Binance Futures: The Ultimate Beginner’s Guide

This Binance Futures Beginner's Guide will walk you through exactly what you need to know to get started on the platform.

Binance is one of the largest cryptocurrency exchanges that allows its users to trade 100s of cryptocurrencies daily. Binance began as a spot trading exchange, where traders could only profit when the value of a cryptocurrency increased. However, Binance has now since launched ‘Binance Futures’, a futures trading platform that allows traders to use leverage and to open both short and long positions.

In this guide, we’re going to walk you through the following:

- Features of the Binance Futures Platform

- Opening a Binance Futures Account

- Funding a Binance Futures Account

- Binance Futures Interface

- Placing Your First Trade

- Binance Futures Signals

Before we look at how we open a Binance Futures account, let’s talk about the features we expect to find on the futures platform.

1. Features of the Binance Futures Platform

Binance Futures is an attractive trading platform because it allows traders to do two things:

- Enter into short positions

- Trade with leverage

These are two very important features for traders because it gives them different ways to profit when trading cryptocurrency. The price of Bitcoin doesn’t always move upwards, and will regularly experience severe downward price action. With Binance Futures, traders can profit when Bitcoin moves up or down. Being able to trade with leverage is also very important, because it lets traders maximize their returns by being able to trade more than 100x the funds in their accounts.

Long & Short

The process of longing can very much be summarized as follows: buying a cryptocurrency at a specific price, the price of a cryptocurrency increases, then selling the cryptocurrency at its new increased price and making a return. For example, say the price of Bitcoin was currently trading at $10,000 and you decide to buy 1 BTC; this makes your purchase price $10,000. Now, if the price of Bitcoin were to increase to $11,000 and you sell, this would result in a 10% return, yielding a $1,000 profit minus any trading fees. This process is known as going long on a cryptocurrency and is the primary method in which many new traders tend to invest.

This is in contrast to the process of going short on cryptocurrency which can be summarized as follows: borrowing a cryptocurrency from a willing lender that is then immediately sold at market price, the price of the cryptocurrency then declines, the cryptocurrency is then repurchased at a lower cost then returned to the borrower. To illustrate, Bob borrows 1 BTC from Amy which he then immediately sells at market price of $10,000. The price of 1 BTC then falls to a price of $8,000 at which point Bob buys back the 1 BTC then returns it back to Amy. The net result of this is a $2,000 profit for Bob as well Amy having received her 1 BTC.

Now that we know what to expect from the Binance Futures platform, let’s take a look at how we can open an account.

2. Opening a Binance Futures Account

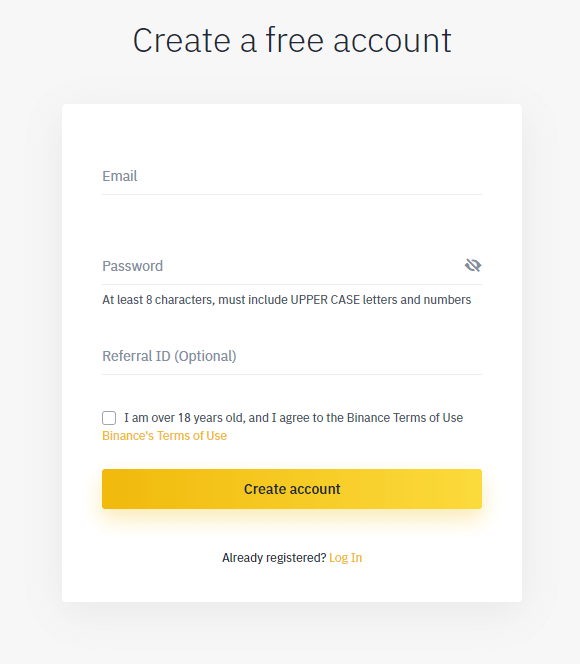

Getting started on Binance Futures is very straightforward. Before you can open a Binance Futures account, you will need to first open a regular Binance account. If you don’t already have one, then go to Binance.com and click on ‘Register’ in the top right corner of the webpage. You can also get registered on Binance by clicking here, then follow these steps closely:

- Enter in your email address and password.

- Then click on ‘create account’

- You should then receive a verification message in your email – follow the instructions in the email to complete your registration.

