Uniswap Exchange Fully Explained

Conventional cryptocurrency exchanges like Binance and Coinbase, which are centralized, somewhat favor whales – traders holding large amounts of a given coin and can potentially manipulate its price by trading – meaning that small traders will always be at a disadvantage or the mercy of the whales. This perceived favoritism arises from the fact that these exchanges utilize limit order books.

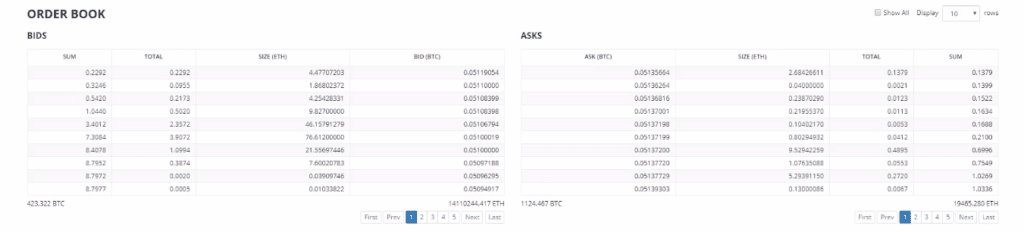

In the crypto trading world, and generally the entire financial markets, a limit order is an order to buy or sell an asset at a specific price or lower, when purchasing, or at a particular price or higher, when selling. Exchanges keep track of these orders using limit order books (example below) and use the lowest ask (price an investor is willing to sell a coin) and highest bid (price an investor is ready to buy the asset at) to determine the price of the coin. Usually, the price displayed in such exchanges is the average value of the highest bid and lowest ask or the price at which the platform executed the last trade.

Back to the limit order, the exchange may not complete an investor’s (buyer or seller) trade if the limit order is not reached. But it may execute it if the investor is a whale who, through price manipulation, causes the price of the coin to hit their limit order. This is because a buy order on the limit order book has to be matched with a similarly priced sell order on the opposite end of the book and vice versa. Small traders cannot enjoy this luxury because they cannot move the market, which means that this arrangement is disadvantageous.

Conventional exchanges also fall short in another entirely different way. The limit order system makes it susceptible to low liquidity, which effectively means that trades may not be completed. Liquidity, in this context, refers to the total number of open buy and sell orders, recorded in the order book, for a given asset.

These problems underscore the downside of centralized exchanges, and this is why Uniswap exchange exists.

What is a Uniswap Exchange

Created in 2018 by Hayden Adams in response to calls for a new trading paradigm in a Reddit post by Ethereum’s creator, Vitalik Buterin. Uniswap is a protocol that runs on Ethereum’s blockchain, which makes it compatible with ERC-20 tokens, and facilitates the decentralized exchange of assets. So, is Uniswap an exchange? Yes, it is because it enables the transfer of assets.

Since its creation, Uniswap has grown to become one of the largest decentralized crypto exchanges in the world by volume and is also central to the growth of decentralized finance (DeFi). If you want to take your trading to the next level, you can follow signals from professional traders. Notably, the term decentralized means that a central business or body does not own the exchange, as is the case with conventional exchanges such as Coinbase and Binance.

Further, a Uniswap exchange does away with the limit order books synonymous with these conventional exchanges. It does not give market makers the liberty of specifying prices. Instead, it does this on its own, with the market makers’ mandate only being to provide the funds or coins.

Uniswap facilitates peer-to-peer trading using algorithms collectively known as automated market makers (AMMs), as well as liquidity pools. But the facilitation and operations of the Uniswap exchange are unique.

How does Uniswap Exchange differ from Conventional Exchanges?

Typically, a traditional exchange such as Binance works on the principles of a limit book, as stated. Let’s imagine a trader who has owns 10 ETH coins and has $500 in cash. This person may opt to sell the coins at different ask prices, say, 4 ETH at $130 and 6 ETH at $150. They may set their bid price at $70 for 5 ETH and $110 for 10 ETH on the buy-side.

Notably, if a different buyer happens to set their bid price at $150 for 6 ETH, the exchange will execute the trade as the order book has matched the ask price with a similarly priced bid price. At the same time, if the exchange has a seller who has set their ask price at $110 for 10 ETH, the platform will complete the trade by matching the seller’s ask price with the trader’s bid price.

As stated, these orders make up an order book and dictate an asset’s market price. Now, continue imagining with me a situation whereby this traditional exchange now takes all the ask and bid prices, pools them together, and subsequently executes trades based on arbitrary prices that it comes up with using algorithms. Understandably, this would change the entire trading landscape and perhaps even trigger complaints among sellers and buyers. But this very description highlights how Uniswap works and principally how it differs from a centralized exchange.

How does Uniswap Exchange Work?

In Uniswap, sellers and buyers, collectively known as market makers, do not specify the prices at which they wish to sell or buy an asset. Instead, this exchange pools everyone’s buy and sell orders (liquidity), in the form of money, and uses a deterministic algorithm (AMM), to make the market, i.e., determine the prices.

