Cryptocurrency Trading Algorithms

The markets ain't like they used to be. The integration of technology and the interlinkage of global markets have obliterated the barriers-of-entry that used to exist.

But while this is the case, trading hasn't got easier. In fact, it's a tad harder since most traders aren't trading full-time. So they have to allocate time, resources, and energy, beyond their daily work requirements, towards analyzing the markets to establish what option to buy or sell. To further compound the problem, brokers and exchanges now have more analytical tools on their platforms, which somewhat steepen the learning curve for beginners.

Indeed, cryptocurrency trading has a low barrier-of-entry as indicated by the statistics that the number of people with blockchain wallets has more than doubled in two years, from February 2019 to February 2021. According to Statista, the figure was 33.76 million in February 2012. Currently, there are a total of 67.09 million users. In contrast, there were about 13.9 million online forex traders in 2018 – no current data exists – with research suggesting that the figure could be lower. This is despite the forex markets being comparatively older.

This evident ease of entry to crypto trading comes at a cost – because it facilitates quick starts, it creates a situation whereby those trading do not have time to come up with a strategy by which to stick. The result is losses. About 95% of crypto day traders lose money, although the figure is likely even higher. Also, cryptocurrency prices are extremely volatile. Simply put, crypto trading is not a walk in the park.

Nonetheless, it’s not all doom and gloom. You can use crypto trading algorithms to ensure that your trading experience does not entail always losing money. But how will they help you avoid losing money? Well, by determining the right time to buy or sell, thereby allowing you to take profits or minimize losses (manage risks). This article is an in-depth discussion of crypto trading algorithms, their benefits, and the types you are likely to encounter as you trade.

What is a Crypto Trading Algorithm?

A crypto trading algorithm refers to a set of rules and strategies, in the form of mathematical models and formulas, that determine the right time to sell or buy particular crypto. The use of algorithms in trading crypto coins is known as cryptocurrency algorithmic trading. Notably, these algorithms are packaged in programs, commonly referred to as crypto trading bots.

The terms mathematical models and formulas might mislead you into thinking that algorithmic trading is always a complicated process, far from it. A program that buys a crypto every 10 minutes and holds a position for, say, two hours is also a crypto trading algorithm.

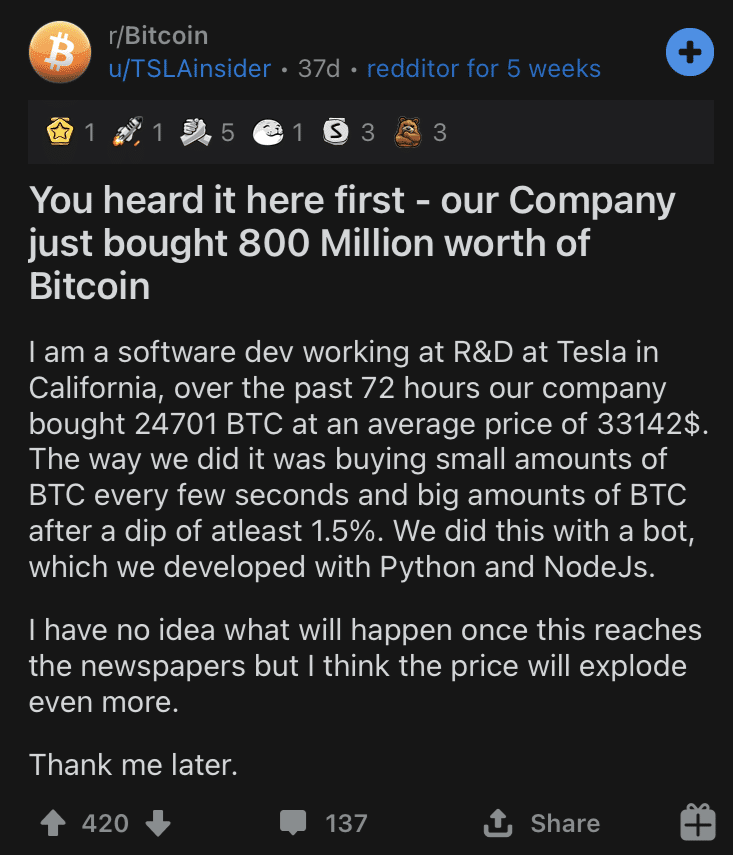

A Reddit post, which has since been debunked as having been a hoax, perfectly captures how a typical crypto trading bot works. In the post, the Reddit user u/TSLAinsider, who claimed to be part of Tesla’s R&D, stated that Tesla had purchased 24,701 Bitcoins over 72 hours with the help of a bot developed using Python and NodeJs. The bot would buy large volumes of BTC if the price dropped by at least 1.5%, while continually buying small volumes every few seconds.

