Crypto Signals: An Ultimate Beginner's Guide

Crypto Signals are effectively a set of instructions sent out from a professional group to an individual telling them what cryptocurrency to buy, the price to buy at, the sell-targets, and lastly, what price to set the stop loss at. These signals are recommended trades that the provider has researched themselves and therefore thinks that there is a high probability of making a return.

This ultimate beginner's guide will walk you through everything you need to know about crypto signals including: an explanation of what crypto signals actually are, how to get started, which signal providers to use, the cryptocurrency exchange we recommend for following signals, and the top tips that we suggest you follow in order to maximize your returns. So without any further delays, let’s get into the ultimate beginner’s guide to crypto signals.

What are Crypto Signals

As previously mentioned, crypto signals are a set of instructions sent directly to you informing you of which cryptocurrency to buy. A signal will typically contain the following information:

- The cryptocurrency to buy – The signal will specify which cryptocurrency that should be bought, e.g. BTC, ETH, XRP

- The buy-in price – The price you should try to buy the cryptocurrency at

- The sell-targets – The price you should sell the cryptocurrency at in order to achieve a profit

- Stop losses – A mechanism to automatically exit your position to mitigate losses

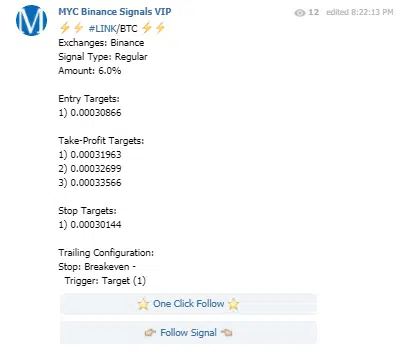

As can been seen from the image above, the signal lets you know which cryptocurrency to buy, the exchange the signal is for, as well as what percentage of your current holdings you should put towards the trade, which in this case is 6%. You also have the entry target, i.e. when you should initially buy the crypto, 3 possible sell-targets, or take-profit targets, and 1 stop loss target in case the trade should go against you.

Typically for the entry target, the signal provider will also give you a range as opposed to giving an absolute value. For example, instead of specifying a buy-in price of $8500 per bitcoin, a signal provider may provide a range of $8500 – $8600 per bitcoin. This gives traders plenty of scope to try and achieve the correct buy-in price as this would ultimately affect their resulting profit.

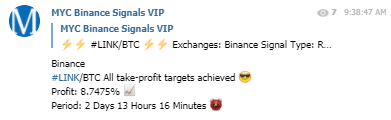

If the crypto signal provider you’ve subscribed to recommends a good trade, then you'll make a nice return:

It should be pointed out that you will receive instant notifications from your provider when: the entry price is achieved, any profit-targets are hit and if the stop-loss is triggered. This is a great way of staying informed about any trades without manually having to go on to the exchange to check.

Before we move on, as you can see in the example signals above, crypto signals are also cryptocurrency exchange specific. That is, the provider recommends trades of a specific cryptocurrency on a specific exchange platform. So in order follow a trade signal, you need to have an account with that exchange. The major exchanges that most signal providers will provide signals for include: Binance, BitMex, Bittrex and Coinbase. However, if you’re new, we recommend creating trading accounts for Binance and BitMex and following signals for those exchanges only.

Receiving Crypto Signals

Now that you know what crypto signals are, let's talk more about how you get those signals, and how to make sure that you follow the crypto signals as effectively as possible.

There are a few ways to receive signals from providers, but by far the most popular method of getting them is on Telegram. Telegram is an instant messaging service app that has the look and feel of WhatsApp. However, Telegram has certain unique features that sets it apart, the most important being its bot functionality.

Telegram bots can be programmed and designed to handle messages automatically. Users typically interact with these bots by issuing command messages in group environments. These bots can be used to issue crypto calls that allows users to place a trade automatically without having to get on to a cryptocurrency exchange. As long as the correct permissions have been setup, you can place all your trades automatically with the click of a button through Telegram.

