positive position then he goes long with “buy” contracts, and if he decides to open a negative position, he goes short with “sell” contracts. An investor’s position can be either positive or negative for the same instrument.

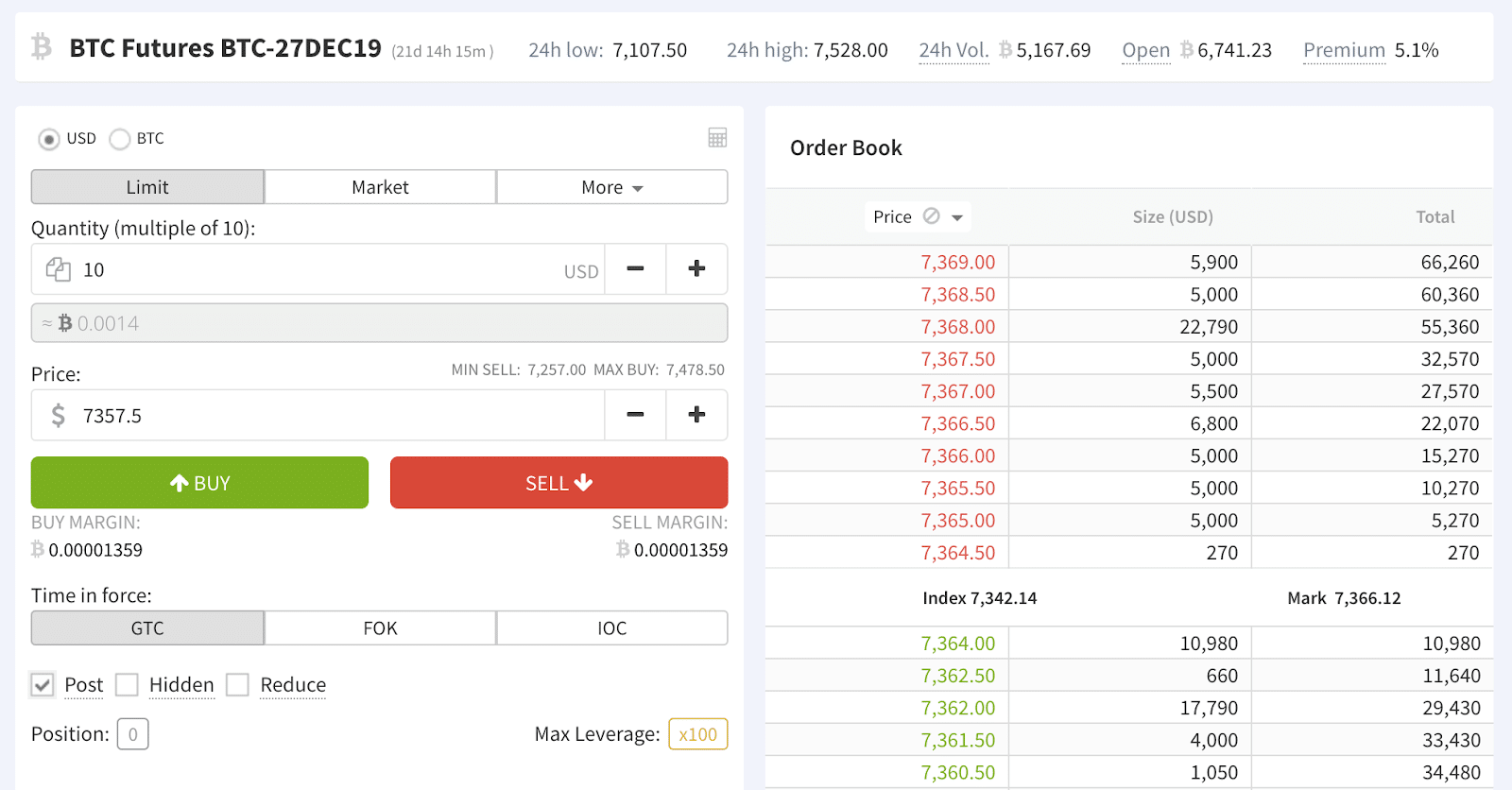

- How to create them on Deribit: On Deribit, futures contracts are set at $10 per contract. The current BTC index can be found at the top left of the screen. Users can decide whether they want to place a limit order, a market order, a stop-limit order, or a stop-market order. Placing a market order is realized when you outbid the order book. So if you want to minimize your fee make sure your click the post field in the bottom left so your order is not matched instantly.