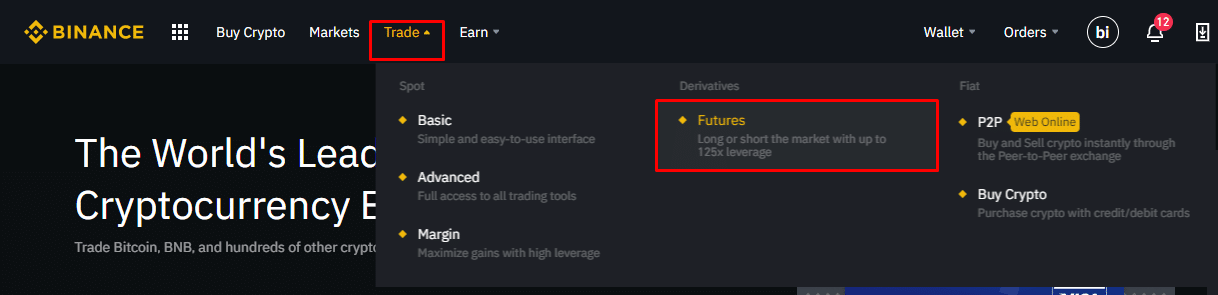

Now, if you already had a regular Binance account (or you just created one), you can open your Binance Futures account by navigating to the Binance homepage and first clicking on the ‘Trade’ button, and then clicking on ‘Futures’. See the image below.

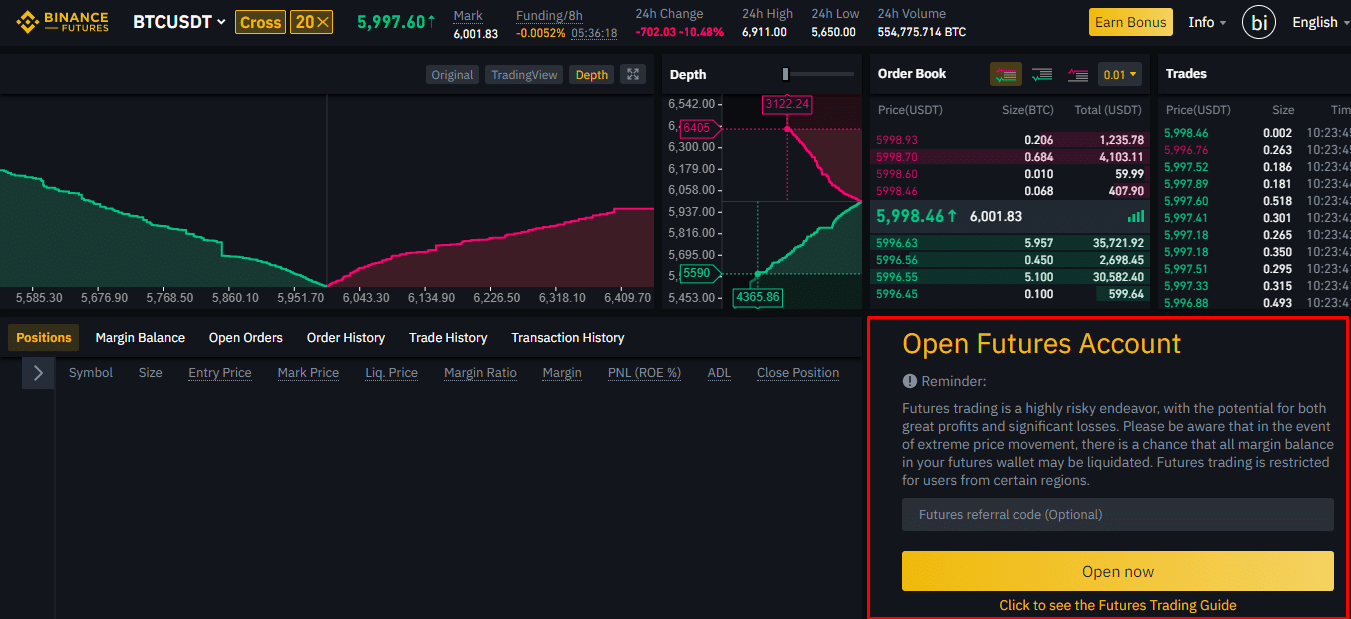

You should now be looking at the Binance Futures interface. To open your Binance Futures account simply click on ‘open now’ and your Binance Futures account should now be open!

