5 Best BitMEX Signals Groups on Telegram

Joining BitMEX signals groups as way of generating additional returns is becoming increasingly popular. These groups are becoming especially important when you factor in that a majority of cryptocurrencies are either stagnating, or worse, declining in value.

BitMEX signals groups work by simply sending you signals letting you know which cryptocurrency you should buy and at what specific time. When they work, these groups can be very profitable, however, when they don’t work, they can lead to a terrible user experience. That’s why in this article we will take a detailed look at what the best BitMEX signals groups on Telegram are so you can make profits and avoid losses. We will also take a look at what BitMEX is as a trading platform in general so when it comes to interpreting a BitMEX trading signal, you know what to look out for.

For those who aren’t sure what a crypto trading signal is, then let’s do a quick introduction.

What are BitMEX Signals?

Signals are cryptocurrency exchange specific, meaning that you need to ensure that you have an account with the exchange that the signal provider is sending is signals for. You can’t for example, follow a BitMEX signal with a Binance account.

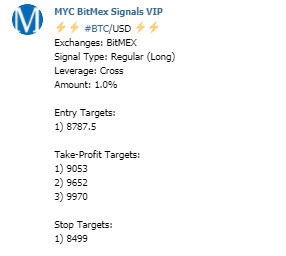

A BitMEX trading signal will typically contain the following information:

- The cryptocurrency to buy – The signal will specify which cryptocurrency you should buy, e.g. BTC, ETH, XRP

- The buy-in price – The price you should buy the cryptocurrency at

- The sell-targets – The price you should sell the cryptocurrency at in order to achieve a profit

- Stop losses – A mechanism to automatically exit your position to mitigate losses

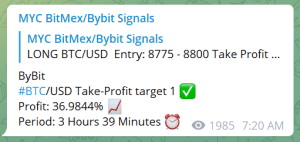

As can been seen from the image above, the signal lets you know which cryptocurrency to buy, which in is this case is BTC; the exchange the signal is for, which is BitMEX. Each signal will also contain what leverage you should use (I’ll explain more about this later in the guide), as well as what percentage of your current holdings you should put towards the trade, which in this case is 1%. You also have the entry target, 3 possible sell-targets, or take-profit targets, and 1 stop loss target in case the trade should go against you.

With each trade, you should also be notified if a significant event happens, such as the entry-targets being achieved:

This signal shows that the entry target was achieved at an average buy price of $8787.5. From this point, the trade is now active and if you’ve chosen a good BitMEX signals provider, you should then make a nice profit:

Each take-profit will tell you the percentage return you’ve made, as well as the length of time it took for it to be achieved. If you’ve chosen a professional BitMEX signal provider, then all these notifications should be managed in the Telegram group by a bot.

The biggest advantage of bots is the speed of execution, which is why when sending out signals, providers will typically have the option for their members to following the signal through the use of a bot. One current popular bot used for following signals is Cornix.

As can be seen from the image above, the Cornix bot is integrated into the Telegram channel of the premium group such that, all a user needs to do to follow the signal is press “One Click Follow”. This will automatically place the trade on behalf of the user. It is important to note that in order to use this functionality, a user must first grant the bot access to their account via the cryptocurrency exchange’s API keys. Even though some groups do not provide this automated trading feature, it’s nice to give users the option so they can decide for themselves if or not to leverage this functionality.

Now that you know what BitMEX signals are, let’s get into the list of the top 5 Best BitMEX Signals groups on Telegram.

1. MYC Signals (@MYC Signals)

Number of Subscribers: 35K.

Focus/Description: Provides Binance and BitMEXsignals as well as educational content on crypto trading.

Approximate Post Rate: 5+ signals per day.

With 36,000 subscribers, MYC Signals’ telegram group offers high-quality signals paired with exceptional customer service, which has earned them our top spot among BitMEX signals providers. They advocate for consistent and sustainable returns over big bets, which means that their members are able to generate a steady stream of income by following their signals without having to worry about losing it all.

How's how you can get started with them:

1) If you have telegram then be sure to reach out to the admin, @MYCSupportBot, as well as to join their free crypto signal group, MYC Signals. Alternatively, if you don't have Telegram, feel free to contact them via email: [email protected] and they'll walk you through how to get started.

2) They offer 2 premium channels for you to join: MYC BitMEX Signals VIP and MYC Binance Signals VIP. The membership can be paid via any cryptocurrency of your choice or via card over at their payments page.

