Best Crypto Day Trading Strategies

What is Crypto Day Trading?

Crypto day trading is the purchase and sale of cryptocurrencies over the course of a single day to produce quick and consistent profits. For those who know what they are doing, day trading can be a way to make money quickly. However, the reverse is just as true for those who don’t know what they are doing.

The term day trading was first used to refer to hourly stock trades between market hours. However, crypto exchanges operate all day long, every day of the week. This makes trading a lucrative undertaking regardless of your time zone – again – if you know what you’re doing.

As a day trader, you can’t keep a crypto asset with you for more than a couple of hours. Once you’ve owned a cryptocurrency for over 24 hours, your trade will become a swing trade. Let’s walk through an example of day trading to really hammer the concept home.

Example: Garry purchases Ether, expecting a rise in its price within the next hour since an institutional investor just announced its intentions to buy Ether. Garry purchases 10 ETH priced at $2,200 apiece. As expected, the price moves up to $2,350 within 45 minutes. Garry quickly initiates a sell trade and makes a $1,500 profit. That’s 6.82% within 45 minutes — not too shabby, is it?

If your eyes just lit up, take a pause. This is an example of a successful trade. The prices could have just as easily moved in the opposite direction. Cryptos are a risky asset class. Be sure to thoroughly understand your risk appetite before you day trade crypto.

Things to Know Before You Start Day Trading

As you take your first steps to become a crypto day trader, you need to prepare yourself mentally. Let’s talk about a few basic mindset essentials you should know before you make your first trade.

Know when to take the loss

Predicting the future is impossible. Before you make your first trade, realize that losses are a part of trading. Even the most successful trader makes a losing trade every once in a while.

When the situation so warrants, make the move, close the trade, and take the loss without trying to “chase” it. A trader is said to be chasing losses when they try to take on additional risk hoping to make good the loss already incurred. This can be a costly proposition – always accept a loss when it’s prudent to do so.

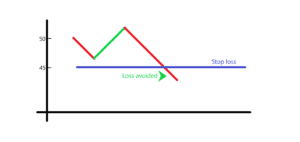

If you have a hard time accepting a loss, consider adding a stop loss to your trades. A stop loss basically triggers a sell order when the price of an asset falls beyond the defined threshold. For example, if you purchase XRP at $1, you could add a 10% stop loss.

If the price goes below $0.9, the system will automatically trigger a sell order. This means if the price continues falling and touches $0.8, you’d have shielded yourself against the additional $0.1 worth of loss per XRP.

Volatility

Volatility is a major pro as well as con of day trading. Volatility is essentially the degree to which the price of an asset moves, resulting in either a colossal profit or a nightmarish loss.

Given that crypto is a fairly new asset class, they tend to be extremely volatile. It’s actually not entirely uncommon for a crypto’s price to rise or fall by 20% to 50% within 24 hours, maybe more. In fact, just a week before this writing, BTC tumbled about 30% and is still on its way down. Investors who invested a few years ago still have their capital intact, but someone who had invested 3 months ago, lost a good chunk.

Therefore, you must go in with your eyes wide open. Only trade with capital that you can afford to lose.

Establish clear goals

Finally, set realistic goals. Establishing goals clearly beforehand will keep fear and greed at bay. When the time you’ve set for a trade expires, exit the trade regardless of whether you’re in the green or bleeding red. You’d be surprised by how much money this can save you. A good signals provider will give you clear take-profit and stop loss targets, to keep you disciplined.

Day Trading Strategies

Now that we have a solid foundation, let’s talk about some strategies that can help you stack the odds of success in your favor. The underlying idea of day trading is to generate a profit from short-term trading opportunities. Therefore, as a day trader, you’ll need a knack for identifying these opportunities quickly.

Note that this is an entirely different setup from value investing where you look at the fundamentals of an asset to understand its long-term prospects. Day trading is about identifying the gaps and riding the trends looking for short-term gains.

Following are some strategies that could help you generate decent profits.

Steady Incremental Profit Accumulation Strategy (SIPAS)

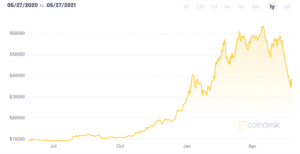

As a beginner, you’d want to steer clear of any wild fluctuations within the crypto market. The best bet for navigating through the crypto market’s volatility? Stablecoins! For example, look at the following chart to get a feel of just how stable USDT is as compared to BTC.