The existence of such programs/bots and their increased acceptance and use have been precipitated by technology. Needless to say, they have eliminated emotions and impulse trading, at least to some extent, especially when used as stipulated. This, in addition to other benefits that I’ll discuss later, are compelling reasons why crypto trading algorithms should be part of your cryptocurrency trading. Nonetheless, to understand how and why they effectively minimize losses, it is crucial to understand the history.

History of Algorithmic Trading

Algorithm trading traces its roots to the Securities and Exchange Commission’s authorization of electronic exchange in 1998. This move brought about the digitization of High-Frequency Trading (HFT), although, at that time, the trades took a few seconds for them to be completed. This execution time reduced as the technology became even more sophisticated and advanced.

The execution time first reduced to milliseconds, then microseconds, and, finally, nanosecond times became a possibility – in 2012. This became a reality in 2011, when a company called Fixnetix developed the iX-eCute chip, capable of processing trades in 740 nanoseconds. For context, a nanosecond is equivalent to one billionth of a second, i.e., 0.000000001 seconds.

As computing power has improved over the years, so has the scope of algorithmic trading increased. Presently, it incorporates several strategies, which define the types of trading algorithms. With that being said, the bottom line is that the various strategies will help you and other traders determine the right time to sell or buy crypto. Also, depending on the program you are using, this can be done for you – automated trading.

Applications of Crypto Trading Algorithms

You can use algorithm trading for the following applications:

- Risk management, i.e., to minimize losses

- To know the right time to buy

- To know the right time to sell

- Trading on multiple exchanges (depends on the crypto trading bot you are using)

Why Use Crypto Trading Algorithms

Understanding the statistic that 95% of day traders lose money is key towards gaining insight into why using crypto trading software and bots is necessary. There are three reasons behind the worrying numbers:

- Steep Learning Curve

- Time

- Amount of Data

1. Steep Learning Curve

Certainly, creating a cryptocurrency wallet and opening an account on a reputable exchange is relatively straightforward. Also, the payment options available have increased, unlike a few years ago. While these factors have made getting into crypto trading easy, a lot still goes into being a successful trader.

Thus, traders who have to allocate a few hours towards learning the basics soon find out that this time is not enough. This is one of the reasons they lose money. They do not spend the time needed to fully grasp crypto trading and the meanings/implications of certain price movements.

Nonetheless, crypto trading bots remedy this because they use machine learning to understand the crypto market continuously. They also analyze the technical data. In short, crypto algorithmic trading eliminates the need to learn everything on your own.

2. Time

Analyzing the markets needs time. Also, you should continually monitor the price movements to determine the appropriate time to trade. Doing all this manually may not be possible for part-time traders, thereby necessitating the use of cryptocurrency trading software.

3. Amount of Data

Making an informed trading decision requires a trader to sift through large volumes of data to identify trends. To make matters worse, there are over 4000 cryptocurrencies in the market, according to Investopedia. Without the help of algorithmic trading, it would be virtually impossible to track each of these coins.

So, now that you know what cryptocurrency algorithmic trading is, its history, and why you should use it when trading, it is time to discuss the types of crypto trading algorithms/strategies you are likely to encounter.

Types of Crypto Trading Algorithms (Strategies)

When you decide to go the crypto algorithmic trading way, you will have to choose from the following strategies:

- Arbitrage Trading

- Market-making

- Time-weighted average price (TWAP)

- Volume-weighted average price (VWAP)

- Iceberg algorithm

- Smart order routing (SOR)

Arbitrage Trading

Algorithms that perform arbitrage strategies compare prices across multiple exchanges to identify trading platforms with different prices for the same cryptocurrency. Upon detecting the variations, the bot purchases the coin from the exchange with a low price and sells them to another whose price is higher. The algorithms capitalize on the existing inefficiencies in the market for profit – without considering the fees that exchanges charge, of course. This strategy is known as simple arbitrage.