3) Once you’re all signed up and you’re a premium member, they’ll work with you to make sure you can follow their signals as easily as possible, as well as to solve any problems you may have. They tout 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response.

2. Crypto Trades Today (@CTT)

Number of Subscribers: 6K

Focus/Description: Provides Binance and BitMEX signals as well as educational content on crypto trading.

Approximate Post Rate: 7+ signals per week

CTT is a unique group in that they have a large team of traders. As a result, each trader at CTT only issues a trade when they have a high level of confidence. Compare this to the all-too-common scenario where signal providers are forced to make (often risky) trades at prescribed intervals, and it’s easy to see why CTT is so successful and quickly becoming one of the most popular signals providers. You’ll get a steady stream of rock-solid signals from experienced traders.

3. WhaleTank

Number of Subscribers: 21K.

Focus/Description: A heavy focus on technical analysis as well as providing signals for Binance and BitMEX.

Approximate Post Rate: 0-3 signals per week.

This list wouldn’t be complete without a nod to the team over at WhaleTank. These guys were one of the first on the scene, and have been providing solid returns for their members since day one. WhaleTank concentrate heavily on utilizing technical analysis to identify trade opportunities for their members.

4. 4C Trading

Number of Subscribers: 8K.

Focus/Description: Issues signals for BitMEX.

Approximate Post Rate: 0-3 signals per week.

The team over at 4C Trading News run a pretty slick operation with the focus they place on following wider news events happening in the crypto space. They can be seen as the macro-focused signal provider due a thesis they seem to have of news events having a drastic impact on the price of various cryptocurrencies. They also issue reports showing how much potential returns prospective members could have made if they took the plunge and subscribed.

5. Yo Crypto

Number of Subscribers: 29K.

Focus/Description: Issues BitMEX signals.

Approximate Post Rate: 0-3 signals per week.

Yo Crypto has been relaunched to Yo Crypto 2.0 and is a respected signal provider in the space. They have a consistent track record of providing reliable signals and so when it comes to selecting a provider, they’re a solid choice. They don’t provide as much technical analysis in their groups as other signal providers, with a majority of their posts in their free group being solely about the profit they make in their premium group.

Now that you have a better idea of the best 5 BitMEX signals providers, I think it would be a good idea to explore what exactly BitMEX is as a platform, how it’s different from other cryptocurrency exchanges, and how to get setup so you can start following signals.

BitMEX Signals Trading, a Beginner’s Guide

BitMEX is one of the more popular cryptocurrency exchanges because of the margin and leverage trading that it offers. It allows everyday trader to significantly increase the potential returns that they can make when compared to other exchanges such as Coinbase, Binance and Bittrex, that do not have this functionality.

In this section, we’ll explore exactly what BitMEX is, how you can increase your returns by utilizing its leverage functionality and our top tips to remember when using the exchange.

What is BitMEX?

At a fundamental level, BitMEX is a trading platform similar to other exchanges such as Coinbase. However, the key differentiator is, instead of directly buying and selling cryptocurrencies such as Bitcoin like with other exchanges, you’re buying and selling contracts.

BitMEX offers a few different contracts, but the one you would predominantly be using and therefore should be aware of are, perpetual contracts. Perpetual contracts are a type of futures contract in that they are simply an agreement to buy or sell a cryptocurrency at a predetermined price at a specified time in the future. What make perpetual contracts special is that they do not have an expiry date and so can be held for an indefinite amount of time.

These perpetual contracts that you would be buying selling are known as derivatives because they derive their value from something else. For example, XBT/USD is the ticker symbol used on BitMEX to represent Bitcoin. XBT are perpetual contracts in which 1 contract is equal to 1 USD of Bitcoin. This is to say that the XBT contract, derives its value from the price of Bitcoin, hence why it’s called a derivative product.

The key thing to note here is, when you’re buying and selling XBT contracts on BitMEX, you are not directly buying and selling bitcoin itself, but instead, a representation of it in the form of a contract.

Now that you have a better understanding of what exactly you’d be buying and selling when using BitMEX, it’s time to introduce to you what makes BitMEX so attractive to traders. Simply put, it is the ability to use margin to leverage trade.

BitMEX Signals: Margin & Leverage

Margin and Leverage are two interlinking concepts that are used by traders to significantly enhance how much money they are able to make on each trade.

Margin is the amount of capital that you are required to deposit into a trading account in order to cover any possible losses. It is with this margin amount that you are then able to leverage in order to trade as if you have larger amounts of capital. For example, say you wanted to buy $10,000 worth of Bitcoin, but you only have $1,000. With margin and leverage, this trade would still possible.

