Crypto CFD Day Trading Strategies

Trading online is not a new phenomenon, and it has been around for decades. Retail traders couldn't always access markets as they do now; the technology only evolved in the last few decades.

Initially, only large banks and hedge funds could access the markets. Investing and trading were for the wealthy only. Many different opportunities arose with the rise of the cryptocurrency markets, and retail traders can now take advantage of this.

However, trading CFDs comes with risk, particularly in the cryptocurrency markets. Like any other financial market, you will need to have a proven strategy to make consistent profits.

This article teaches about CFDs and the best strategies you can follow for crypto CFD trading which will enrich your trading experience.

What are CFDs?

In CFD trading, which is contract-for-differences, a contract exists between a buyer and a seller. The buyer will pay the seller the difference in price from the contract's start until it expires.

Trading CFDs became popular in the '90s when brokers started using them for stock trading to hedge losses. Since then, retail traders have started using it as a way to take advantage of the markets.

Many brokers offer CFD trading of stocks, indices, currencies, commodities, and cryptocurrencies.

When you trade CFDs, you don't own the physical asset. However, you profit from the difference in the asset's price over time.

How does CFDs work?

To fully understand how Crypto CFDs work, we will use a practical example.

Let's say that you are a price action day trader, and you analyzed the Bitcoin price chart. You see an opportunity to buy Bitcoin based on your analysis since you predict that the price will increase.

Therefore, you purchase a CFD from your broker. At the time of the purchase, the price of Bitcoin is trading at $43,614.

After 8 hours, you check your position, and you realize the trade is running in profit. You, therefore, sell the CFD back to the broker. The broker buys the CFD from you at the current Bitcoin price of $47,445.

The difference in price $47,445 – $ 43,614 is $3,831. Therefore, your total profit is $3,831.

This example is very simplified, and we excluded broker fees, spreads, and taxes. However, the principle is to profit from a price difference.

Best Crypto CFD trading strategies

Before you start purchasing CFDs, you need to know when and how to enter the market. It’s not as simple as buying a contract and hoping the price will increase and your profit.

You can use proven strategies to help you sharpen your skills and enter the market confidently with low risk. One way to do this is by using telegram signals from a team of professional investors. Crypto trading strategies are just a set of protocols and rules that a trader or an investor set for themselves to enter the market.

Cryptos tend to be driven a lot by fundamentals, but technical analysis strategies work fine. Technical analysis can be in any form; some traders use the Elliott wave, while some find it better to trade using indicators. Price action is also a great way of trading cryptos.

Well, it only matters what type of trader you are and the strategy you use. As there are tons of strategies to follow on the internet but not every method works.

But you don't have to work as we have put together 3 top crypto trading strategies that work most of the time and are bound to give profit if the market moves in our favour.

Here we have listed the top 3 strategies to use for crypto CFDs.

1. Breakout strategy

As the name suggests, breakout strategy is nothing but looking out for the price to break specific support and resistance zones or pivot points in more technical terms. Many times, the price struggles to move up or down and goes into range or consolidation state.

Moving forward, when there is bullish or bearish pressure from the sellers or the buyers, the price tends to break the zone, and that is called a breakout.

The breakout strategy is very straightforward to understand and use. We will be using price action and multi time frames to trade this strategy.

First, you will open your chart and move to a 4hr time frame. Here, you will need to find the overall market direction and figure out if the price is ranging or behaving bullish or bearish.

Once you know the market direction, move to 1hr time frame to analyze price patterns and candlestick rejections. Use a 30min time frame for trade execution.