USDT:

BTC:

It’s highly recommended that you start with a heavily traded stablecoin such as USDT. All major exchanges will have Tether (USDT) and other altcoins with a history of stability. For the first few sessions, aim for 1% to 2% profits from a range of stablecoin-altcoin pairs, i.e., about 8% to 10% gain in a single trading day.

As you begin to gain confidence, start trying your hand on more volatile assets. That’s where you’ll be able to generate better returns of anywhere between 4% to 10% per trade. Don’t bite off more than you can chew; if you’re a beginner, SIPAS is the best way to get your momentum going.

Scalping

Scalping is one of the most popular day trading strategies. It aims to profit from small movements in the asset’s price. As a scalper, you will need to look for pricing gaps in the bid-ask spread resulting from market inefficiencies.

However, like most day trading strategies, scalpers need to make plenty of trades since the profit per trade is rather small. To remedy this, scalpers trade futures contracts or on margins to use leverage for amplifying their gains, though leverage may also amplify losses.

It’s best to have a large bankroll to make enough gains from scalping. Even with a very small return on investment, using a large amount for trades will still fetch a significant amount. For example, a 0.6% return on $200,000 can get you $1,200—nothing to sneeze at, correct? Plus, scalpers make dozens of trades per minute, so the gains add up to a significant amount.

Arbitrage

Arbitrage involves profiting from inefficiency in the markets. If that rings a bell, it’s because scalping does the same thing. However, arbitrage is a broader term and scalping is just one way of arbitraging. Crypto day traders can also use arbitrage by buying from one exchange and selling on another.

Crypto is still a largely unregulated market, which means pretty much anybody can set up an exchange. As a result, liquidity and volumes sometimes tend to vary by broad margins across exchanges.

To use arbitrage, sign up with exchanges that you believe will show considerable differences in the prices of a given asset. Ever heard of the “kimchi premium?” Well, there was a time BTC traded at a 40% higher rate in South Korea than in the U.S.

Now, this is an exceptional case and the price difference is rarely, if ever, this large. The differences will most likely be very small. This also necessitates that the traders account for the exchange’s fees, otherwise they may end up losing money.

Leverage BTC’s Volatility

Crypto is 500% more volatile than any other traditional asset class, so why not use volatility in our favor? To be able to do this, you’ll need to use Bitcoin futures, like the one traded on the Chicago Mercantile Exchange.

To use this strategy, you must buy both a call and put option with the same strike price and date of expiration. When BTC’s market price moves away from the strike price in either direction enough to cover your premium, you’ll exit the trade with a profit.

Note that volatility actually works for the trader rather than against. The more volatile a coin is, the sooner it will cover the premium and generate gains. This is why this strategy is best suited for when you expect the volatility of a certain asset to rise, rather than otherwise. If an asset trades flat until your expiration date, you’ll make no profits, and also lose the premium amount.

Mistakes to Avoid

It’s your money – act like it

Simply relying on tips or recommendations from experts can and will put your money at risk. If you don’t understand crypto, learn first. Start slow and explore the market. As your knowledge keeps growing, you’ll start to notice a difference of opinion and see why even experts can sometimes be wrong. Work your way up, because it’s your hard-earned money.

Using money you can’t afford to lose

Even the most experienced traders aren’t immune to mistakes and tend to suffer considerable losses. Beginners may naturally be more prone to errors, though. While it’s important to make and learn from mistakes, make sure you’re not using money that your life depends on. Make sure you’re taking care of your emergency fund, savings, and insurance before you use any money for day trading crypto.

Resist herd behavior

As a trader, you like to stay in the know about what’s happening in the market via Twitter, CNBC, etc. However, you should always be wary of the information you receive from these sources. Double-check for accuracy of the information before making any decisions.

Getting trading signals on telegram from professional traders can help you get rid of the noise, keep disciplined, and provide a second opinion when you're not sure. Or when trading gets tough and

Complacent approach towards security

Hackers see free money and they flock to it. Being complacent towards security has caused countless investors to lose their money forever. To ensure your money is safe from hackers, always use two-factor authentication and data encryption.

If possible, save your crypto on cold wallets rather than on the exchange’s wallet. Make physical copies of your keys and passwords and store them somewhere safe.

Final Thoughts

If you invested time into reading this guide, you should pat yourself on the back. You’re committed to your goals and willing to learn – a trait that most successful traders share.

Cryptocurrencies are a goldmine for day traders because of their volatility. The volatility provides the perfect environment that traders need to produce significantly larger gains. However, it also demands adequate risk management practices from traders.

Get yourself in the right mindset, study the strategies you have at your disposal, and be sure to avoid mistakes we discussed above—and that should set you up for a great start.