If you selected leverage at a ratio of 1:10, then in order to purchase $10,000 worth of Bitcoin, you would only need to put up $1,000 as margin. This margin amount is used to cover any potential losses, however, you are now able to trade as if you owned $10,000 worth of Bitcoin from just $1,000.

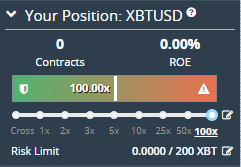

The other leverage ratios offered by BitMEX include:

- 1:2

- 1:3

- 1:5

- 1:10

- 1:25

- 1:50

- 1:100

- Cross

The advantage of leveraged trading on margin is that you can make a much higher return on your invested capital. For example, let’s say the price of Bitcoin went up to $11,000; if you had invested $10,000, this only yields a return of 10%. Conversely, using leverage trading at 1:10 ratio where your initial investment was only $1,000, this yields a return of 1000%.

However, this does go both ways. If the price if Bitcoin fell to $9,000, your entire $1,000 margin would be lost; this is known as the liquidation price. The liquidation price is calculated differently depending on the platform you use to trade, so it is important you understand at what price below your entry point your position would be closed.

With that being said, another advantage to margin and leverage trading is that you cannot lose any more than your margin. In this instance, your losses are said to be limited and your potential returns unlimited.

With margin being such an important functionality on the BitMEX platform, now is a good point in the guide to quickly explain the differences between isolated margin and cross margin.

BitMEX Signals: Isolated & Cross Margin

Isolated margin is the initial capital required to open a position. One of the key advantages of isolated margin is that you can control exactly how much capital you are willing to risk in order to limit potential losses in case the market moves against you. Examples of isolated margins would simply be the leverage ratios you saw above, such as: 1:2, 1:10 etc. All these ratios require a specific amount of margin in order to open the position in the first place.

Conversely, cross margin is a tool that automatically allows a trader to share margin out between different open positions should one of them be at risk of liquidation. For example, say you have two open positions on BitMEX, each requiring a margin of $1,000 and both having a liquidation price of $9,000. Position A is going very well and is trading well above the liquidation price, however, with position B, the trade is going against you and is at risk of being liquidated. With cross margin, $100 can be taken from the margin of position A to position B resulting in a new margin of $1,100. This gives position B more room to recover and therefore reduces the likelihood of liquidation.

BitMEX Signals: Long & Short

What also makes BitMEX special is the fact that you can open short positions. Short selling is simply the process of speculating on the decline of a cryptocurrency. This is in contrast to other cryptocurrency exchanges in which the primary activity they permit you to do is going long on a cryptocurrency. Going long is speculating that a cryptocurrency will increase in price.

The process of longing can very much be summarized as follows: buying a cryptocurrency at a specific price, the price of a cryptocurrency increases, then selling the cryptocurrency at its new increased price and making a return. For example, say the price of Bitcoin was currently trading at $10,000 and you decide to buy 1 BTC; this makes your purchase price $10,000. Now, if the price of Bitcoin were to increase to $11,000 and you sell, this would result in a 10% return, yielding a $1,000 profit minus any trading fees. This process is known as going long on a cryptocurrency and is the primary method in which many new traders tend to invest.

This is in contrast to the process of going short on cryptocurrency which can be summarized as follows: borrowing a cryptocurrency from a willing lender that is then immediately sold at market price, the price of the cryptocurrency then declines, the cryptocurrency is then repurchased at a lower cost then returned to the borrower. To illustrate, Bob borrows 1 BTC from Amy which he then immediately sells at market price of $10,000. The price of 1 BTC then falls to a price of $8,000 at which point Bob buys back the 1 BTC then returns it back to Amy. The net result of this is a $2,000 profit for Bob minus any trading fees.

Of course, in both examples, I am illustrating the upside of long and short selling. However, with trading there is always the possibility that it can go against you which is why it’s always important to practice correct risk management – the most important being: don’t invest more than you can afford to lose.

Order Book

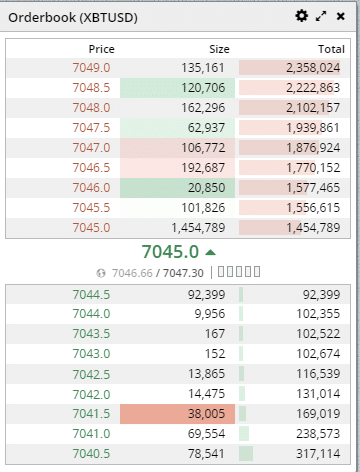

An order book is the number of buy and sell orders that have been placed at a particular price for a cryptocurrency. The order book is updated in real time and so can be a very useful tool in gauging the sentiment around a cryptocurrency.