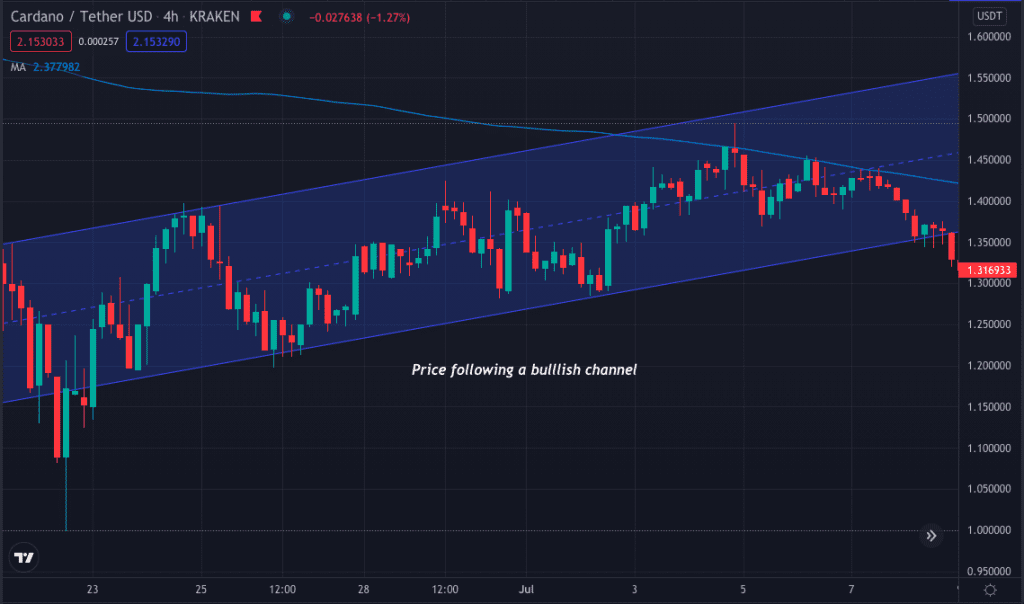

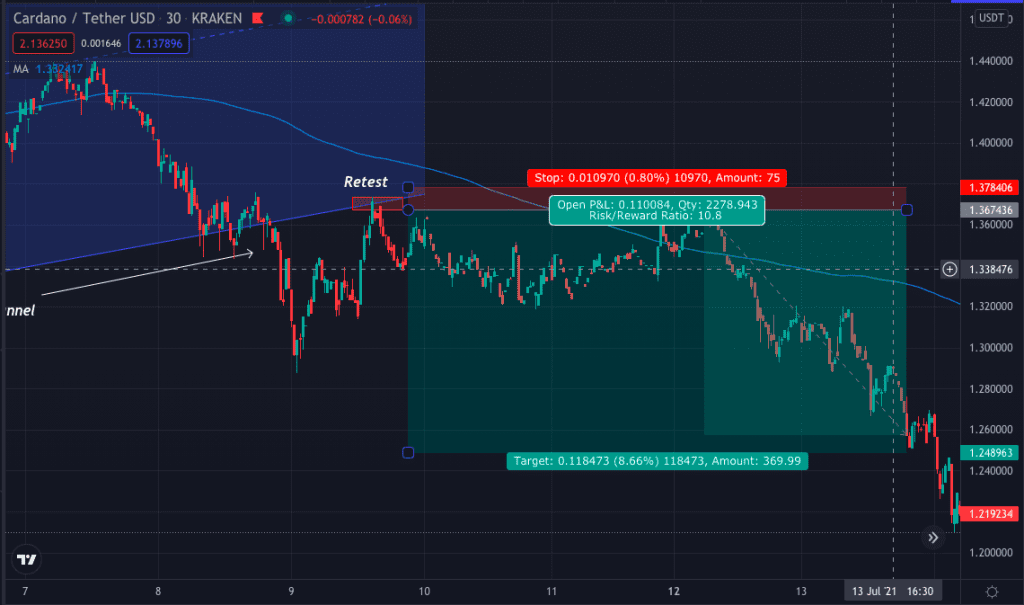

In the above ADA/USDT 4hr chart, you can see the price was following a bullish channel. Here you might take buy trades on the trendline touch as support. But the best trade setup would be the breakout.

You will wait for the price to break the channel, either moving down or up.