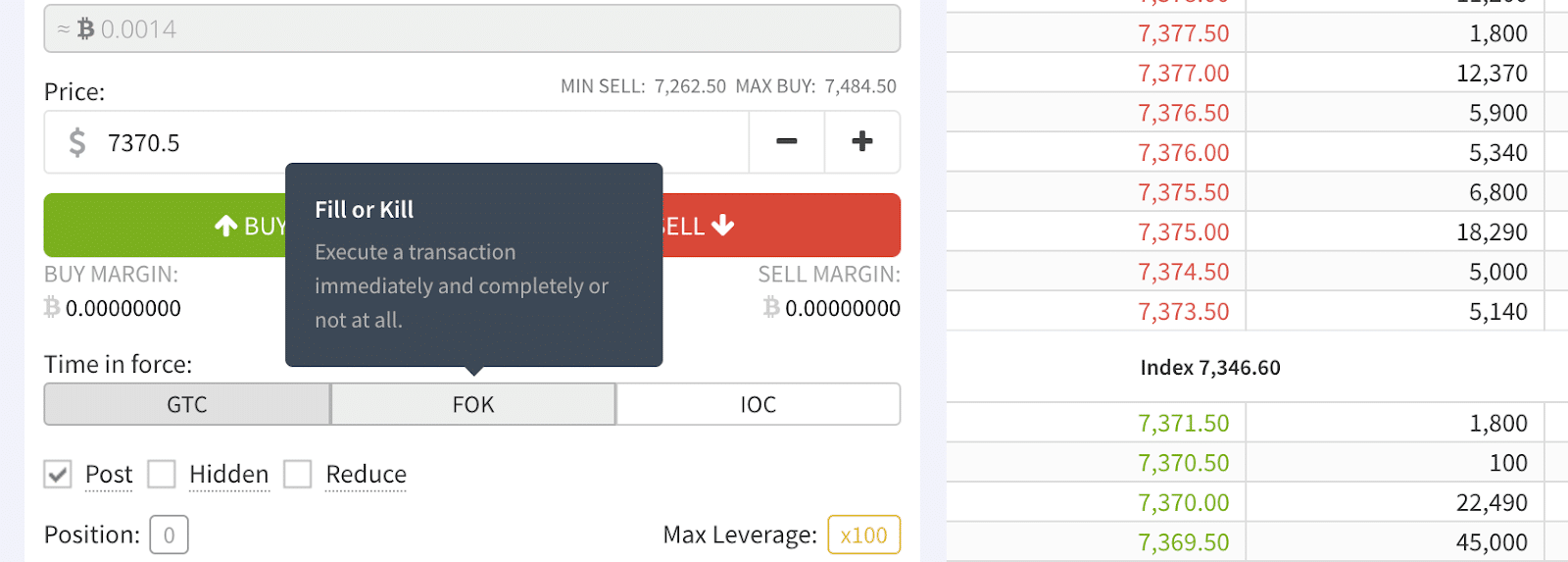

If users want to set stop losses or plan to take profits from their trades instantly they can chose between three “time in force” buttons.

- GTC (Good Till Cancel): this is the default option. Unfilled orders will remain in order book until canceled if you have this selected.

- FOK (Fill Or Kill): this option allows you to either execute a transaction immediately and completely, or not at all.

- IOC (Immediate Or Cancel): this option allows you to execute a transaction immediately and then any portion of the order that cannot be immediately filled is cancelled.

How to create & manage Perpetual Swap Options Contracts

- What are perpetual options contracts: A perpetual option is a non-standard, or exotic, financial option with no fixed maturity and no exercise limit. While the life of a standard option can vary from a few days to several years, a perpetual option can be exercised at any time without expiration. These contracts are also referred to as “non-expiring options” or “expirationless options.”

- How to create perpetual options contracts on Deribit: Since perpetual options have no expiration date, no maturity date will need to be set for the creation of this option contract. The order process will be nearly identical to that of creating futures contracts.

How to create & manage Options Contracts

- What is an options contract: An options contract is an agreement between two parties to facilitate a potential transaction on the underlying security at a preset price, referred to as the strike price, prior to the expiration date. The two types of contracts are put and call options, both of which can be purchased to speculate on the direction of cryptos or crypto indexes, or sold to generate income.