Another method of receiving crypto signals is through email. Often people who are interested in generating returns by subscribing to a signal group may not have Telegram, and so, some providers do opt to send signals through email. The big disadvantage of this however, is that unless you’re checking your emails every so often, you may miss a signal. This is in contrast to instantly getting notified as soon as a signal comes in from your provider. It certainly isn’t the most popular method of receiving crypto signals, but it does work for some people.

Crypto Signals Providers

Now that you have a better idea of what crypto signals are and the various ways you can receive them, let's talk more about who is actually providing these crypto signals, how the groups are setup, and exactly what the process is of joining these groups.

First off, a large percentage of the crypto signals community resides on Telegram. As such, the process of joining typically is to get in contact with the admin of the signal group, who will then walk you through how to pay and join. Yes, you do have to pay to receive some crypto signals, and while that has some downsides, it's often a worthwhile investment — what you pay in fees will be more that recouped when you receive signals from a professional trader.

This is a good moment in the guide to explain how these signal providers structure their groups. Bearing in mind that these groups are all on Telegram, a typical structure may be:

- Free Group – This Telegram group will contain all the non-paying individuals who are interested in signing up for a premium group. The free group typically contains the largest number of members and gives the signal provider an opportunity to show the non-paying members the amount of returns they could be making if they signed up for a premium membership. Here's our recommendation for the best free crypto signals groups.

- Paid Group – If you decide that you trust the signal provider, you may decide to sign up for their paid group where you’ll receive all the premium signals. It’s in this group that the provider must really demonstrate the value you’ve paid for by sending signals that generate returns. If the provider fails to do so, they risk their members not renewing their premium membership for the following month. Here's our recommendation for the best paid crypto signals groups.

The premium telegram groups are often cryptocurrency exchange specific. This is why it becomes important to have an account with the exchange your provider is sending signals for. There exists slight price discrepancies between cryptocurrency exchanges that mean a price of $8500 per bitcoin on Binance may in fact be $8,550 per bitcoin on Coinbase.

Furthermore, in terms of pricing structure, these signal providers will typically require you to pay monthly in order to have access to their premium channel. In terms of payment options, there are two main methods:

- Cryptocurrency (BTC, ETH etc)

- Card

Cryptocurrency – Of course paying by cryptocurrency is the most popular payment method for gaining access to a premium group. Typically, you would inform the admin of the group which crypto you wanted to join the paid group, at which point they would then provide you with an address for where to send your crypto payment. Some groups also require you to send the transaction ID as further proof that the payment originated from you.

Card – For those that aren’t quite that savvy, there is the option to pay by card, however, very few groups provide this option. Major payment processors include: VISA and Mastercard.

Deciding group to join

By now you should have a much better understanding of a crypto signals and crypto signals providers… but how do you know which group to join? What makes one signals provider better than the next? Of course, providers will vary, but in general, a crypto signals provider should have the following features (in addition to the signals themselves!):

- Notify you with updates

- Provide latest news stories

- Provide technical analysis

- Automated Trading

Notifying with you updates – We’ve briefly touched on this earlier in the guide, but a crypto trading signal provider should absolutely give you updates on any signal they’ve issued. If you decide to follow a signal but then have no idea how your trade is performing, that’s a terrible user experience. Providers will therefore ensure that they release updates on any previously issued signals whether it’s updates on if the buy-in price has been achieved, or a profit-target has been reached, you can be sure that you’ll get a notification when something important happens.

Keeping you updated with news stories – Good providers will also comment on any news stories that may affect any signals they’ve issued. They can encourage their members to hold strong and stay in a position despite seemingly bad news, or they may encourage them to sell. Either way, a provider has more knowledge than their members and should be offering guidance on how best to navigate any uncertainty.