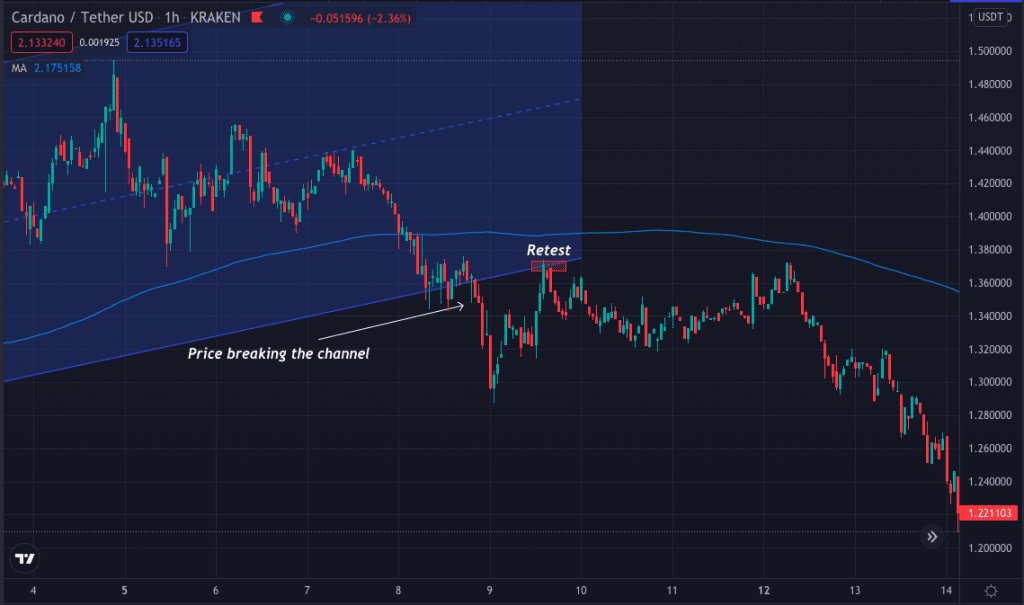

Moving to the 1hr time frame after a long wait, you can see the price was successfully able to break the zone moving down.

Note: You will not enter the trade immediately; instead, wait for the price to retest the breakout zone.

Price after going down after a breakout came up and tested the zone. This strategy of break and retest gives you a significant risk:reward ratio.

Moving to 30min for trade execution, you will take your trade near the retest zone after candle rejection. You can use 1:3 and put your SL 15-20pips from your entry.

2. Golden cross

If you have a good knowledge about trading, you must have heard about the Golden cross trading strategy. The Golden cross or Death cross crypto trading strategy is a trading technique in which you use two moving averages.

For those who are absolute beginners, a moving average is a technical trading tool that uses data points by constantly calculating the average of the closing price. Moving average is a line on the chart that denotes the average price over the period.

The crossing of the moving average is nothing but just the two moving averages crossing each other. The two MAs used in this strategy are 50 and 200. The 50 moving average shows the average of the previous 50 days closing price while the 200 moving average denotes the average of the previous 200 days closing price on an hourly time frame, daily, or weekly.

There are two types of crossovers:

- Convergence referred to as the gold cross

- Divergence referred to as death cross

Convergence happens when the 50 moving average crosses the 200 moving average from below moving up.

Convergence signals a buying opportunity, while the divergence occurs when the 50 moving average crosses the 200 moving average moving down from up and signals a selling opportunity.