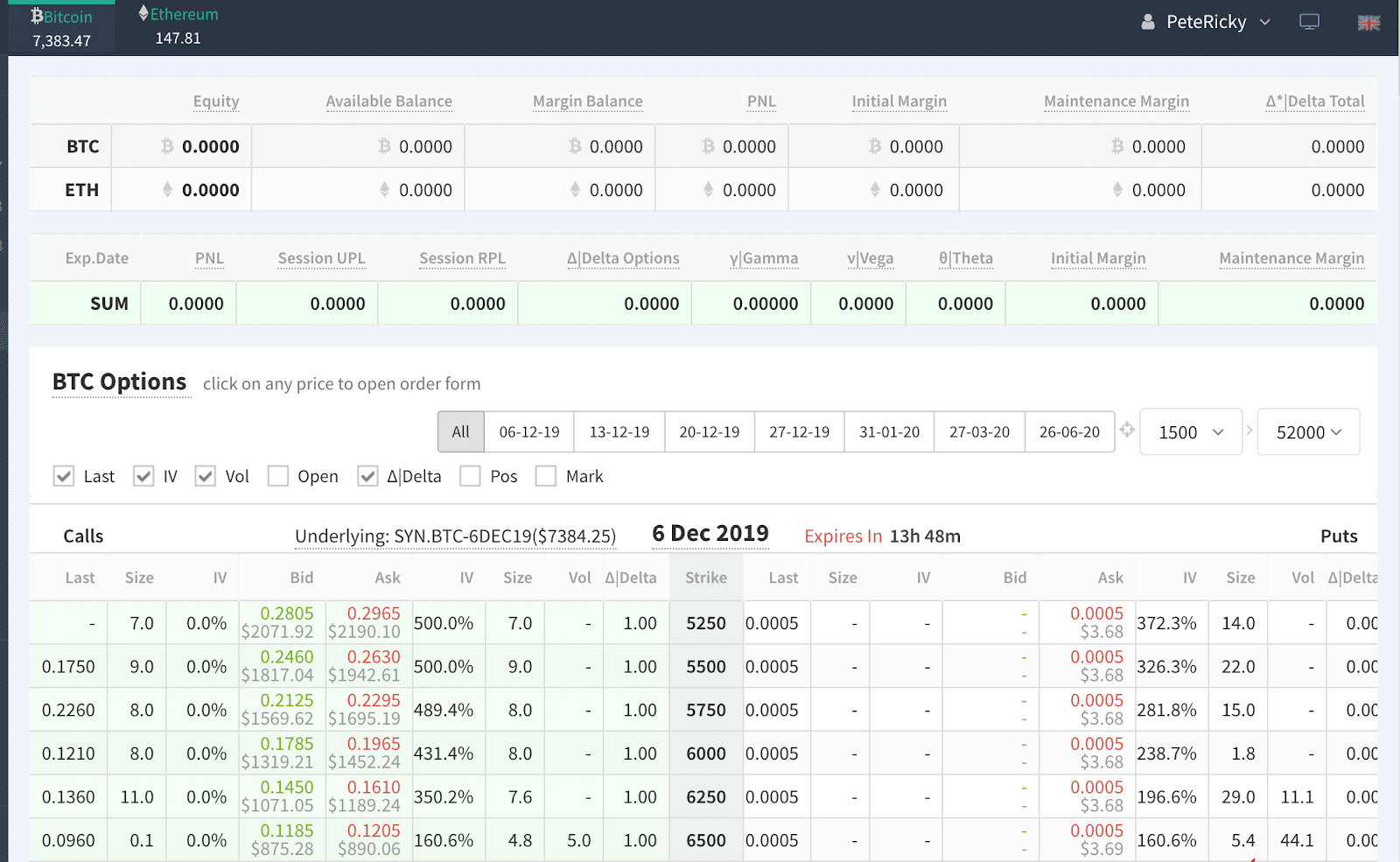

- Liquidation Parameters: Trading accounts for options are initially set up with the margin requirement of 10%, but you are required to maintain a 3% margin on your position. So if your margin falls below the maintenance margin, your positions will be automatically liquidated. Your account balance, margin, initial margin and maintenance margin can be found at the top of the screen.