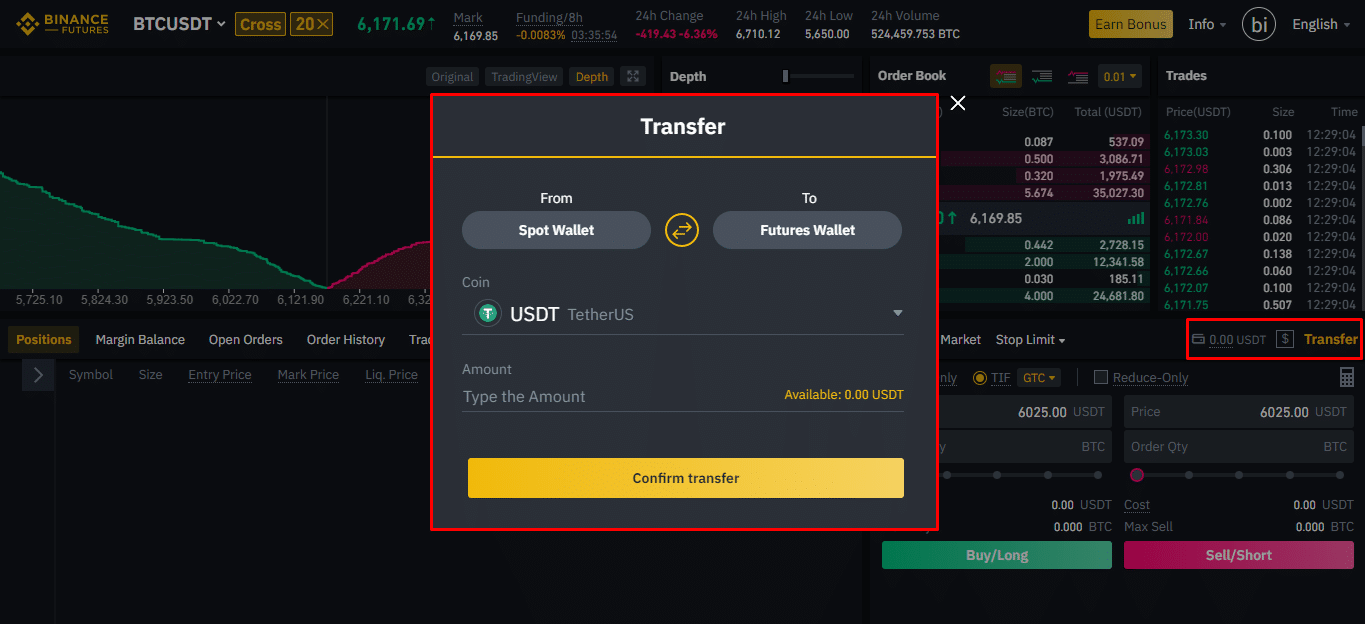

3. Funding a Binance Futures Account

Now it’s time to deposit some funds into your Binance Futures account so that you can start trading! All futures contracts on the platform are traded in Tether (USDT), so you will need to deposit some USDT before you begin trading on the Binance Futures platform.

You can transfer funds from your Spot Wallet (this is the wallet you use on regular Binance) to your Futures Wallet (which will be the wallet that you’re using on the Binance Futures platform). To transfer funds to your Futures Wallet, simply click on ‘Transfer' in the bottom right of the screen. You can then decide on the amount of USDT that you would like to transfer and click on ‘Confirm transfer'. You should then see the funds added to your Futures Wallet.

If you don’t have any USDT in your Spot wallet, you will need to first purchase some USDT on your regular binance account, and then you will be able to transfer the funds to your Futures Wallet. You can either purchase the USDT by card or deposit it into your Spot Wallet.

If you’re not quite sure how to fund your Spot wallet with USDT, then take a look at this guide (it’s a pretty easy process, and shouldn’t take long): How to Deposit on Binance.