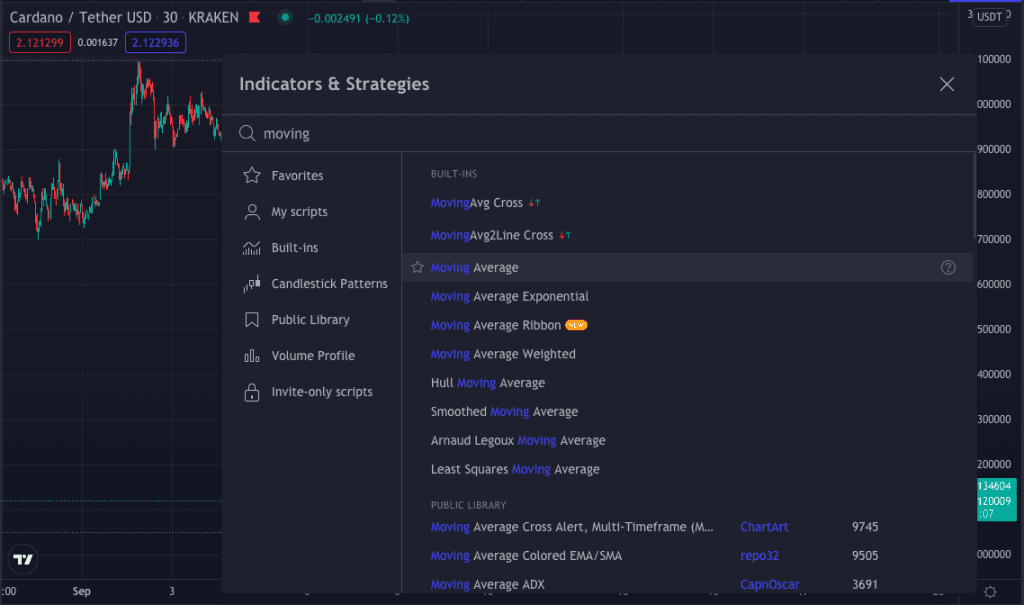

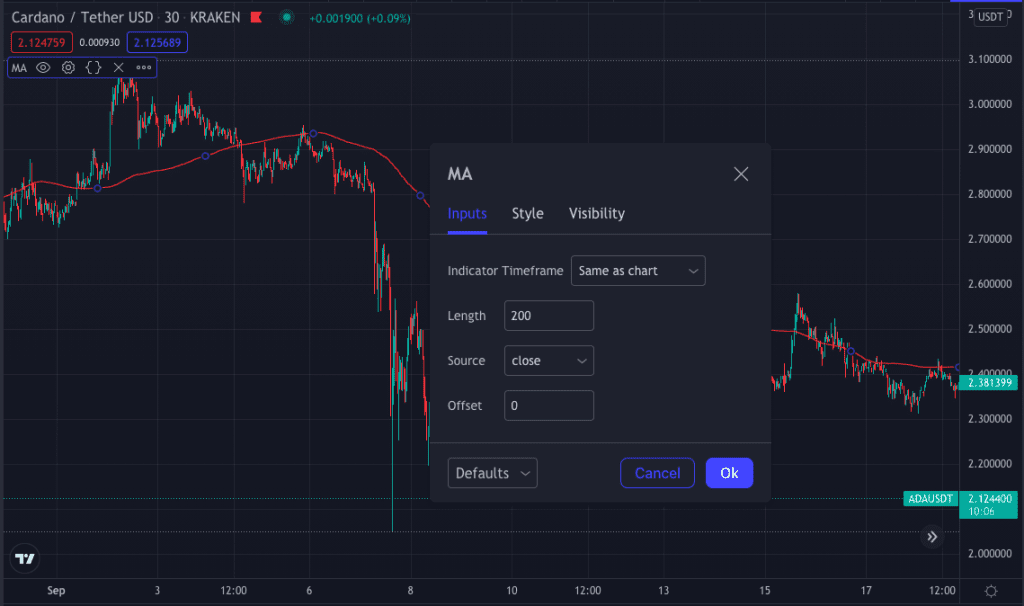

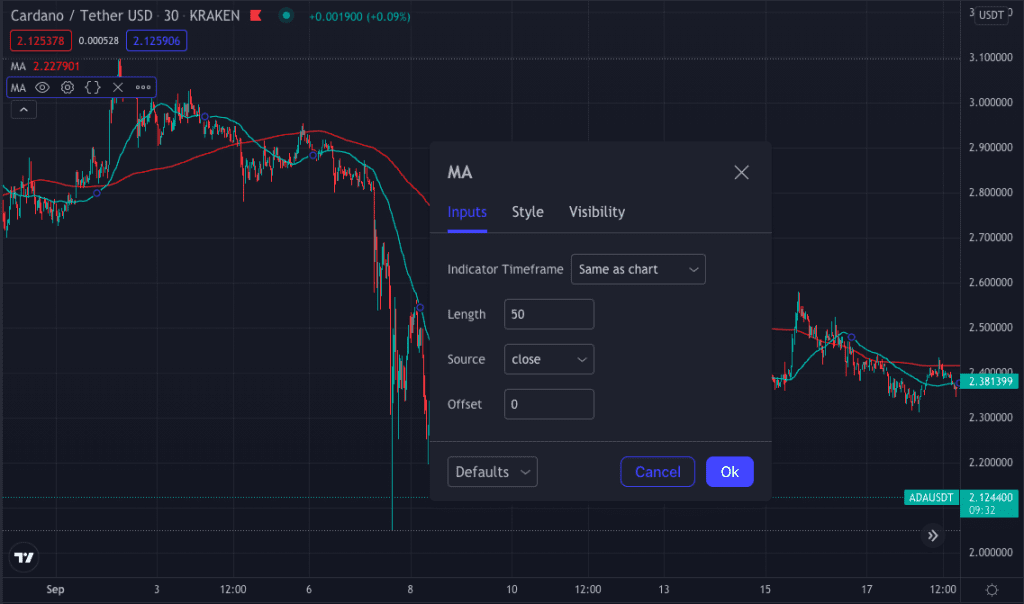

To apply the two moving averages, head over to the trading tools section on your chart and find the moving average. Then click on it twice to get two MAs on your chart. Also, don't forget to move your chart to 4hr or daily time frame. Edit the MAs to one of 50 and one of 200.

Selecting moving averages from the toolbar.

Adjusting the MAs to 200 period.

Adjusting the MAs to 50 period.

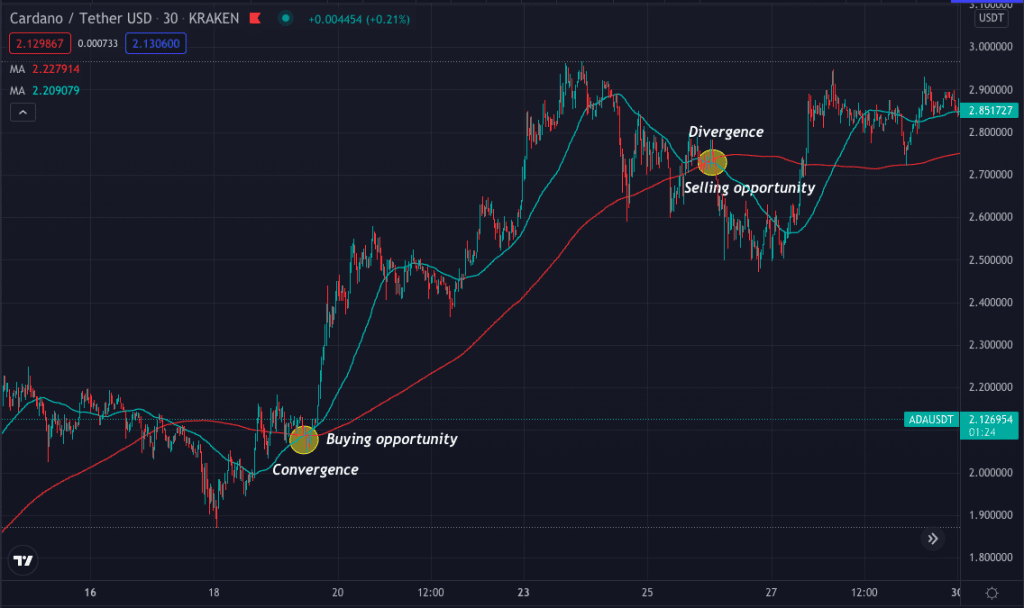

Once you have the moving averages set on your chart, you can start looking for trading opportunities. In the below ADA/USDT 30min chart, you can see the hunt for short-term trading opportunities.

When the blue line(50 MA) crosses the red line(200 MA) moving up, we have the convergence, which is the signal for a BUY. When the blue line(50 MA) crosses the red line(200 MA) moving down, we have the divergence, which is the signal for a SELL.

3. RSI divergence

Traders in all corners of the world make use of RSI to check the oversold and overbought, but you can actually do a lot more with RSI. RSI divergence is another excellent strategy that you can follow and trade the crypto market.