Alternatively, the arbitrage trading algorithms could opt for triangular arbitrage, which involves using cryptocurrency pairs. In this strategy, the crypto trading bot exchanges coin A, say, BTC with coin B (ETH), then coin B with coin C (DOGE), and, finally, coin C with coin A. This move introduces unrelated coins (ETH and DOGE), which have a likelihood of creating price dislocations.

Market-Making

The market-making strategy relies on the existence of market makers, i.e., companies or even individuals who offer consecutive buy and sell orders to profit off the difference (spread) between the bid and ask prices. The bid price is the maximum amount at which a buyer is willing to purchase a crypto coin, while the ask price is the seller’s minimum sell price.

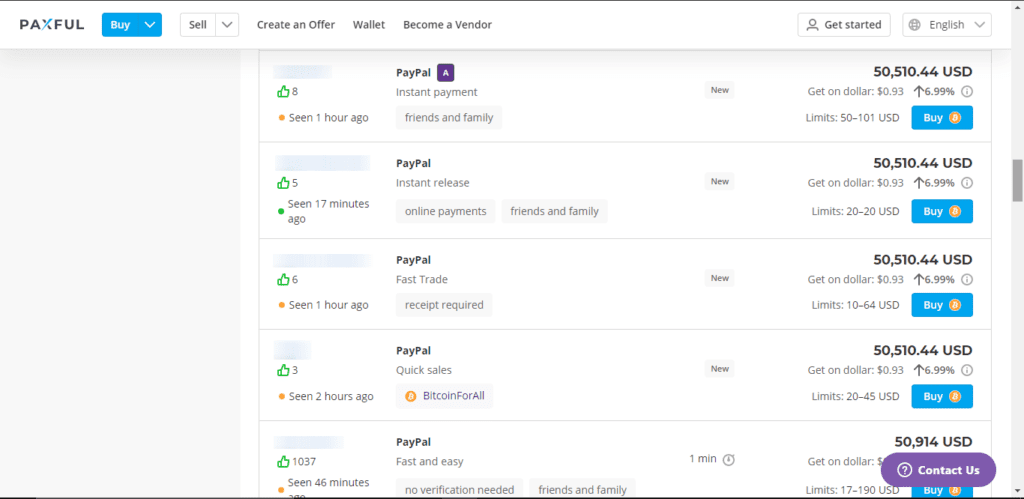

Such market makers are often unconcerned about whether the price of an asset is going up or down. Market makers are common on crypto exchanges, e.g., Paxful (below), Binance, and LocalBitcoins, since trading is done through order books (buyers indicate their bid price and sellers include their ask price). For context, at the time of writing this article, 1 BTC was about $48,700.

Volume-weighted Average Price (VWAP)

A volume-weighted average price (VWAP) algorithm looks at the crypto’s traded volume over a given period, say, a day, week, or month and then sells/buys the crypto at a price as close to the average price as possible. To make this possible, it divides the order into smaller chunks before executing the trade. In so doing, VWAP distributes large orders.

Time-weighted Average Price (TWAP)

The time-weighted average price (TWAP) works with a fixed time. This strategy calculates the average price of the crypto within this time and then attempts to execute the sell or buy order at a price that is as close to the calculated mean price as possible. Like the VWAP algorithm, TWAP also divides orders into smaller bits. TWAP works to minimize the volatility for which cryptocurrency trading is known.

Smart Order Routing (SOR)

In smart order routing (SOR) strategy, the crypto trading bot compares cryptocurrency pairs’ prices across multiple exchanges, intending to identify the best prices. Upon spotting the best offer, it will route your trades, thereby facilitating a switch from the crypto you held before to a new one.

SOR has several benefits:

- It helps traders find the best crypto rates

- It is an automated process

- It provides access to multiple exchanges, thereby distributing assets across them. This prevents reliance on just a single market

- It provides an opportunity for the arbitrage strategy to work

Iceberg Algorithm

The iceberg algorithm works by dividing large orders into smaller disclosed orders. It is only when one disclosed order is executed that the iceberg algorithm lines up the subsequent one. This algorithm helps traders avoid buy walls or sell walls. This is because the large orders that create such walls are never executed entirely. Instead, exchanges prioritize small orders, which are unlikely to dictate the prices of the cryptocurrency. The iceberg algorithm also provides privacy since only the smaller disclosed order is made public.

Crypto algorithmic trading exists to make trading easier. When selecting a crypto trading bot, all you have to do is choose your preferred strategy from the list above. These programs are a must-have for traders, given that they make the trading experience somewhat more manageable than doing everything manually.