What is Kyber Network?

Last Updated: 1st November 2018

Kyber Network is an Ethereum based protocol that allows for the instantaneous exchange and conversion of digital assets in a decentralized and trustless manner. Kyber Network was conceived to serve as an alternative to centralized trading exchanges, which are increasingly becoming prone to hacks. Kyber Network aims, through use of its protocol, to bring about an ecosystem of decentralized and trustless digital asset exchange.

With Kyber Network’s on-chain protocol, users will be able to exchange digital assets instantaneously; the protocol also allows users to conduct conversions of various digital assets.

A digital asset conversion on Kyber Network would be the following:

Alice wants to pay Bob for a cup of coffee that she had bought. However, Bob accepts only Bitcoin as a payment method, and Alice possesses only Ether in her wallet. In this situation, the protocol would convert Alice’s Ether tokens into Bitcoin and send it straight to Bob, all in one single transaction.

One novel design about the protocol is that it does not maintain a global order book. Instead, Kyber Network maintains a reserve, which houses a certain amount of digital assets for the purposes of maintaining exchange liquidity. This reserve is under the control of the Kyber smart contract; the contract can also determine the conversion rate for each digital asset pair by looking to all other reserves on the network. The conversion rate for digital assets are regularly updated by reserve managers, with the Kyber smart contract using the most favorable rate for users when executing an exchange.

Kyber Network Stakeholders

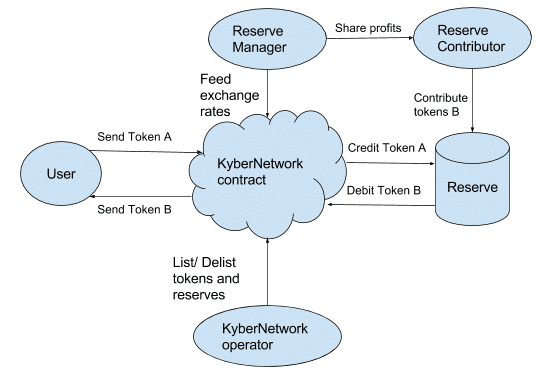

Actors within the ecosystem can be categorised into the following:

- Users – These are the actors that will be sending and receiving various digital assets to and from the network. These actors include: individual users, smart contract accounts and merchants.

- Reserve entity(ies) – These actors play a crucial role in the ecosystem, by functioning as a source of liquidity to the platform. Reserve entities can be separated into 3 categories: the Kyber Network’s own reserve, public reserves, and private reserves. The difference between a public and private reserve is that, with public reserves, reserve contributions can be taken from the public, whereas with private reserves, reserve contributions are provided completely by that private entity.

- Reserve contributors – These are the individuals that provide capital to reserve entities, in the form of reserve contributions, to increase their liquidity. By providing reserve contributions, these contributors have the opportunity to have a share in profits from that reserve. Reserve contributors only exist in public reserves that accept contributions from the public to increase liquidity.

- Reserve Manager – This actor maintains their own reserve; they also determine the conversion rates of digital assets that they possess in their reserve, and feed those rates into Kyber Network.

- Kyber Network Operator – This actor is responsible for adding and removing reserve entities, and also listing and delisting pairs of digital assets on the network. In the initial stages, this role will be played by the Kyber team themselves, but later on they will be replaced by a decentralized governance model.

It is also important to note that the platform incentivises reserve entities to enter into the ecosystem as reserve managers will be able to monetize their assets. Because reserve entities serve trade requests from users, they can earn profits from the spread, which can be decided by the reserve manager. Furthermore, Kyber Network does not hold any funds contained in any reserves. These funds are stored in reserve contracts that abide by Kyber Network rules.

These actors within the ecosystem interact with the Kyber Network contract in different ways, as shown below:

Dynamic Reserve Pooling

Kyber Network can assure that there is ample liquidity in its ecosystem by leveraging reserve entities in its network. Kyber Network is configured to allow the entrance of multiple reserves entities. This ensures that there is no monopoly of reserves, which produces more competitive conversion rates for digital assets in the ecosystem. The added benefit of having numerous reserves in the ecosystem is that it allows Kyber Network to support tokens with low trading volume. A reserve manager who chooses to deal in tokens with low trading volume is free to do so.

When a trade or conversion request is made, Kyber Network will retrieve conversion rates from all reserves that can process the request. Kyber Network will then choose the most competitive conversion rate and carry out the request.

Kyber Network Crystal (KNC)

KNC tokens are required for reserve entities to participate in the network. These tokens will need to be pre-purchased and stored by these entities. In every trade request that a reserve entity is able to serve, the trade volume will be paid by the reserve to the Kyber Network platform in KNC tokens. This fee represents the reserve entity’s right to able to operate and earn profits from the trading activities in the Kyber Network ecosystem. The collected fee in KNC tokens are used to cover operational expense and supporting partners. Any KNC tokens that remain after these costs have been covered will be burned.

The Future of Kyber Network

Kyber Network is an interesting protocol that is aiming to solve a very important issue that exists in the crypto-space today, centralized digital asset exchanges and hacks. Given the decentralized and trustless nature of digital assets in the space, it is necessary that there be a decentralized and trustless platform upon which individuals can trade these digital assets.