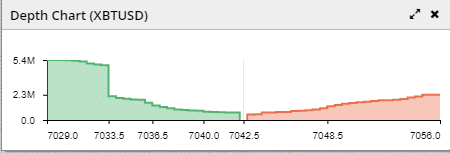

There's also the market depth which can be used to provide an indication of the liquidity of a cryptocurrency. Liquidity refers to the ability of a cryptocurrency to bought and sold quickly without affecting the price. The larger the trading volume of a cryptocurrency, the higher the liquidity and vice versa.

The red line indicates the people who want to sell, and the green the people who want to buy. The dollar amounts on the x-axis is the price a market participant is willing to buy or sell a particular cryptocurrency. While the y-axis indicates the number of cryptocurrencies the buyer or seller wants.

For example, if Bob executed a trade for the sale of a single bitcoin for $3500, this would be classed as a market order and join the order book. Bob’s executed trade would sit in the order book until it was filled, i.e. until Bob’s trade was matched with another individual who is willing to purchase his one bitcoin at a price of $3500.

In terms of liquidity, more liquid cryptocurrencies tend to be preferred by traders because it means when they attempt to exit a position, they will not negatively affect the price. In addition, more liquid cryptocurrencies are significantly harder to manipulate, making them less likely to fall prey to pump and dump schemes that are prevalent within the cryptocurrency space.

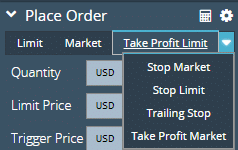

Placing an Order

When opening a position, or placing an order on BitMEX, there are a few different ways you can do this which may materially affect how much profit you’re able to generate from a trade. In this section, I'll walk you through the various ways in which you can place an order on BitMEX, with a short description of each method so you know which to use in any given situation.

The various types of orders that can be placed on BitMEX include:

- Market Order

- Limit Order

- Stop Market Order

- Stop Limit Order

- Trailing Stop Order

- Take Profit Limit Order

- Take Profit Market Order

Market Order – Probably the most common type of order that a new trader tends to use is a market order. It's the fastest way to get an order into the market to be filled immediately. This is because the order will be executed at the best possible price that is present in the order book at the given time. However, to compensate for the speed of execution, market orders tend to be more expensive in the form of higher trading fees.

Limit Order – If you know what you’re doing, limit order tends to be the most common order type. This is because limit orders allow you to specify the price at which you would like to buy/sell a cryptocurrency. For example, if Bitcoin was currently trading at $10,000 but you would prefer to purchase at $9,800, then you can specify a limit order price of that amount. The order would then be placed in the order book until it was filled.

Stop Market Order – A stop market order is an order that doesn’t enter the order book until a certain trigger price is reached. This has the benefit of allowing a trader to enter the market automatically without having to wait around until the market reaches a certain point before doing so manually. This may seem like a limit order; however, the key differentiator is when the trigger price is reached, the stop market order will become a market order (as opposed to a limit order) which more or less guarantees entry into the position.

Trailing Stop Order – A trailing stop order is an order that automatically follows your position as the market rises to secure profits as well as to mitigate risk. A trailing stop order is not set a specific price, but instead at a percentage away from the current market price. For example, you can set a trailing stop order to always be 10% away from the current market price. So, as the market rises, you can secure profits, but at the same time mitigate your downside risk.

Take Profit Limit Order – A take profit limit order is used to specify the price point at which you would like to take profits. It’s a like a stop limit order but is placed in the opposite direction. When the trigger price is reached, the take profit limit order will become a limit order. It’s a great tool to use to secure profits when placing a new trade. I would always recommend a take profit limit order as part of any effective trading strategy.

Take Profit Market Order – Similar to a take profit limit order except when the trigger price is reached, the order becomes a market order, which again, effectively guarantees the order will be filled. This is in contrast to a limit order in which that there is always a risk the order may not be filled. However, the advantage to this is cheaper trading fees.

As you can see, there are several types of orders that can be placed on the BitMEX exchange, knowing what each one does adds another tool your trading tool belt and increase the likelihood of you being a successful trader. My recommendation would also be to study these order types and become familiar with them. Once you have done this, look for ways in which you can start to incorporate them into your trading strategy.