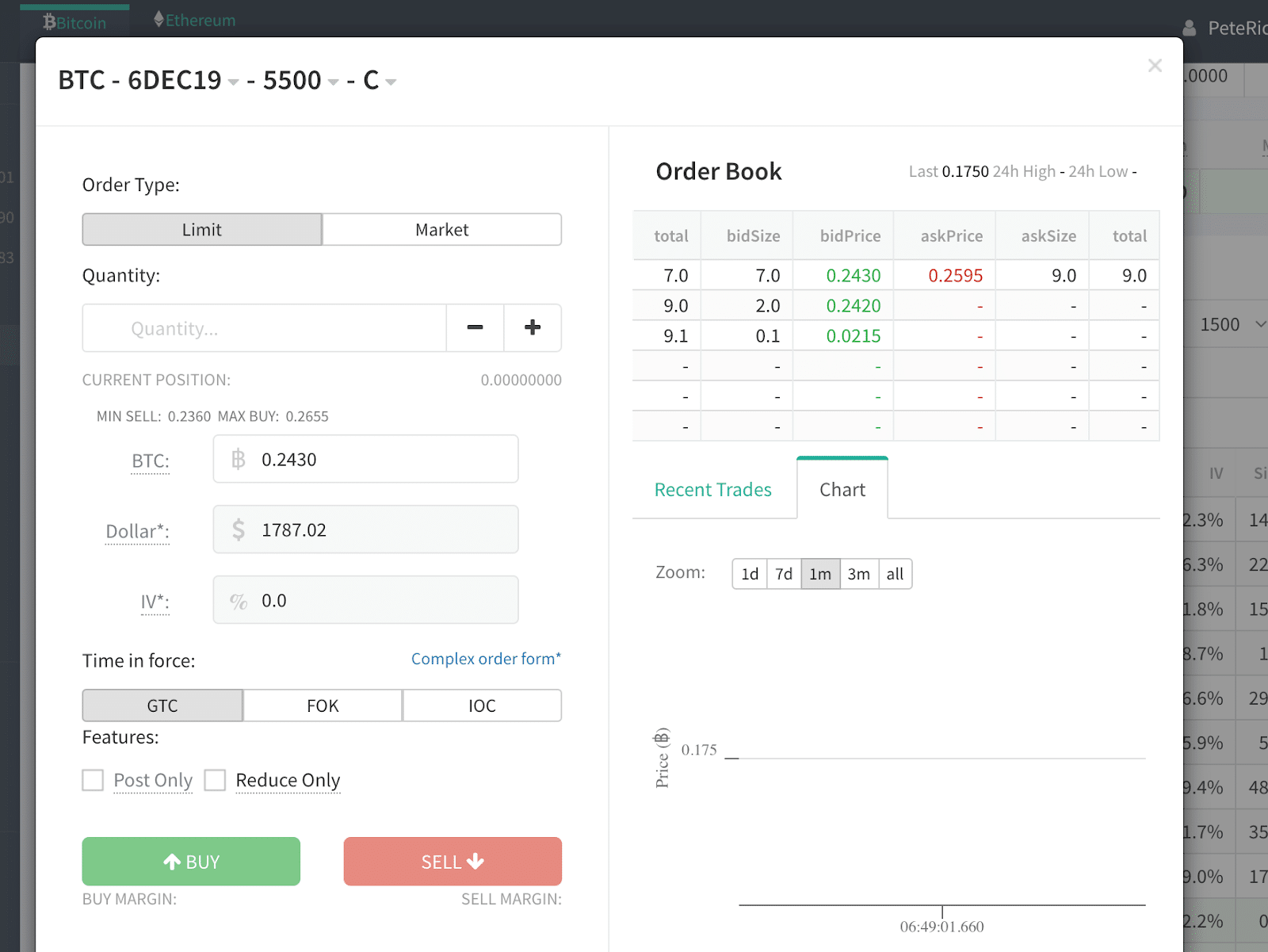

How to create options contracts on Deribit: The great thing about Deribit Exchange is that it allows you to trade bitcoin options even though the market is very new. Deribit allows users to place Calls and Puts based on how they would like to trade. To create a new contract, simply click on a square on the Call or Put side. Once you have clicked a call or put, a trade order ticket will pop up for you to fill out, like this:

Users can determine if they would like to place a limit or market order. As users populate the quantity field at the top of the screen, the buy and sell margin at the bottom of the screen will be calculated accordingly. On the right you are able to see the order book as well as recent trades. The “Time in force” option bar is still available for creating options contracts. Additionally at the bottom are “Post Only” and “Reduce Only” buttons. If you click the “Post Only” box your orders will be adjusted to always enter the order book as a maker order without immediate matching. If you click the “Reduce Only” box your orders will be intended to only reduce a current position.