4. Binance Futures Interface

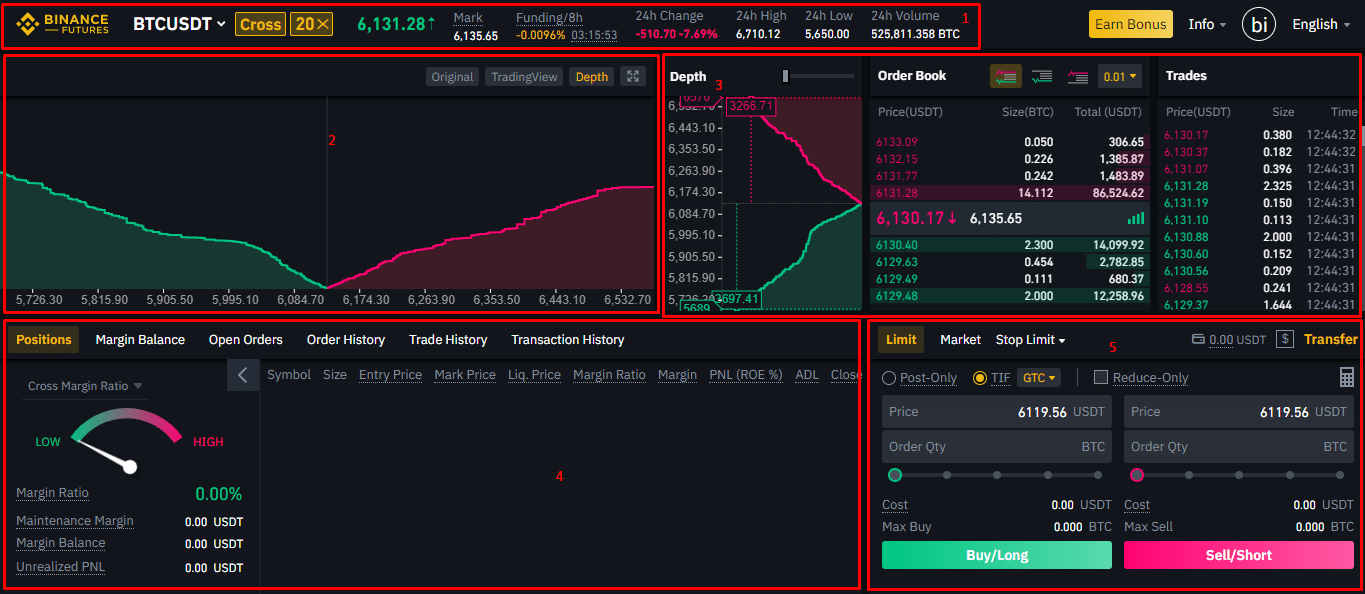

Now it looks like there’s a lot going on in the image above, but let’s break each section down:

- This is where you can choose the contract that you’d like to trade and also adjust your leverage. Binance has numerous contracts to choose from, with the primary one obviously being the BTCUSDT contract. The default leverage on the platform is 20x, but you can take this all the way up to 125x leverage. You can also switch between cross margin and isolated margin here.

- This is your chart, you can switch between the price chart (by clicking either the original or trading view button) and order book depth.

- Here you can see a live feed of order book data along with graphics showing the depth of the order book.

- Here you will be able to check your trading activity. You will also be able to switch between tabs to check the status of any current positions that you are in. This will include information such as: margin balance, entry price and mark price.

- Here you will be able to enter your orders and also switch between different order types.

There is also a Binance Futures testnet, where you can play around with the platform and get used to all its features. You can take a look at the testnet here.

5. Placing Your First Trade

Now that you’re up to speed on how to create and fund your Binance Futures account, it’s time to place your first trade.

Placing a trade is very straight forward. You first want to select the order type, you have three options:

- Market order

- Limit order; and

- Stop Limit order

You want to avoid using market order if you can, because you’ll usually end up paying more in fees. Instead, placing trades via limit orders or stop limit orders will cut down on the fees and should be the primary way in which you execute your trades. You’ll want to use a stop limit order if you want to incorporate either a stop loss or take profit target into your trades.

6. Binance Futures Signal

Now, trading the markets can be difficult, because it can be tricky to know when to buy or sell. With MYC Signals, you don’t have to perform all sorts of market analysis to determine when to buy and sell, we will do that for you.

MYC Signals is a spin-off of the Mycryptopedia.com publication. MYC Signals has a team of experienced cryptocurrency traders that will send you trading signals telling you exactly when to buy and sell.

Here’s how you can start receiving our Binance Futures trading signals:

1) If you have telegram then be sure to reach out to the admin, @MYCSupportBot, as well as to join their free crypto signal group, MYC Signals. Alternatively, if you don’t have Telegram, feel free to contact us via email: [email protected] and we’ll walk you through how to get started.

2) We offer 2 premium channels for you to join: MYC BitMex Signals VIP and MYC Binance Futures Signals VIP. Membership can be paid via any cryptocurrency of your choice or via card over at their payments page.

