A Complete Guide to Forex Scalping

Forex scalpers are essentially arbitragers that aim to profit from executing a large volume of trades at lightning speeds.

If this sentence made little sense to you, this article is for you. We’re going to talk about everything you need to know as a beginner trader or a keen learner about Forex scalping.

What is Forex Scalping?

Scalping is a trading method that requires real-time technical analysis of a given asset. A scalper’s goal is to leverage the gap in prices, that vanish in the blink of an eye, to profit from them by executing a trade in this short time frame.

Traders’ affinity for scalping is rooted in the fact that it offers consistent trading opportunities within a given trading day. Forex scalpers aim to gain just a few pips per trade. Scalpers try to squeeze the profits resulting from the bid-ask spread of a currency pair.

The bid price is the price at which the broker is willing to buy the pair, and the ask price is the price at which the scalper is willing to sell.

Scalpers close their positions within seconds, unlike other traders who hold their position for hours or days. Naturally, they do this over and over throughout the trading day, since gains on each trade are small.

The Forex market’s volatility and liquidity facilitate scalping. Scalpers scan the price movements in currency pairs, and open and quickly close a trade when they see an opportunity.

Scalpers also need a solid exit strategy. One large loss-making transaction can wipe out the small gains a trader makes throughout the day. Before you start scalping, ensure that you have the right tools to execute trades quickly, and more importantly, the mental stamina to keep up. You can also combine your knowledge with signals from professional traders on telegram, which will provide another view on the market and help keep your profits consistent.

Is Scalping for You?

It depends on the time you can put into scalping and your mental capacity to keep thinking about market movements.

As we discussed previously, scalpers need to execute a large volume of transactions to see considerable gains. Scalping requires continuously gauging the markets and placing orders throughout the day. This translates to as many hours as a 9 to 5 job, if not more.

Scalping also demands that you keep your eyes wide open and make quick predictions as to which direction the price of a pair will head in. Only then can you open and close positions within seconds to gain from the bid-ask spread.

While it’s common for all strategies, as a trader, you must be open to the possibility of losses. It happens to the best of us every once in a while. However, leverage can make losses pinch hard. All traders want to maximize profitable trades and minimize losing trades—but it’s important to realize when it’s time to take the loss and close the position before losses run deep.

If you’re someone with ample time to dedicate to trading, the mental fortitude to apply yourself for a good 8 or more hours each day, and the ability to stomach occasional losses, scalping may be a fruitful endeavor for you.

Scalping Prerequisites

Set up an Account with a Reliable Broker

Forex is an international, unregulated market. There are no governing bodies looking over your agreement with the broker. So, it’s prudent to carefully read and understand the agreement and responsibilities of both parties to the contract. Always try to stick with an experienced broker, perhaps one that a friend or another trustworthy individual can recommend based on their experience.

Pay special attention to conditions regarding the margin; an agreement may include a clause to automatically liquidate your account if your trades are in the red and you’re overleveraged. Don’t shy away from asking questions to the sales rep when you’re signing up, and read the agreement thoroughly.

Practice on Broker’s Platform

Trading platforms differ from broker to broker. Since you’ll need to execute trades within seconds, it’s ideal to familiarize yourself with the broker’s platform before you start trading. Remember, mistakes can cost scalpers their entire day’s gains.

Your broker’s platform most likely allows opening a practice account where you can execute dummy trades. This enables you to get some hands-on experience with the platform and see in real-time what your scalping trades will look like.

System Redundancy

System redundancy means having more than one method to execute your trades. We know it's essential to open and close positions quickly while scalping. So, what happens if your internet connection gives you a hard time? You may have opened a position, and now you can’t close it without internet access.

This is why it’s helpful to have system redundancy. Ensure beforehand that you’re able to quickly get on a call with your broker’s dealing desk should the need arise. Don’t forget about factoring in the time required for authentication, too. Any oversight here can cost you a good deal.

Schedule Scalping Sessions

Liquidity is a scalper’s best pal. Liquidity differs among currency pairs and trading sessions. Ideally, beginners should stick to the most highly traded pairs like the USD/JPY.

Forex markets are international markets where you can trade any time of the day. However, liquidity changes throughout the day. Trading volumes start to climb after 7 AM when the London session commences. 5 hours later, the New York session kicks off and contributes to the trading volume.

Liquidity peaks when both these major markets are in session. So, time your trading sessions accordingly to leverage liquidity in your trades.

Basic Scalping Strategies

You’ve now set up an account with your broker and are ready to start scalping. So, how exactly do you scalp forex? Let’s walk through a few strategies that will help you in your scalping pursuit.

Aim for low spreads

We’ve said this several times already, but it’s important to drill in—scalpers do not make large gains on a few transactions, they make small gains on a large volume of transactions.

The reason I mention this again is that it ties into the concept of aiming for lower spreads. Currency pairs with lower spreads cover spreads and deliver profits far more quickly.

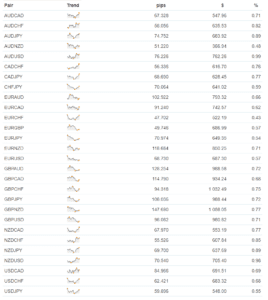

Let’s walk through an example. Following are the live spreads of a few currencies as on the day of this writing:

Notice how highly liquid pairs like EUR/JPY, EUR/GBP, and USD/JPY tend to have the lowest spreads.

