The War Against Privacy Coins

Last Updated: 1st November 2018

Privacy and fungibility have always been an under-the-surface issue for Bitcoin. There have always been far more serious issues that preoccupied the cryptocurrency community. Issues such as: Segregated witness, the Bitcoin Cash fork and the SegWit2X fork, were all contentious issues and thus required more focus by the community. However, as we enter a quiet period, it is time to re-visit these issues, and figure out how Bitcoin’s lack of privacy and fungibility, has inadvertently ordained the rise of privacy coins such as: Monero, DASH, Zcash, Verge and ZenCash.

What is Fungibility and Why Does It Matter

Upon release, Bitcoin was widely touted as being an anonymous currency. However, upon closer inspection, it is clear that at best, Bitcoin is pseudonymous currency. Even though public addresses are used in place of a first and last name, it is still possible to link that public address to a user. We have already seen that as government agencies begin to get to grips with blockchain technology, the public ledger can actually be used to help track exactly where you spend your money, and at what time.

Apart from privacy, Bitcoin’s lack of anonymity has also presented a second problem, one in the form known as, fungibility. Fungibility is a characteristic of a commodity or good whose individual units are interchangeable. For example, the US dollar is fungible, i.e. one US dollar is the same as another US dollar. Because Bitcoins can be tracked, this results in its failure of being fungible. For example, if Bitcoins were to be received from an address known to engage in illegal activity, those Bitcoins are said to be ‘tainted’. Those Bitcoins psychologically are worth less because of where they originated from. Therefore, we get the issue were certain Bitcoins are no longer worth the same amount as each other.

This is in contrast with a privacy coin that is fungible, Monero. Through its use of ring signatures and stealth addresses, a Monero coin cannot be traced. Therefore, as no one can know the origin of a Monero coin at any given time, one Monero can never can considered to be worth less than another. As a result, every Monero coin is worth exactly the same, and successfully meets the criteria of fungibility.

Source: Coinmarketcap

As can be seen from the Coinmarketcap graph, Monero has gone from a price of $14 in January of this year to $120 at the time of writing this article. This is a gain of over 700%, which of course can be attributed to the whole cryptocurrency market as whole gaining traction. However, I believe it would not be unreasonable to attribute some of Monero’s success to advances it has made in ensuring the privacy of its users. Something in my opinion, Bitcoin has failed to do.

Privacy coins: Quiet but Deadly

You only have to take note of the way these privacy coins are marketed in-order to clearly understand which users they are trying to attract. Monero through its use of ring signatures and stealth addresses, or DASH through its use of its PrivateSend function. They have a clear idea of their ideal user and as such, have formed a niche around it. As scrutiny of cryptocurrencies grow, privacy will become a more important factor in considering which cryptocurrency you choose to transact with. Would you hire the services of a small company who specializes in an area of which you require their service, or a big company who only somewhat specializes in it? My concern is, the area these privacy coins have chosen to specialize in, is becoming a growing section within the space, and as such, Bitcoin may struggle to compete.