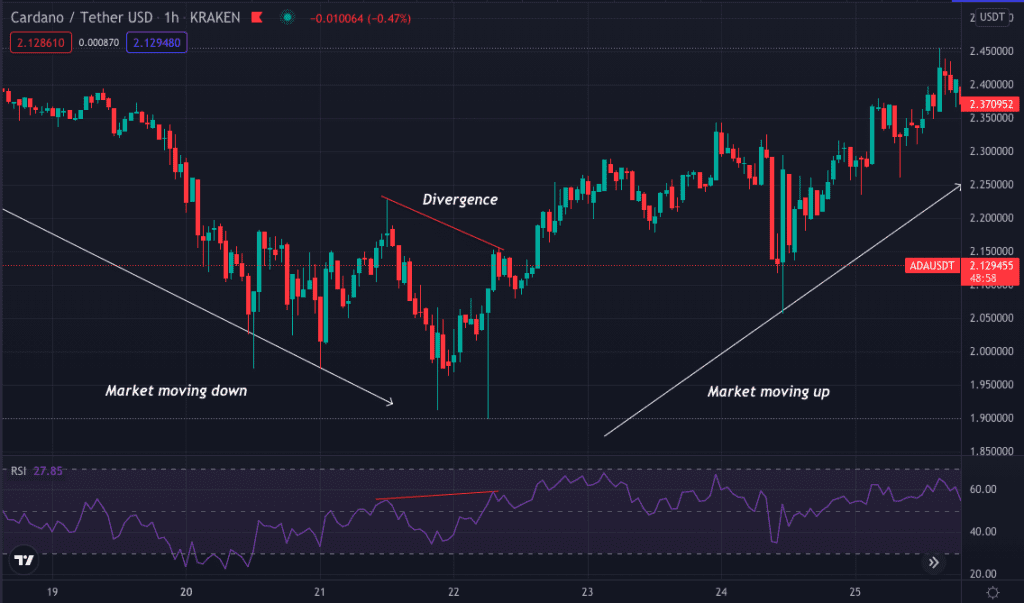

Divergence is when the price action and the RSI does not indicate the same price momentum. For example, when the price action pattern shows the price making higher high and higher low, the price makes higher high and lower low on the RSI.

RSI divergence is a great way to sense trend reversal before it happens. For better understanding, let us look into the below example of ADA/UST.

In the above ADA/USDT 1hr time frame, you can clearly see the divergence. The best time frame to use this strategy is 1hr, 4hr and daily time frame since the higher the time frame, the better is the trading signal.

You can take a short-term trade once you see significant confluences like candlestick rejection, the price at support or resistance, in addition to the RSI divergence on 30min or 15min time frame.

Pros and Cons of CFD trading

Pros

Profit without owning the asset

- Trading CFDs allow you to profit without having to buy the actual underlying asset.

Take both long and short positions.

- CFDs allow you to trade both short and long positions, and are therefore useful as a hedging strategy to minimize or counteract positions which are in a loss.

Low fees and commissions

- Brokers charge low fees and commissions for CFDs, and they mostly make their profit from the spread.

Benefit from leverage

- Most exchange platforms offer reasonable leverage and you can increase your profitability by choosing the appropriate leverage.

Cons

Risk losing it all

- There is a risk of losing it all if your position moves against you, which can be inflated if you use excessive leverage.

High volatility

- The crypto markets are very volatile and sensitive; price changes occur much faster, which can introduce unwanted risks to your positions.

Lack of ownership

- CFD trading takes advantage of price differences only. Therefore, you don't own the actual crypto coins when you trade CFDs. You own the contract only.

Overtrading

- The easy access and low cost requirements of CFDs can lead to overtrading which can result in your margin being at risk.

Final Thoughts

Final Thoughts

Trading in any financial market is risky, so you must have the proper knowledge before entering the market. Cryptocurrency is highly volatile and still evolving, so using appropriate risk management according to your capital is crucial.

The strategies mentioned in the article work most of the time, but this does not mean you will follow the signals produced by the indicator directly. You could confirm your trades and cut bad ones by following signals from professional traders.

Trading in a ranging market is not a good call for beginners as there is no clear market trend, so it is better to use the breakout and retest strategy and avoid ranging markets. It would be best to trade in a clear trending market when the price moves up or down.

Final Thoughts

Final Thoughts