Let’s say you want to gain 5 pips per trade. Assuming you invest in USD/JPY, the market will need to move in your favor by 7 pips (~2 pips to cover the spread and a gain of 5 pips). On the contrary, if you invest in EUR/HUF, the market will need to move in your favor by almost 25 pips for you to gain 5 pips.

Scalpers need to close their trades quickly, so currency pairs with higher spreads aren’t the best choice. Stick with highly liquid currency pairs with the lowest spreads while scalping so you can quickly open and close your positions.

Aim for high volatility

Greater volatility bodes well for scalpers. Think about it, the more volatile a currency pair is, the quicker it will cover the spreads and turn in profits.

Time is a precious commodity for scalpers. The less time their trades take to turn profitable, the more trades they can execute, and increase their aggregate gains.

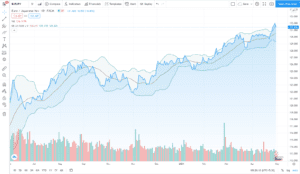

GBP/NZD, AUD/JPY, and GBP/AUD are some of the most volatile currency pairs. The spreads for these currencies differ, though, with AUD/JPY having the lowest spread. While the intensity of volatility may change from time to time depending on a range of factors, here’s how it looked over the past 10 weeks from this writing:

Use Technical Indicators

Technical analysis is like bread and butter for traders. If you don’t have enough trading experience, though, stick with the basic indicators. We have a complete guide on forex trading indicators right here on mycryptopedia!

However, ensure that you don’t enter trades based on what any one indicator tells you. Use a confluence of indicators before you make a trading decision.

The Simple Moving Average (SMA) and Exponential Moving Average (EMA) are one of the easiest indicators to understand. Moving averages are commonly used by scalpers to scan for short-term variance in a currency pair’s price trends.

Bollinger bands help traders gauge market volatility. They’re a great tool to have in every scalper’s toolkit because they help identify volatility among low spread currency pairs, which generally tend to be the least volatile.

For example, we know that GBP/AUD is significantly more volatile than EUR/JPY. The wideness of the Bollinger bands tells us the same thing:

EUR/JPY

GBP/AUD

While GBP/AUD doesn’t have a very low spread, these charts show how GBP/AUD is significantly more volatile than EUR/JPY.

Scalpers can use the Relative Strength Index (RSI) to identify entry and exit points for their trade. This moment oscillator can help traders predict the direction of a currency pair’s price over a specific time frame.

When Should You Refrain from Scalping?

Scalping is a high-energy activity. It requires focus and diligence. If you’re not feeling great on a given day, don’t scalp.

If you’re going through an emotionally tough time, didn’t get enough sleep the previous night, or just feel low-energy for whatever reason—you may end up in the red at the end of the day.

However, for some, scalping can be stressful and downright exhausting. If you’ve scalped for a while but feel you can’t keep up, don’t force yourself into it. Your scalping experience thus far can be valuable and you can use that experience to become a successful day trader or swing trader.

Tips for Acing Your Scalping Game

Luck has no role to play when it comes to successful scalping. Unlike investors, scalpers thrive in the face of volatility. Scalpers need a focused approach, a reliable set of tools, a robust strategy, and discipline to become successful.

Use the following tips as you begin your journey as a scalper to stack the odds of success in your favor.

Outline Your Strategy and Goals

All traders have a common goal—profit. However, here the word goal has a wider scope. Profit from a scalping trade can be small. Regardless of what strategy you use, you’ll need a large volume of transactions to earn tangible profit. Set realistic goals and don’t push yourself to overwork.

It’s wise to choose a strategy that you feel comfortable with and can follow diligently without exceptions. Outlining your strategy and goals beforehand will help you be mindful as you start to live among price lines and candlesticks.

Manage Risk

The use of leverage is common among scalpers because profits from scalping tend to be minuscule. Leverage amplifies the upside as well as the downside potential, and therefore managing risk becomes critical. Scalpers that use a stop-loss may have some more leeway for leverage.

However, take cognizance of any disruptive news or economic data being released, because these can cause the spreads to widen and keep your stop-loss from triggering. It’s highly advisable to maintain a low leverage ratio during unpredictable times.

Steer Clear of Complacence

Scalping will frequently test your mental resilience. Emotional control and the ability to remain calm and composed are quintessential to not just success, but your survival as a scalper as well. Letting emotions get the best of you will most likely drive you into a pitfall. Therefore, be extremely disciplined while scalping. Complacence can be expensive!

Final Thoughts

Scalping is a great strategy for retail traders. However, to make the trades worth your while, you’ll need to take on leverage, which requires you to put down a large deposit.

If you like to know where you’re putting your money and prefer to analyze a security inside out before investing, scalping will be a nightmarish experience for you.

On the contrary, if you like the thrill of working in a fast-paced environment and analyzing charts by the minute, you’ll enjoy scalping. Of course, you’ll also need to be able to make quick decisions and have thick enough skin to accept the occasional losses. With forex trading signals though you'll sometimes be able to see a train-wreck trade and avoid it, thanks to the experience of more senior traders.