Fees to expect

Following is the exact fee structure of all Deribit fees to expect, as worded by the Deribit team:

Deribit Derivatives Exchange operates a maker-taker fee model. BTC Futures orders which provide liquidity receive a rebate of 0.02%. A rebate is a partial refund delivered to the creator of the contract. This rebate means that the user will be paid back 0.02% of the total contract if the order provided liquidity. Orders that take liquidity are charged a small fee of only 0.05%. The fee is calculated as a percentage of the underlying asset of the contract. Perpetual contracts orders providing liquidity receive a rebate of 0.025%, order that take liquidity are charged a fee of 0.075%.

BTC Perpetual Contracts

- Maker Rebate: 0.025%

- Taker Fee: 0.075%

BTC Futures

- Maker Rebate: 0.02%

- Taker Fee: 0.05%

ETH Perpetual + Futures

- Maker Rebate: 0.00%

- Taker Fee: 0.05%

BTC and ETH Options

- 0.04% of underlying or 0.0004 BTC/option contract

- 0.04% of underlying or 0.0004 ETH/option contract

Fees can never be higher than 12.5% of the price of the option. For example if an option is traded at 0.0001 BTC, the taker fee will be 0.0000125 BTC (instead of 0.0004 BTC), thus 12.5% of 0.0001 BTC.

Delivery (settlement at expiration)

For deliveries (expiration) half the fees of taker orders are charged. Eg: 0.025% for Futures, and 0.02% for Options, where for options the fee can never be more than 12.5% of the value of the option.

Fees for Liquidation trades BTC

Liquidations are charged a higher fee than normal. Fees are raised with 0.30% of underlying contract size. The surplus fees of liquidations will automatically fund the insurance fund.

Futures liquidations fees: 0.5% fee, 0.45% goes to the insurance fund.

Perpetual contracts liquidations fees: 0.5% fee, 0.425% goes to the insurance fund.

Options liquidations trades: 0.19% of underlying or 0.0019 BTC/options contract, 0.15% of underlying or 0.0015 BTC per contract goes to the insurance fund.

So the higher fees of liquidation trades are the income for the insurance fund.

Fees for Liquidation trades ETH

Liquidations are charged a higher fee than normal. Fees are raised with 0.30% of underlying contract size. The surplus fees of liquidations will automatically fund the insurance fund.

Futures liquidations fees: 0.9% fee, 0.85% goes to the insurance fund.

Perpetual contracts liquidations fees: 0.9% fee, 0.85% goes to the insurance fund

Options liquidations trades: 0.19% of underlying or 0.0019 ETH/options contract, 0.19% of underlying or 0.0015 ETH per contract goes to the insurance fund.

So the higher fees of liquidation trades are the income for the insurance fund.