Clearly, at its basic level, the algorithm is a cog in the wheel that drives a Uniswap exchange, a building block, if you will. And while it determines the price at which an asset is to be sold or bought (we’ll detail how it does this shortly), other vital processes also simultaneously take place.

Liquidity Provider Incentive

For example, this decentralized exchange incentivizes people to become liquidity providers (LP) by ‘rewarding’ them. These people pool their monetary resources together, creating a fund that the exchange subsequently uses to execute trades. Importantly, every asset traded on the Uniswap exchange has its own pool.

This system creates a situation whereby traders do not have to wait for a buyer or seller to set a bid or ask price commensurate with their offer for the trade to be executed. Instead, they can trade instantly provided there’s enough liquidity. And, as stated, the platform ensures that the liquidity is enough at all times using the reward system.

This reward system is based on a token that every LP receives as a percentage of their contribution to the pool. For example, if an LP contributes $20,000 to a liquidity pool that had $200,000 in total, the platform gives them a token corresponding to 10% (percentage of the contribution to the total amount). Thereafter, the LP can redeem this token for a part of the trading fees.

Uniswap charges a flat fee of 0.3% for every trade that users make. It follows that, in the long run, the charges will amount to a lump sum figure, stored in reserve, from which the LP’s share is deducted, in line with their percentage contribution, once they decide to withdraw their support.

Nonetheless, the Uniswap exchange v2 made a few changes to this. With this alteration, 0.05% of every transaction fee the platform charges goes into funding the platform’s future development and is subject to a community vote that can decide to turn it on or off. At present, it is off, meaning the payment regime that used to exist with the first version is still in use.

Automated market markers

With the other aspect of the Uniswap exchange already discussed, let’s now talk about the algorithm behind the platform’s effectiveness. First popularized in 2002 by R Hanson’s logarithmic market scoring rule (LMSR) for yielding estimates of market prices, automated market makers (AMMs) have grown to become an integral part of decentralized finance, particularly with regards to their ability to measure the price of an asset.

Since their initial popularization, AMMs have been improved upon, leading to multiple variants not based on Hanson’s LMSR. In the cryptocurrency world, the constant function market maker (CFMM) is the most common as it is deployed in multiple decentralized protocols such as Uniswap, Curve, and Balancer.

Notably, Uniswap specifically uses a CFMM/AMM variant called the Constant Product AMM, which has desirable characteristics. For instance, it is unaffected by the size of the liquidity pool and always provides liquidity regardless of the existing conditions. This means that irrespective of whether the number of buy and sell orders is small or high, liquidity is always guaranteed using this model.

Constant Product Market Maker Model

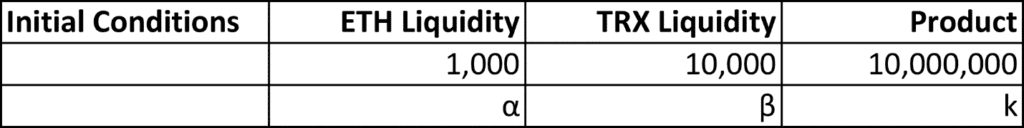

The constant product market maker model links two reserves α and β, each containing its own unique asset, thereby creating a liquidity pool. Notably, this pool always has assets, thanks to the liquidity providers, meaning that at no one time will the number of coins in any of the reserves making up the pool be equal to zero.

This model follows the principle that any change in the reserve, due to withdrawal or deposit of an asset (trade), occurs in such a way that the product of the two reserves is always equal to a constant k, hence its name ‘constant product market’ (α * β = k).

For instance, if the pool contains 1,000 ETH and 10,000 TRX (TRON), the constant k will be equal to 10,000,000. Any change in ETH causes an increase in TRX, meaning that this relationship is not linear but rather, inverse. In more technical terms, TRX will increase asymptotically as more ETH coins are withdrawn from the pool.

Notably, the price that this system displays depends on the number of coins a trader intends to purchase. The higher the size of the order is, the higher they are bound to pay. For instance, a trader buying 1 ETH will pay less premium than one who is purchasing 500 ETH. At the same time, the amount of premium paid also depends on the size of the pool from which the coins are being withdrawn. A pool that originally held 10 million ETH and TRX coins will require the trader to pay a higher premium for buying 100 ETH than a pool that initially had 100 million ETH and TRX coins.

This arrangement prevents whales from making large trades, effectively implying that it creates a level playing field for large and small traders. Importantly, the constant product maker also seals any possible arbitrage loopholes in a sophisticated method that relies on the ratios of the two cryptocurrency pairs being traded.

Advantages of Uniswap

- It allows investors to trade whenever they wish because they do not have to wait for a buyer or seller to set a bid or ask price that corresponds to what they have set

- It evens out the playing field for both small and large traders

Conclusion

Uniswap has grown in popularity and usefulness since its inception in 2018. Currently, it is considered the fourth-largest DeFi platform. It is compatible with wallet services and all ERC-20 tokens. In summary, it is an excellent addition to the crypto trading world. If you're interested in making consistent gains trading crypto, combine your knowledge of the crypto universe with trading signals from professionals.