Providing Technical Analysis – Some people are content to blindly follow the calls of a signal provider, but if you want to know a little bit more about WHY a signal is being issued, then you’ll want to join a group that provides technical analysis. Technical analysis, or TA, is simply the use of historical trends to try to predict future price movements. These are the tools that signal providers will largely use to try to identify profitable trades. You can use the fact that whether or not a provider decides to issue TA analysis as a factor when determining the competence of the provider. If the provider posts well-thought out, and easily understandable analysis, it's an indication that they know what their doing. However, if the analysis is nonsensical or is non-existent, it may bring the credibility of the provider into question.

Automated Trading – Automated trading is becoming a staple when it comes to cryptocurrency trading. More often than not, the trade activity you may see in the order book of a cryptocurrency will be bots; this is due to the several advantages that the use of one offers. The biggest advantage of bots is the speed of execution, which is why when sending out signals, providers will typically have the option for their members to following the signal through the use of a bot. The most popular bot used for following signals on Telegram is Cornix.

As can be seen from the image above, the Cornix bot is integrated into the Telegram channel of the premium group such that, all a user needs to do to follow the signal is press “One Click Follow”. This will automatically place the trade on behalf of the user. It is important to note that in order to use this functionality, a user must first grant the bot access to their account via the cryptocurrency exchange’s API keys. Even though some groups do not provide this automated trading feature, it’s nice to give users the option so they can decide for themselves if or not to leverage this functionality.

Pros of Crypto Signals

Now that you’re effectively an expert on crypto signals providers, what are the pros of subscribing to one?

Pros:

- Can be very profitable

- No need to conduct research yourself

- Great learning opportunity

Can be very profitable – The obvious advantage of subscribing to a crypto signals provider is that if they do what they say on the tin, then they can be very profitable. Even though you may not see news stories of people becoming millionaires from these groups, they can be a great way of adding an additional $1,000 to your monthly salary. With that being said, you can only be as profitable as the provider you’re with, which is why it’s important you select carefully. There are plenty of self-proclaimed professional traders out there offering paid signals, so it's important that you find a group with a proven record of success.

No need to conduct research yourself – The second biggest advantage of using a crypto signals provider is the sheer amount of time you can save. You no longer need to spend hours looking at charts or conducting research yourself when you can pay someone else to do it. As long as you’re able to generate a return greater than the amount that you paid to be to be part of the group, then it’s more than worth it.

Great learning opportunity – Subscribing to a crypto signal provider gives you the opportunity to learn from those who are better at spotting profitable trades than you are. Giving the fact that so many providers do conduct technical analysis detailing the rationale behind each signal they issue, you can read these posts and try to apply their teachings for yourself. Gradually, you’ll become more proficient at spotting trades to a point where you may not even need a signal provider anymore.

How to get Started

The section you’ve all been waiting to for… “How do I actually get started with crypto signals?”. We have put together a number of guides to help you find the group that is best for you, but one group repeated comes out on top. They are one of the biggest and most trusted crypto signals groups: MYC Signals.

1) If you have telegram then be sure to reach out to our admin, @MYCSupportBot, as well as to join their free crypto signal group, MYC Signals. Alternatively, if you don't have Telegram, feel free to contact them via email: [email protected] and they'll walk you through how to get started.

2) They offer 2 premium channels for you to join: MYC BitMex/Bybit/Deribit Signals VIP and MYC Binance Futures Signals VIP. The membership can be paid via any cryptocurrency of your choice or via card over at our payments page.

3) Once you’re all signed up and you’re a premium member, they'll work with you to make sure you can follow their signals as easily as possible, as well as to solve any problems you may have. They tout 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response.

Conclusion

To conclude, crypto signals are a burgeoning new space within the cryptocurrency eco-system. They offer several advantages such as being more profitable, saving time and potentially being a great learning opportunity.

If you’re able to find a trustworthy signal provider that's been properly vetted, then the sky really does become the limit. We would encourage people to see crypto signals as a means of supplementing their income as opposed to looking at it as a ploy to get rich quickly. If you’re able add an extra $500 or $1000 to your monthly income with minimal effort, then that in itself should been seen as a success.