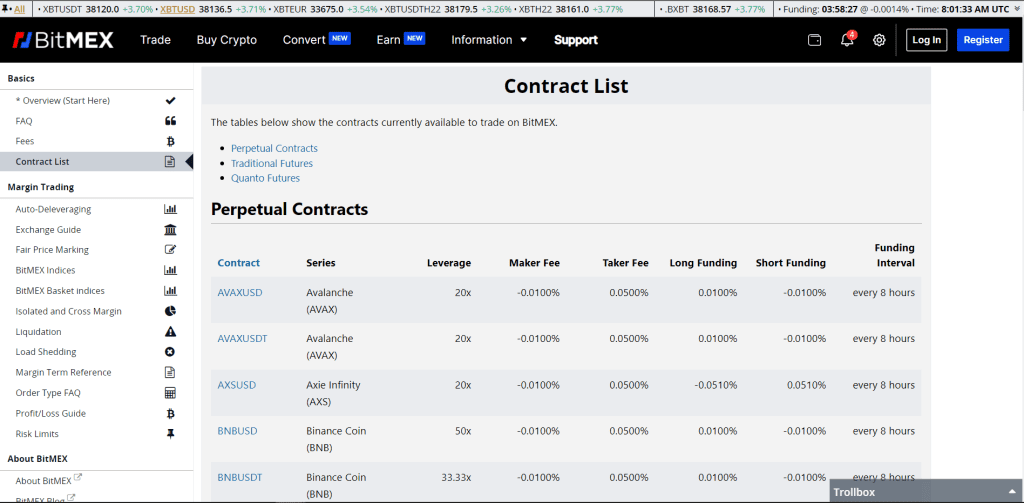

BitMEX Contracts

Now that you have a comprehensive understanding of what BitMEX is as a cryptocurrency exchange, and the tools available to you such as: leverage and order types, we can now begin to dive deep into the type of contracts you’ll likely be trading day to day.

The contracts that BitMEX currently allows its users to trade include:

- Bitcoin (XBT)

- Cardano (ADA)

- Bitcoin Cash (BCH)

- EOS

- Ethereum (ETH)

- Litecoin (LTC)

- Tron (TRX)

- Ripple (XRP)

Each contract can be longed or shorted with its own maximum leverage. As of writing this article the following maximum leverage available for each contract is:

- Bitcoin – 100x

- Cardano – 20x

- Bitcoin Cash – 20x

- EOS – 20X

- Ethereum – 50x

- Litecoin – 33x

- Tron – 20x

- Ripple – 20x

Trading with leverage is something that should always be approached with care and should not be done unless you have a valid trading strategy in place. Even though the advantage of trading on BitMEX is the large amounts of return you can make from a single trade, it harbors a distinct disadvantage in that you stand to lose a lot more of your capital in a shorter time period.

Conclusion

To conclude, this guide has taken a look at the best 5 BitMEX signals providers as well as what BitMEX is as an exchange and how to get started. I hope that you now have a better understanding of what BitMEX is so you can properly assess which signal provider to go with. There are many BitMEX providers who’s sole aim is to try to pull the wool over the eyes of their members, however, you should now be able to discern a scam from the quality of the signals you receive alone.

MYC Signals is one of the most respected BitMEX signal providers in the space and if you’re looking to get started then we recommend you start with us. To do so, here are some easy steps for you to follow:

1) If you have telegram then be sure to reach out to our admin, @MYCSupportBot, as well as to join our free crypto signal group, MYC Signals. Alternatively, if you don’t have Telegram, feel free to contact us via email: [email protected] and we’ll walk you through how to get started.

2) We offer 2 premium channels for you to join: MYC BitMEX Signals VIP and MYC Binance Signals VIP. Each group comes with a monthly membership payment of $90/month, or $170/month for access to both channels. The membership can be paid via any cryptocurrency of your choice or via card over at our payments page.

4) Once you’re all signed up and you’re a premium member, we’ll work with you to make sure you can follow our signals as easily as possible, as well as to solve any problems you may have. We tout 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response. All our signals can easily be followed by our Cornix bot if you so wish, and we actually encourage our members to do this. But if you want to receive signals via email, we do that too!

I hope you found this article useful and that it provided you with at least some value in better informing you of the BitMEX signals landscape. Again, feel free to reach out to use if you have any questions or would like some support.

Happy Trading!