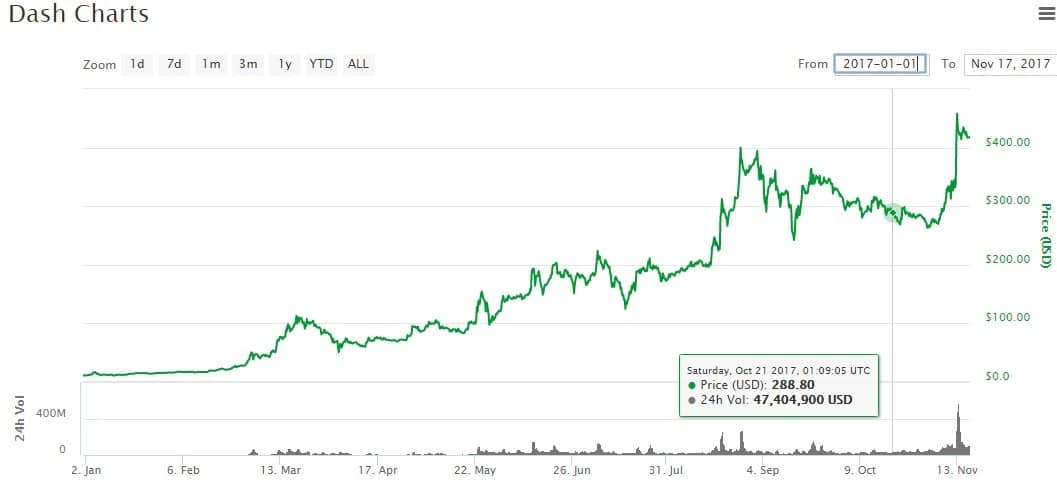

Source: Coinmarketcap

DASH has seen an extraordinary increase in price from $11 in January of this year to $418 at the time of writing this article. An increase of a massive 3700%. I was so surprised at this number that I had to double check I calculated it correctly! In contrast, Bitcoin has seen a price increase of 706% over the same time period. Of course, Bitcoin was trading at a significantly higher price of $1000 to DASH’s $11, so any percentage changes will always favour DASH. However, once again, I do not think it is unreasonable to attribute some of DASH’s successe to the slight improvement in anonymity it offers over Bitcoin.

Hardcore cryptocurrency users who value their privacy above all else; which cryptocurrency do you think they will use in-order to ensure their privacy is never compromised? Although, A solution in the form of Confidential Transactions, may prove to be a viable solution in helping Bitcoin reassert itself as a true privacy coin.

Bitcoin’s Saving Grace: Confidential Transactions

Currently being spearheaded by Gregory Maxwell, Confidential Transactions (CTs) is a powerful tool that ensures only the people who are participating in a transaction, are privy to the amount that is being transferred. Parties can also choose who they want their transactions to be visible to.

However, a previous issue of CTs is that they were roughly 16x the size of a normal transaction. Given the recent debate over the scaling of Bitcoin, CTs were therefore never thought to be a viable solution to Bitcoin’s anonymity issue. Recently, in an update by Grergory Maxwell, CTs have been compressed to the point where they are only roughly 3x the size of a normal transaction. This represents a tremendous amount of progress, and therefore makes CTs a very plausible solution.

Conclusion

To conclude, Bitcoin has asserted itself has the dominant cryptocurrency in the space. However, I believe we are seeing slight shifts into areas that Bitcoin struggles. Areas of privacy, and areas of fungibility. These two issues have allowed for the rise of privacy coins, such as DASH and Monero, who solve these issues significantly better than Bitcoin. I argue that while we have been distracted with other issues such as scalability, the issue of privacy has gone relatively unnoticed. Whilst significant progress is being made in the area of Confidential Transactions, the purpose of this article is to simply reorient the community in tackling these issues head on.

Dash has grown into a cryptocurrency that is far more then just a cryptocurrency with a focus on privacy. Dash has in comparison with Bitcoin :

* much lower fees

* faster transactions

* higher capacity for its network transaction processing (8x)

* decentralized governance and budget system

* on-chain scaling solution, by using bigger blocks and specialized hardware in the future

* optional instant transactions

* optional privacy on its transactions

Dash is forging partnerships that allows it to fully use the peer-to-peer cash system that Satoshi once envisioned for Bitcoin which is slipping away from Bitcoin due to high fees and an unwillingness to implement higher blocksizes for its network.

While Bitcoin will slowly drift off to become a value of store with highly centralized off-chain aspects, Dash is headed to become a value of usebility with

decentralized on-chain aspects.

Monero on the other hand just has one focus and one focus only, which is privacy. So in that regard it should indeed be considered a privacy focussed cryptocurrency.

Time will tell if the future is with an open-traceable ledger (Bitcoin), a closed private ledger (Monero) or with an open ledger with optional privacy and peer-to-peer cash capabilities (Dash).

I still think the scale issue (implying centralization issue) is more fundamental. Suppose scale is a non-issue, a traditional scheme is available to protect the privacy already. On the other hand, suppose any part in the ecosystem is centralized, say, 100 specialized machines instead than a 10000 grass-root machines for node/mining/hub/… , then even a cryptocurrency is privacy strong, it is so easy for the government or any big player to seize control from the 100 machines.

Always remember cryptocurrency is much more an economic issue than a computer science issue and the overall attack vectors are far more than the vectors from computer science; a computer science expert says that Joe’s email password is strong enough to break in 1000 years but then Joe always fails in the attack in a social way by phishing or bribe.

Comments are closed.