3) Once you’re all signed up and you’re a premium member, we will work with you to make sure you can follow our signals as easily as possible, as well as to solve any problems you may have. We have 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response.

You can expect our Binance Futures signals to look like the image below:

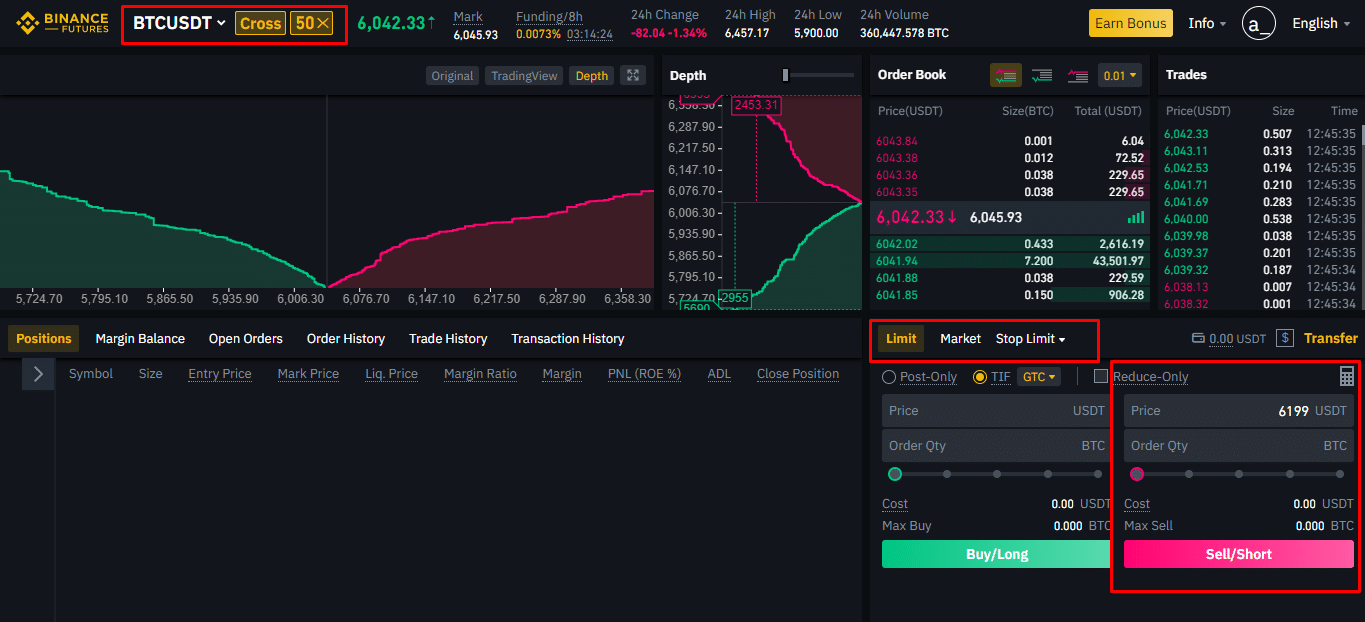

Using this signal, you can now then place a trade on the Binance Futures platform:

Firstly, right at the top of the platform you should choose how much leverage to trade with. Binance allows you to trade with up to 125x leverage, we would recommend starting of with 50x leverage on cross. You should also choose what type of margin you would like to trade with, which can be either: cross margin or isolated margin.

Cross margin: a margin method that utilizes the full amount of funds in your account when trading to avoid liquidation.

Isolated margin: by isolating the margin the position uses, you can limit your losses to the initial margin set, so the full amount of funds in your account is not utilized.

Turning to the bottom right, this is where you would enter your trade. We would recommend using a limit order to place your trades to start off with. Our trading signals will let you know if you should be going long or short, all you have to do is input the entry price and the order quantity. The order quantity will depend on the amount of funds in your account, but we would recommend trading around approximately 10% of your portfolio.

Our signals also contain take profit targets and stop loss targets. These are the price points we think you should be taking profits and setting your stop loss. For example, the signal above is telling us to take profits at 6170 below the entry price. Equally for stop losses, this signal is telling us to set our stop loss at 6300.

You will have to actively monitor your position so that you can either sell to take profit or sell to exit the trade when a stop loss is hit.

That's the end of our Binance Futures Beginner's Guide. This platform provides a lot of opportunities for traders that are looking to maximize their returns trading crypto. We hope you found this guide useful, happy trading!