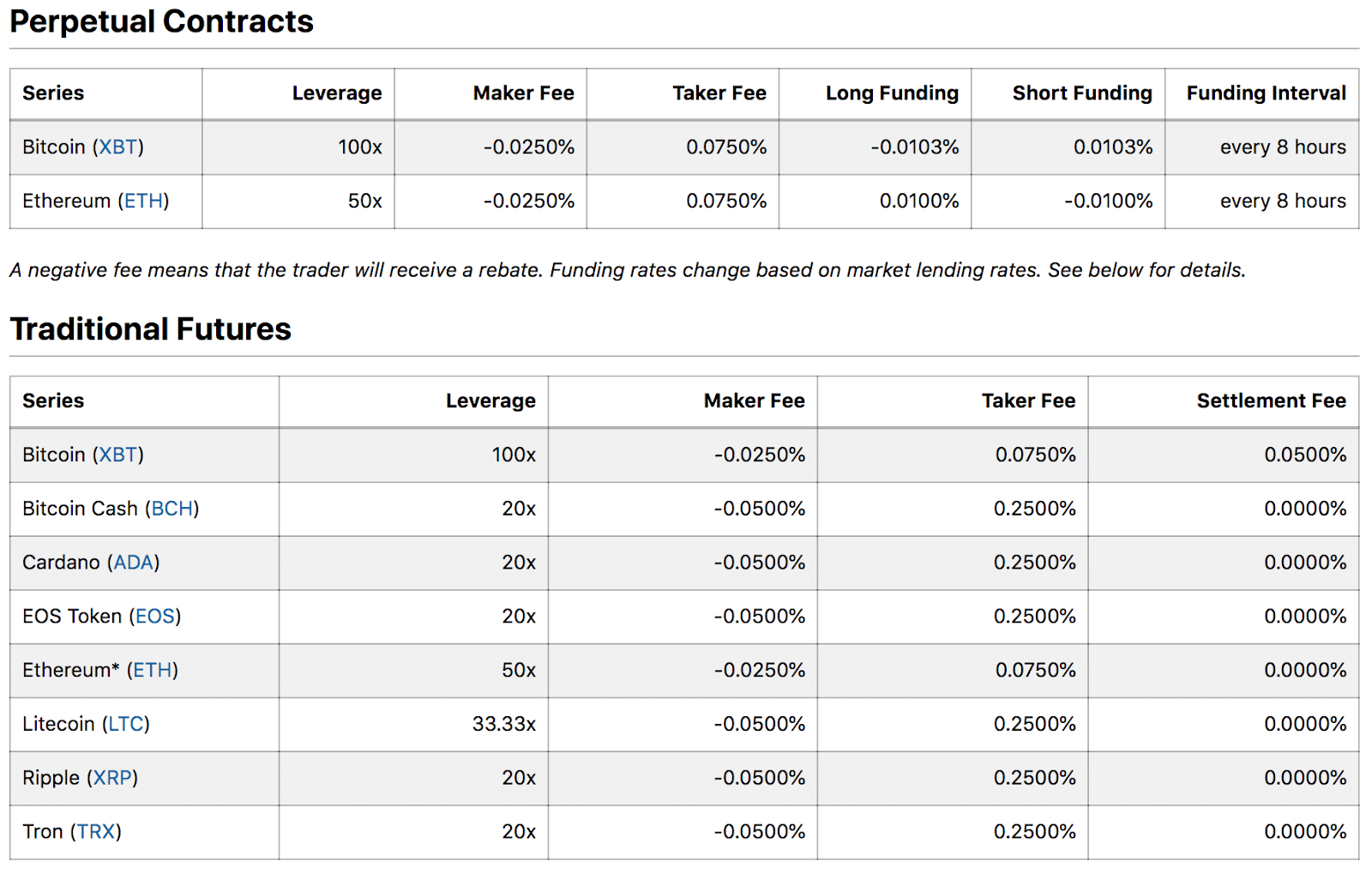

Bitmex Fees for comparison:

The following images are tables of Bitmex’s fees (Deribit Exchange’s most popular competitor). Here you can see exactly where Deribit exchange offers better pricing! These tables show the prices on Bitmex for both bitcoin and ethereum perpetual contracts, as well as the prices of traditional futures contracts for Bitcoin, Bitcoin Cash, Cardano, EOS Token, Ethereum, Litecoin, Ripple and Tron. *Below tables are BITMEX fees only!*

Some notable comparisons are that both Deribit Exchange and Bitmex offer the same 0.0750% taker fees and 0.0250% maker fees for perpetual contracts. Additionally both exchanges offer the same 0.0750% taker fees and 0.0250% maker fees for all traditional futures contracts.

Some notable differences are that Bitmex takes long funding and short funding fees. For Bitmex exchange users these fees are applied to all perpetual contracts, where as Deribit exchange does not incur these fees. Additionally as you can see above, all traditional futures on Bitmex have settlement fee, where this is not the case with Deribit Exchange.

Deribit – Crypto Trading Signals

Deribit is becoming a popular exchange for following crypto trading signals. If you follow the right signal provider, then you stand to make some serous profits:

If you want to get started with following crypto signals on Deribit, then follow the steps below to join the most successful signal provider for Deribit, MYC Signals:

1) If you have telegram then be sure to reach out to the admin, @MYCSupportBot, as well as to join their free crypto signal group, MYC Signals. Alternatively, if you don't have Telegram, feel free to contact them via email: [email protected] and they'll walk you through how to get started.

2) They offer 2 premium channels for you to join: MYC BitMex & Deribit Signals VIP and MYC Binance Signals VIP. The membership can be paid via any cryptocurrency of your choice or via card over at their payments page.

3) Once you’re all signed up and you’re a premium member, they’ll work with you to make sure you can follow their signals as easily as possible, as well as to solve any problems you may have. They tout 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response.

Conclusion

As you can see Deribit Exchange provides a great platform with a wide variety of features allowing for users to quickly get up and trading bitcoin/ether options and futures.

For more information on Deribit you can visit their resource library. We you found this guide helpful! Happy trading.